My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade

- Post #14,541

- Quote

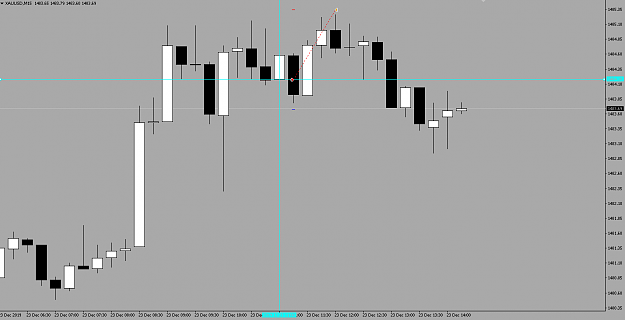

- Dec 21, 2019 1:00pm Dec 21, 2019 1:00pm

- Joined Mar 2012 | Status: Trader | 12,127 Posts

- Post #14,546

- Quote

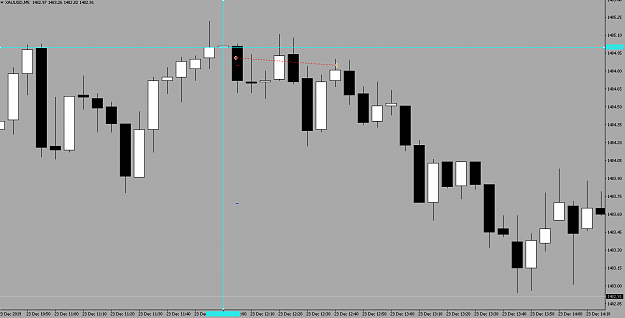

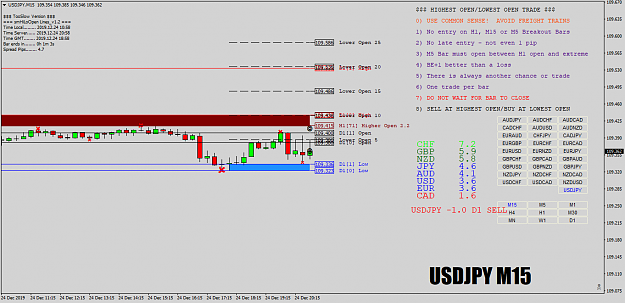

- Dec 24, 2019 8:43am Dec 24, 2019 8:43am

- Joined Oct 2015 | Status: Member | 18,269 Posts

- Post #14,547

- Quote

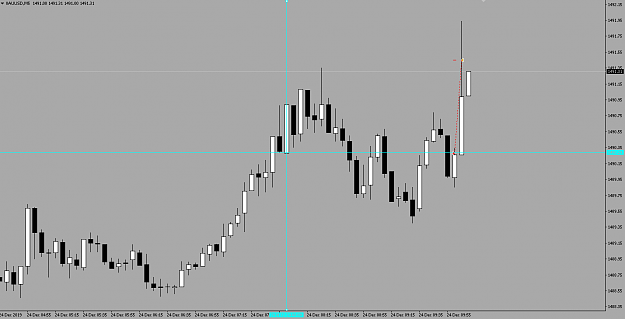

- Dec 24, 2019 1:59pm Dec 24, 2019 1:59pm

- Joined Mar 2012 | Status: Trader | 12,127 Posts

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade

- Post #14,548

- Quote

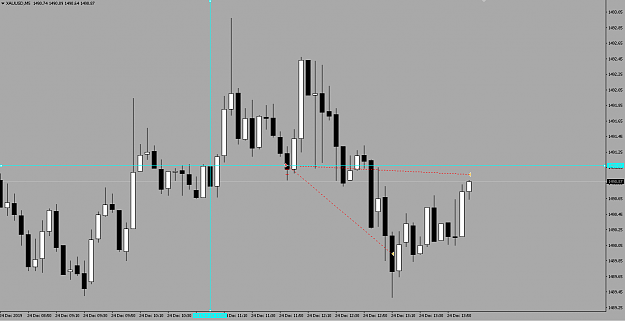

- Dec 30, 2019 2:04pm Dec 30, 2019 2:04pm

- Joined Mar 2012 | Status: Trader | 12,127 Posts

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade

- Post #14,550

- Quote

- Dec 31, 2019 10:07am Dec 31, 2019 10:07am

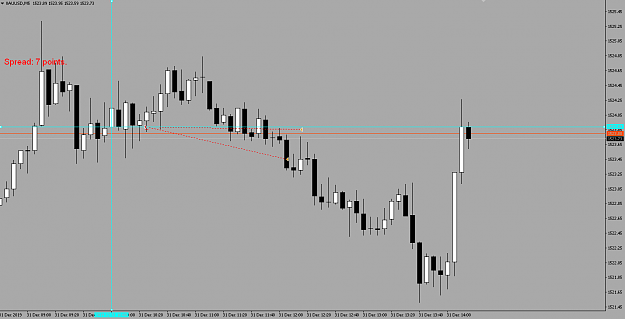

- Joined Oct 2015 | Status: Member | 18,269 Posts

- Post #14,552

- Quote

- Jan 1, 2020 11:33am Jan 1, 2020 11:33am

- Joined Mar 2012 | Status: Trader | 12,127 Posts

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade

- Post #14,554

- Quote

- Jan 3, 2020 6:38am Jan 3, 2020 6:38am

- Joined Oct 2015 | Status: Member | 18,269 Posts

- Post #14,555

- Quote

- Jan 3, 2020 4:50pm Jan 3, 2020 4:50pm

- Joined Mar 2012 | Status: Trader | 12,127 Posts

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade

- Post #14,560

- Quote

- Jan 4, 2020 3:41pm Jan 4, 2020 3:41pm

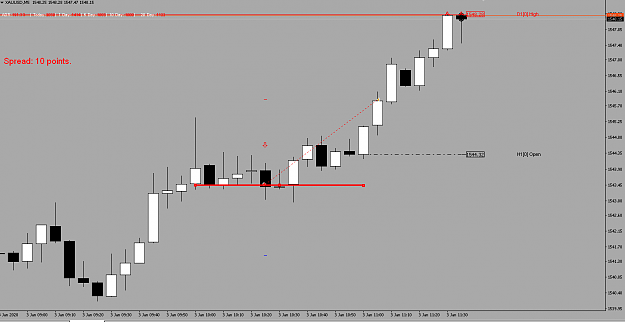

- Joined Oct 2015 | Status: Member | 18,269 Posts