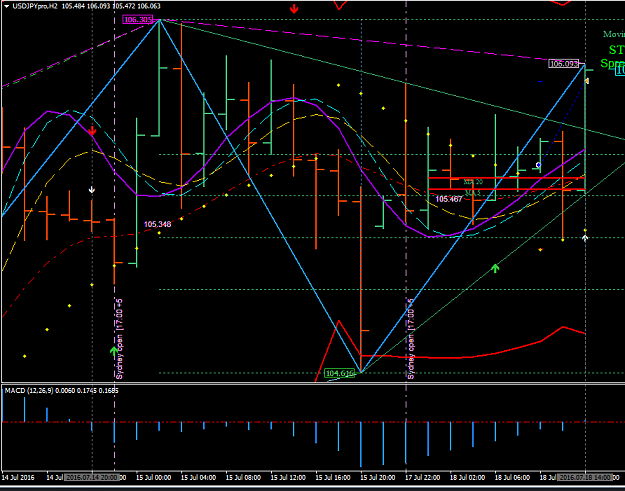

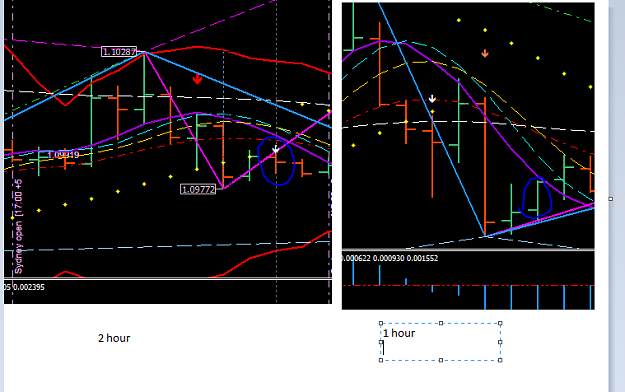

Disliked{quote} According to your graph; Shouldn't ROMAR / EMA be support, and the three horsemens (also acting like support, I thinl) are pointing up for a long? and DB is also attached to the candle for a move up?Ignored

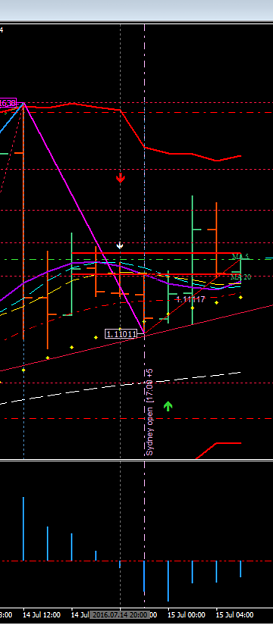

at the point of entry ROMAR is above EMA so that means ROMAR is resistance. besides that the parabolic is on top and white and smooth are above purple.

make sure you look at THE POINT OF ENTRY.

at the end of the chart ROMAR is indeed support as it is below EMA (EMA just slightly above ROMAR) and the horsemen are going up.