Disliked{quote} Hi LeMercenarie, i like to ask you what is the strategy or strategies, that you use more often, i find that after trying HOLO or Wick Zones strategies does not look good in the long term, but i am asking to see in what strategy to invest time in effort to master. Thank you in advanced.Ignored

However, 1-2-3 and HOLO are only a part of a basket of overlapping methods I use throughout my trading day. My main trading session is the UK morning and I usually don't need to do any more than that.

If I do, it is usually because I have nothing else on that day. I am lucky enough to be a full time trader and so I trade so I am able to make free time to live my life away from the charts.

Anyway, if you check out my profile, you will find where I spend most of my time and the method(s) and techniques I use. I should say that most are not really suitable for newcomers to the game. I have been doing this for a long, long time, lol.

The thing with 1-2-3 and HOLO is to narrow your focus to a bare handful of pairs and learn them inside and out. Look at TS himself. Specialises in one pair...one. I specialise overall on The DAX.

Once you do this, you will begin to feel how the market moves, when a set up is strong, when it is more likely to fake you out.

Although I use S+D etc as noted, I should also point out that when I first joined the threads, I ran both completely as-is and out the box.

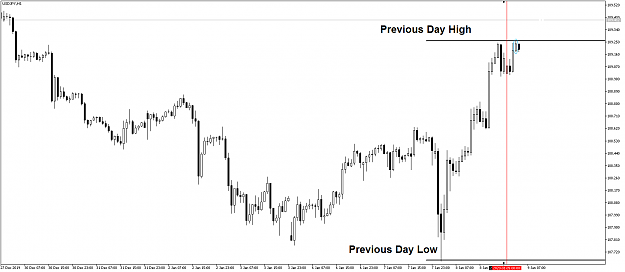

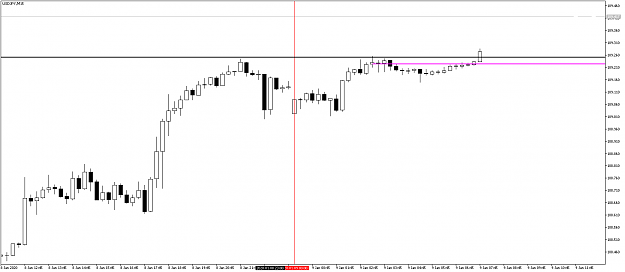

When it comes to Wick-Zone, again, most who struggle are using it purely as a one-off method. Yes, you can do so but that is very limiting. Instead, use Daily WZ to give you that additional concept of bias. Look where price is sitting in relation to the Upper and Lower DWZs. Where has it been the rest of the day? How is it in relation to ADR?

One major thing to know is that Wick-Zones are basically mini Supply + Demand Zones. Think about what that shows you as regards price movement into and out of the zones.

Anyway, apologies to TS for cluttering up the thread. I cannot stress highly enough that YOU DO NOT NEED ADDITIONAL INFORMATION TO RUN 1-2-3 AND HOLO. Learn the method first and then you can possibly look at adding your own spin.

If you want more info, please do not post here out of respect for TS and his wishes.

Lem.

2