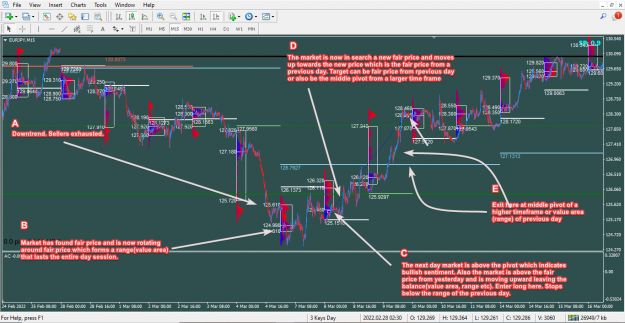

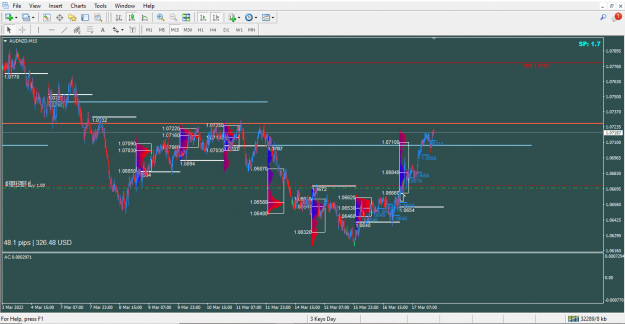

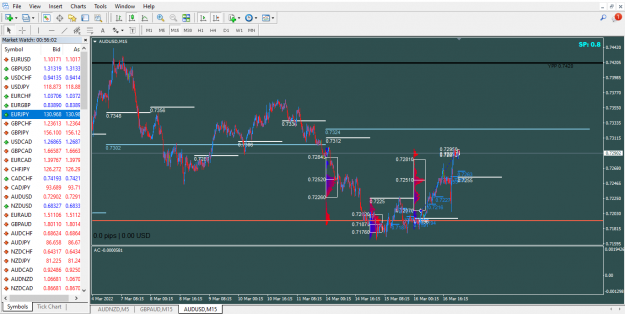

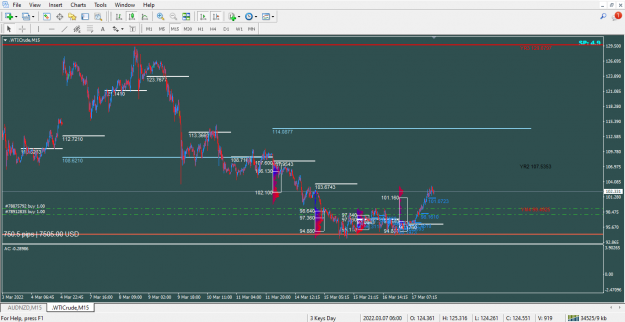

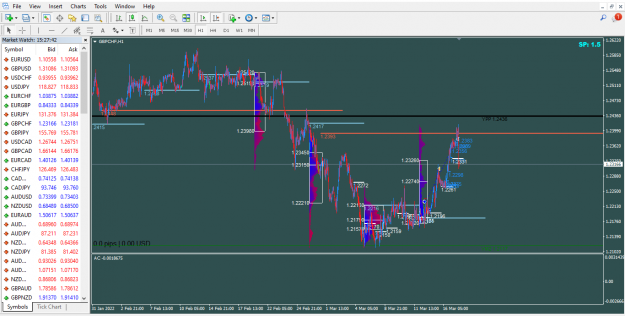

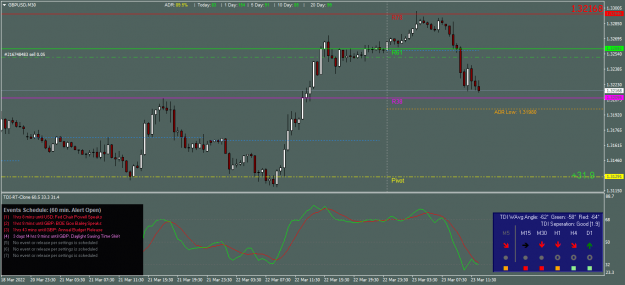

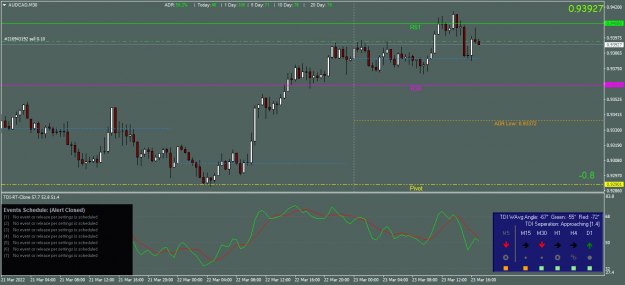

I use the middle pivots only since they are the most powerful pivot. Also I use them for sentiment to trade trend reversals. Not really for support and resistance. What is more powerful than a levels ability to hold is the market's search for a level(fair price and advantageous price). This is why all my trades are the same. I wait for a trend to form. Then wait for it to end in a balance rotation for the whole session(intrady session, day session, week session etc), then if the session ends in a balance(range) when price moves out of the range and is on the proper side of the pivot for my trade(above for longs, below for shorts) I trade the market's search for a new fair price which is typically the fair price established in previous periods(I make sure that the new fair price is far away from the fair price the market is leaving so I get a nice big move).

This objective approach ensure that all my trades are the same and look the same on any timeframe.

This objective approach ensure that all my trades are the same and look the same on any timeframe.

2