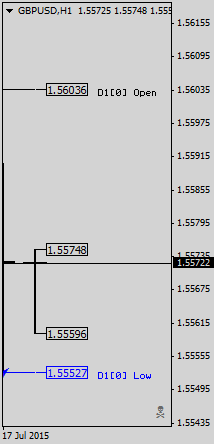

When price is above an open, it is up. Conversely, when price is below an open, it is down. It is a good idea not to short when price is up and not to buy when price is down. Naturally, most traders look for reversals but are impatient and trigger happy thus buying when they should be selling and vice-versa.

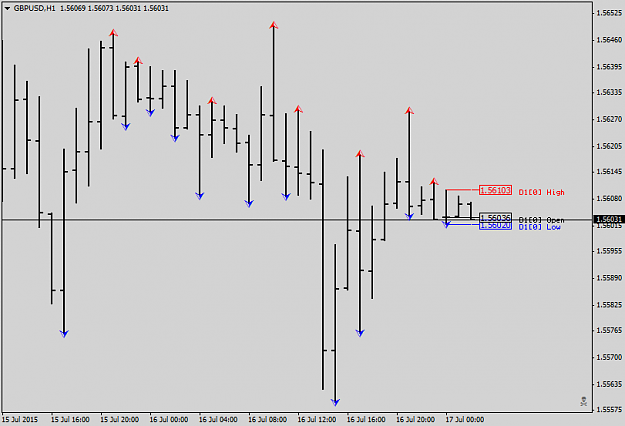

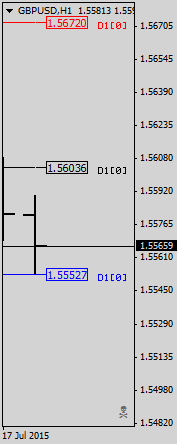

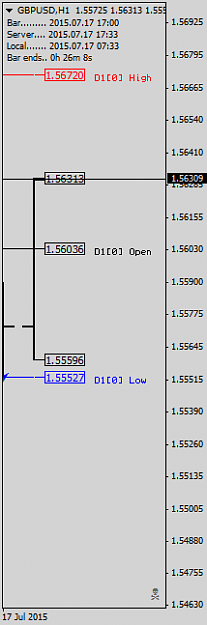

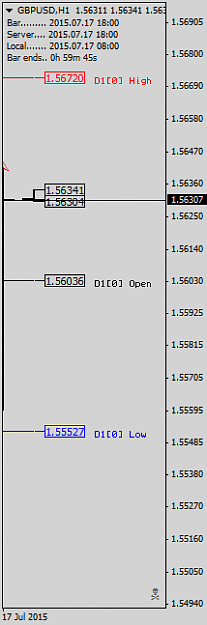

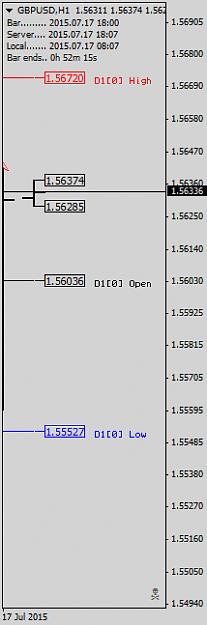

A sell below the H1 open of the bar immediately following the bar making the highest high would have resulted in profit. In summary, a bar makes a high and closes. Next bar fails to make a higher high and reverses. Sell when price drops below the open price of the current bar.

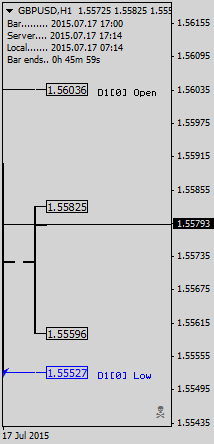

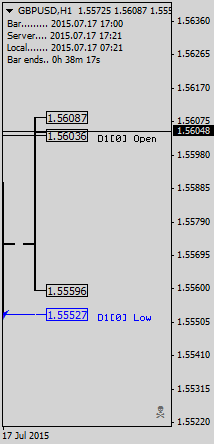

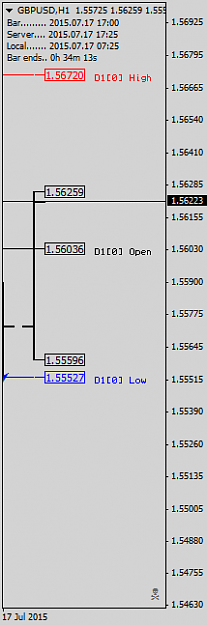

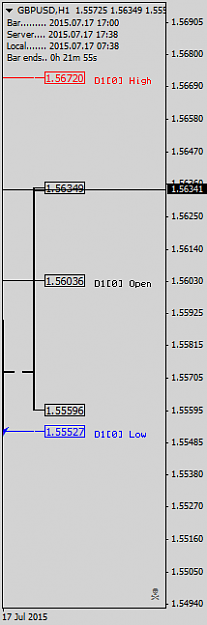

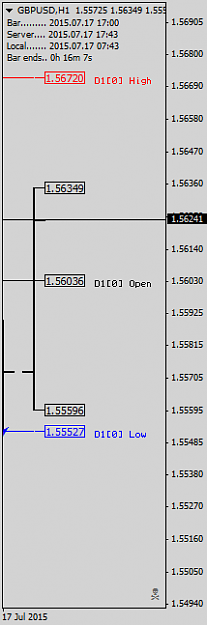

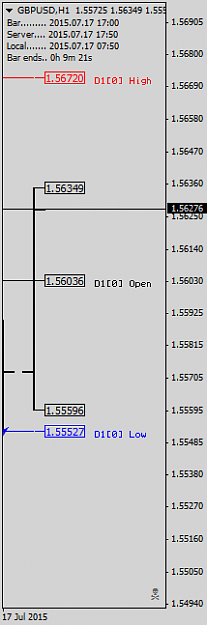

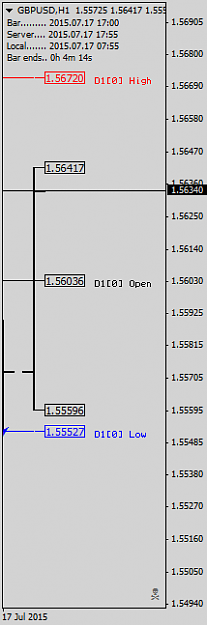

A buy above the H1 open of the bar immediately following the bar making the lowest low would have resulted in profit. In summary, a bar makes a low and closes. Next bar fails to make a lower low and reverses. Buy when price rises above the open price of the current bar.

Please understand none of this is original or new and this is presented for EDUCATIONAL PURPOSES ONLY. You may find your results may differ. Please check with an accredited financial specialist before using real money. FOREX trading can be risky. YOU HAVE BEEN WARNED!

"Perfection is not when you have nothing more to add, but when you have nothing more to take away." - Antoine De Saint Exupery

"It is not about adding on, but taking away. The less technique, the better you are." - Bruce Lee

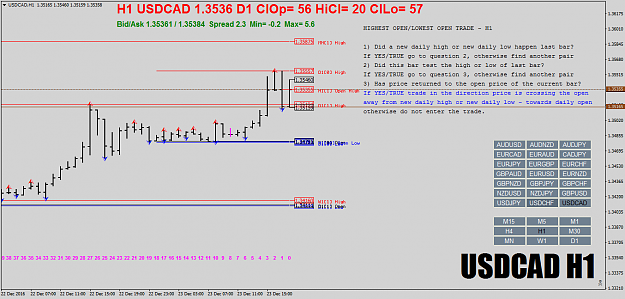

EDIT DEC 23, 2016:

Someone pointed out RULE #3 could be interpreted in more than one way.

See modification on chart.

You want to trade AWAY from the daily high after price makes a new daily high and

trade AWAY from the daily low after price makes a new daily low.

You are ALWAYS trading towards the daily open with this method.

Indicators and templates are in the attachments. Look for the paperclip icon upper righthand corner of your browser.

Please do not discuss or mention EAs in this thread.

EAs are not welcome here.

EAs distract from the method.

You have been warned.

If you want to post code in this thread post the MQ4 files.

Posting only EX4 files is not welcome.

You may wonder why.

EX4 files could contain something harmful.

MQ4 files are compiled on your computer so you can feel relatively safe.

If the coder "vanishes" then the code can not be updated if/when it fails and the code can not be improved or enhanced.

Who wants to be a the mercy of some unseen coder?

Newcomers to the thread, if you want a question answered then copy/paste the following message when you ask your question:

I HAVE READ POST #1 AND THE EXAMPLE LINKS BUT I STILL HAVE A QUESTION

A sell below the H1 open of the bar immediately following the bar making the highest high would have resulted in profit. In summary, a bar makes a high and closes. Next bar fails to make a higher high and reverses. Sell when price drops below the open price of the current bar.

A buy above the H1 open of the bar immediately following the bar making the lowest low would have resulted in profit. In summary, a bar makes a low and closes. Next bar fails to make a lower low and reverses. Buy when price rises above the open price of the current bar.

Please understand none of this is original or new and this is presented for EDUCATIONAL PURPOSES ONLY. You may find your results may differ. Please check with an accredited financial specialist before using real money. FOREX trading can be risky. YOU HAVE BEEN WARNED!

"Perfection is not when you have nothing more to add, but when you have nothing more to take away." - Antoine De Saint Exupery

"It is not about adding on, but taking away. The less technique, the better you are." - Bruce Lee

EDIT DEC 23, 2016:

Someone pointed out RULE #3 could be interpreted in more than one way.

See modification on chart.

You want to trade AWAY from the daily high after price makes a new daily high and

trade AWAY from the daily low after price makes a new daily low.

You are ALWAYS trading towards the daily open with this method.

Indicators and templates are in the attachments. Look for the paperclip icon upper righthand corner of your browser.

Please do not discuss or mention EAs in this thread.

EAs are not welcome here.

EAs distract from the method.

You have been warned.

If you want to post code in this thread post the MQ4 files.

Posting only EX4 files is not welcome.

You may wonder why.

EX4 files could contain something harmful.

MQ4 files are compiled on your computer so you can feel relatively safe.

If the coder "vanishes" then the code can not be updated if/when it fails and the code can not be improved or enhanced.

Who wants to be a the mercy of some unseen coder?

Newcomers to the thread, if you want a question answered then copy/paste the following message when you ask your question:

I HAVE READ POST #1 AND THE EXAMPLE LINKS BUT I STILL HAVE A QUESTION

Attached File(s)

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade