nice trade

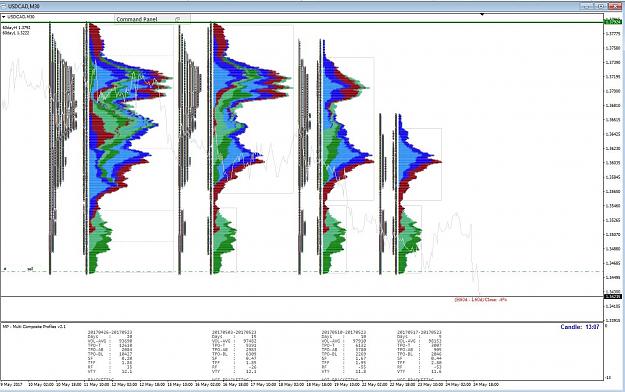

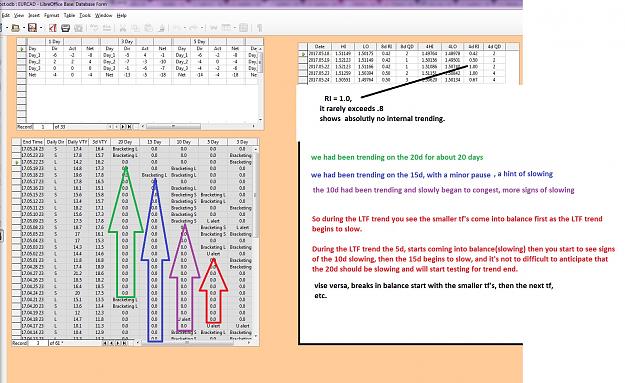

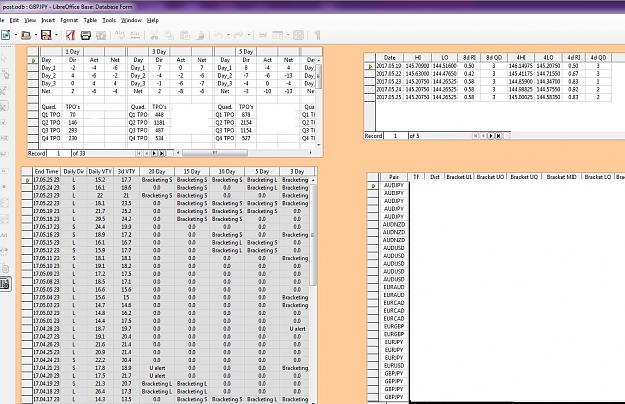

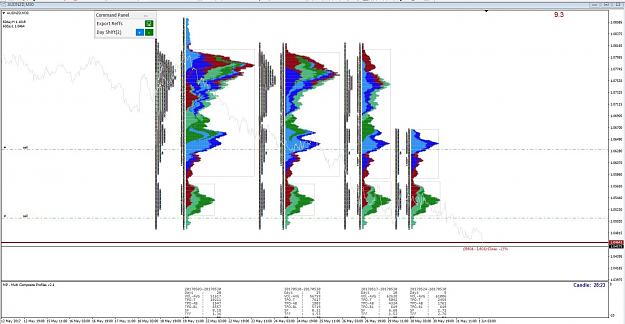

MY trade in usdcad hit my SL, price eventually goes down anyway after that. But yesterday TFF was slowing down abit that i would stay on the side of caution.

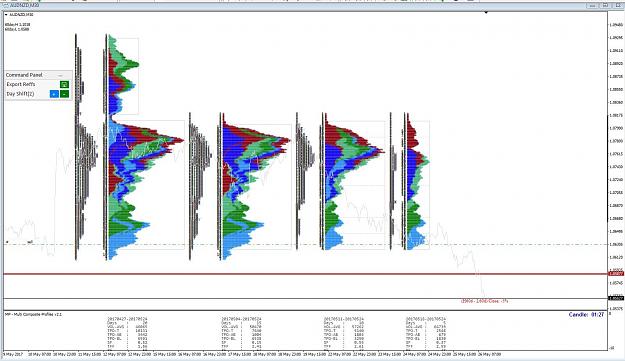

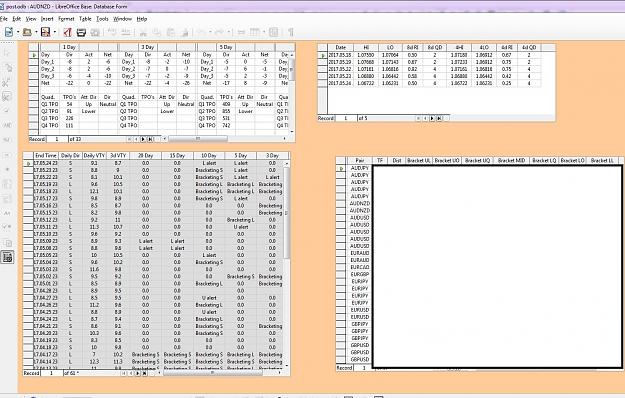

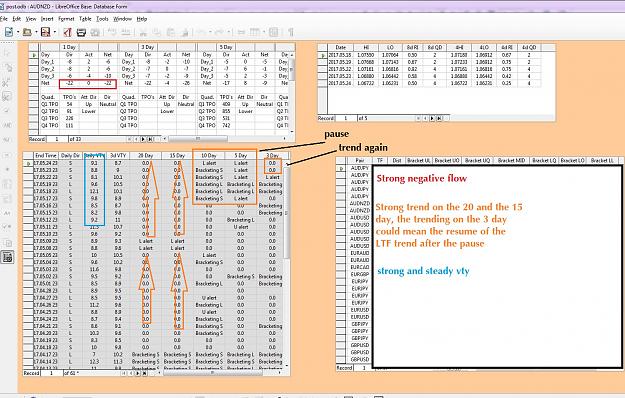

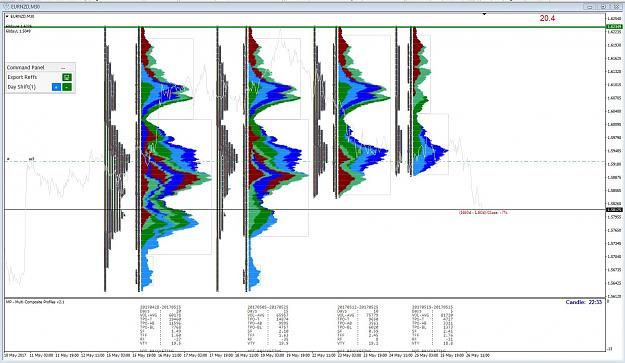

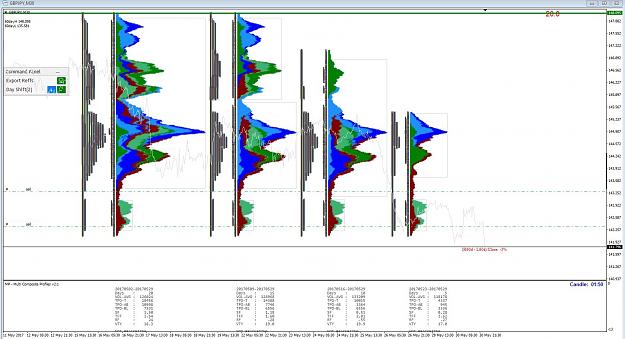

I caught some good trades on nzd and aud on Monday, price is moving so fast vertically up today too for the kiwi, I scale out by today prior to US session for both

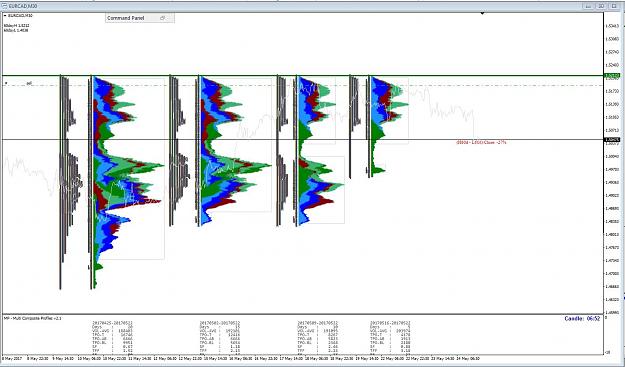

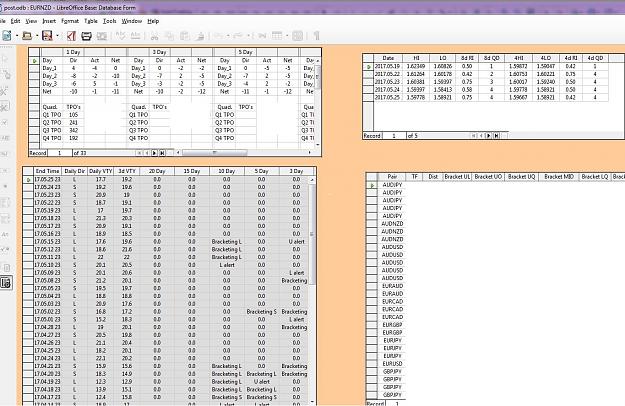

I got some nice trade on the EURUSD too last week but the 20 day SF is so skewed i avoided taking further trades once the capping sets in; And today's high volume shows it with AD & RF down mostly.

MY trade in usdcad hit my SL, price eventually goes down anyway after that. But yesterday TFF was slowing down abit that i would stay on the side of caution.

I caught some good trades on nzd and aud on Monday, price is moving so fast vertically up today too for the kiwi, I scale out by today prior to US session for both

I got some nice trade on the EURUSD too last week but the 20 day SF is so skewed i avoided taking further trades once the capping sets in; And today's high volume shows it with AD & RF down mostly.