AbbVie hit my first long target. Hopefully some good news in the near future to get it moving.

post your best ea which you have used on a live account 4 replies

Post Your Best EAs Here 23 replies

Short Term / Medium Term / Long Term? 3 replies

Post Your Best Indicator Thread 21 replies

Disliked{quote} Further to the above, Alibaba now looking here: https://uk.reuters.com/article/uk-ch...-idUKKCN1GR1UU They have a continual drip-feed of positive announcements and business initiatives. Fundamentals is what has got me in, must buy some more <searching for grandchildren's piggy bank>

Ignored

DislikedAbbVie hit my first long target. Hopefully some good news in the near future to get it moving. {image} {image}Ignored

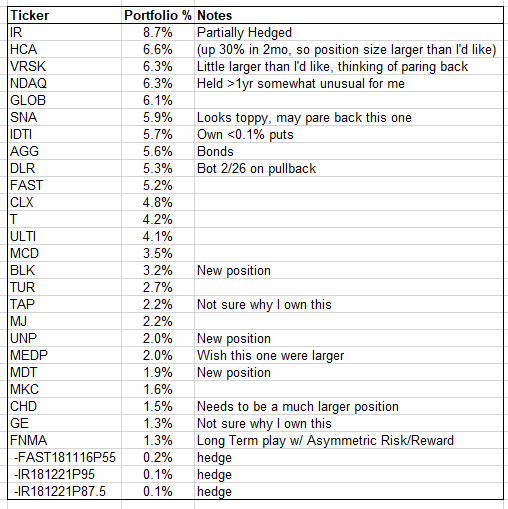

DislikedNice job Exodus. I've been a little out of the loop - liquidated everything to buy a house and now I'm clawing my way back to having a respectable bank roll. Here's a few that caught my eye. (no positions yet) $AAWW {image} $DRE {image} $GLOB {image} $MKC {image} $PEG {image}Ignored

DislikedI have quite a few ideas this week but I don't want to bombard this thread with them all. For those that like to buy things on pullbacks, I like AVB, DLR and COHR. Avalon Bay {image} Digital Realty {image} Coherent {image} For those that like to buy all-time-highs, I like these: FTNT, HCA, and MKC: Fortinet {image} HCA {image} McCormick {image}Ignored

DislikedNice job Exodus. I've been a little out of the loop - liquidated everything to buy a house and now I'm clawing my way back to having a respectable bank roll. Here's a few that caught my eye. (no positions yet) $AAWW {image} $DRE {image} $GLOB {image} $MKC {image} $PEG {image}Ignored

DislikedAAWW was an unmitigated disaster. It illustrates the importance of stop-losses. A reasonable stop would have been around $67-68 area (or buying a 67.5 strike put). I am currently long this thing. Instead of having a stop, I'm long a couple out of the money puts as a small hedge. {image}Ignored

Disliked{quote} I actually think this is a good buy now. https://www.tradingview.com/x/X7fVbmIe/Ignored