I just got an idea in this days how it should be made a simple winner system and requested an indicator:

http://www.forexfactory.com/showthre...21#post8438821

I haven't got any offers yet.

Attachment

Anyway, today I read something interesting too, beside of those somebody became profitable because of this system:

http://www.forexfactory.com/showthre...29#post8324129

Lets see now:

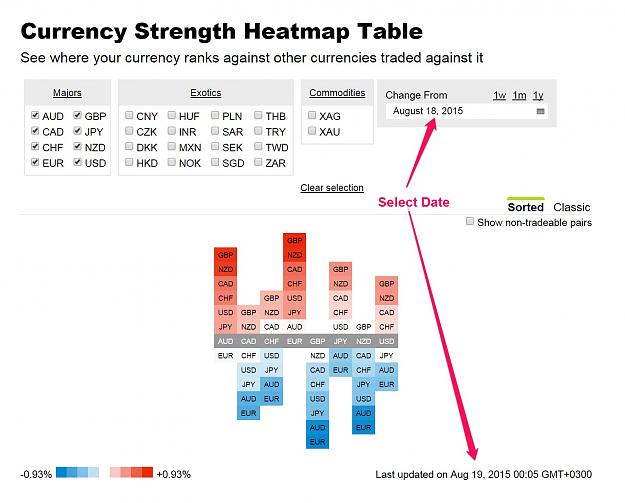

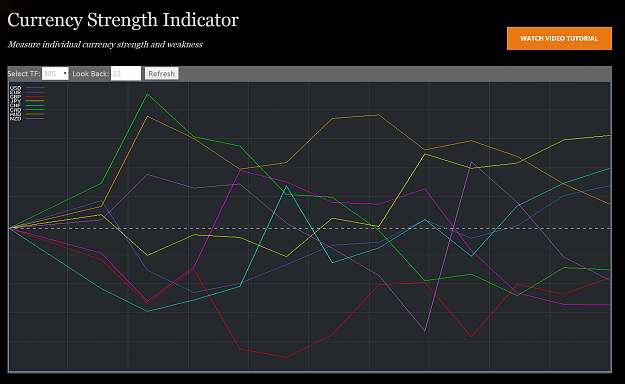

This heat map / currency strength meter it says from yesterday to now it WAS the most profitable to open a Short of EUR/GBP.

But it said what was, which is a lagging "indicator" and it is a Momentum indicator family.

It seems to be ok.

But what to do now if I know, what had the most momentum?

- or I play in hope the momentum it is not finished and it will continue

- or I play in hope the momentum it was so high as the pullback it is coming to a Fibo level.

From my personal experience both is risky:

- sometimes is safe to play against the momentum, because if I enter to lower timeframe I see it is stopped.

- other times huge loss, because I can't determine where to need to put a SL so easy and after the momentum is stopped it retakes the direction.

- and vice versa: I see it is now weak yet and must continue, and when I open a position it is coming a pullback.

First I am checking how much it went already that pair and what is the average movement for that.

Let say his daily average movement is 100 pip and he went only just 120 pip and this is the highest momentum pair for me it is not enough to open a counter direction, case closed: no trade. But if it went 160 or above maybe.

Then I will try to check the reason why it went so much.

If it was a breaking news, that maybe has effect for 16h or 36h, but some other has effect for 5 month

I can't clearly distinguish - and this is my problem- but I try: or take the same direction with movement or play for pullback, depends on the news, fundamentals.

I don't know how it would work the 2x 30 pip system in this case, but it seems to be 60 pip SL(which is fair on majors, but to few on cross pairs).

TP it isn't. It is exited after max 2h, but how much can it move in 2h? - average case it is 20-25 pip in majors.

After NY open in 2h there are major news, which can have major impact. I don't see why it would properly that system.

http://www.forexfactory.com/showthre...21#post8438821

I haven't got any offers yet.

Attachment

Anyway, today I read something interesting too, beside of those somebody became profitable because of this system:

http://www.forexfactory.com/showthre...29#post8324129

QuoteDislikedI have been trading for nine years and I firmly believe that my success,after many losses guys, started when I used the CSM(currency strength meter). Trade the strongest against the weakest...so obvious , ....now the real secret is to only trade at the opening times of Europe and the US and for only two hours each. Don't be tempted to trade longer...take your profit and run.

30 min before opening I straddle my graph with 2 horizontal lines 30 pips either side of the current price and place market orders for the buy and sell of the two currencies...strongest and weakest .

Once the entry is hit the other stays as your stoploss. So if the buy hits, dont cancel the sell order.

If anyone wishes to contact me , my email is [email protected] and I would be happy to assist further and to provide my trading account success history. Of course I do have other secrets happy to share. Regards, Charlie

Lets see now:

This heat map / currency strength meter it says from yesterday to now it WAS the most profitable to open a Short of EUR/GBP.

But it said what was, which is a lagging "indicator" and it is a Momentum indicator family.

It seems to be ok.

But what to do now if I know, what had the most momentum?

- or I play in hope the momentum it is not finished and it will continue

- or I play in hope the momentum it was so high as the pullback it is coming to a Fibo level.

From my personal experience both is risky:

- sometimes is safe to play against the momentum, because if I enter to lower timeframe I see it is stopped.

- other times huge loss, because I can't determine where to need to put a SL so easy and after the momentum is stopped it retakes the direction.

- and vice versa: I see it is now weak yet and must continue, and when I open a position it is coming a pullback.

First I am checking how much it went already that pair and what is the average movement for that.

Let say his daily average movement is 100 pip and he went only just 120 pip and this is the highest momentum pair for me it is not enough to open a counter direction, case closed: no trade. But if it went 160 or above maybe.

Then I will try to check the reason why it went so much.

If it was a breaking news, that maybe has effect for 16h or 36h, but some other has effect for 5 month

I can't clearly distinguish - and this is my problem- but I try: or take the same direction with movement or play for pullback, depends on the news, fundamentals.

I don't know how it would work the 2x 30 pip system in this case, but it seems to be 60 pip SL(which is fair on majors, but to few on cross pairs).

TP it isn't. It is exited after max 2h, but how much can it move in 2h? - average case it is 20-25 pip in majors.

After NY open in 2h there are major news, which can have major impact. I don't see why it would properly that system.

I want to buy PATIENCE