There is no magic formula or an obscure recipe that you can cook and turn you into a profitable trader. When going over your watchlist, you may have realized specific patterns that repeat themselves over and over.

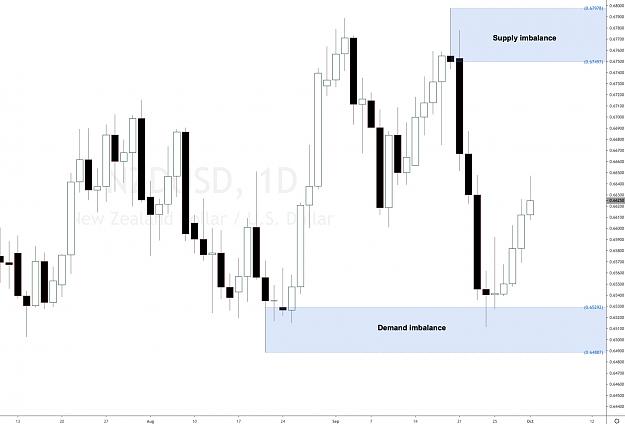

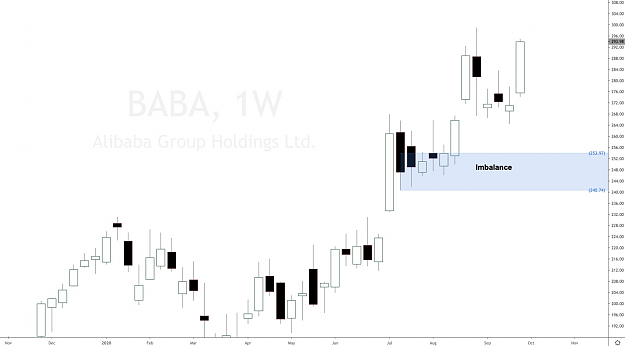

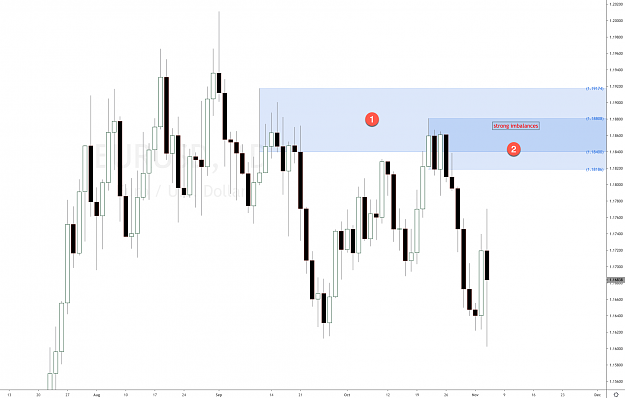

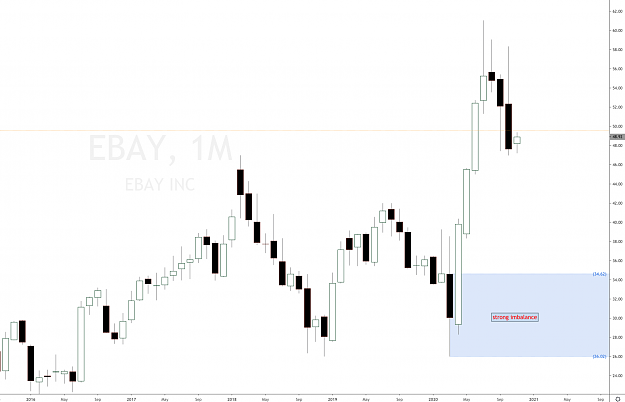

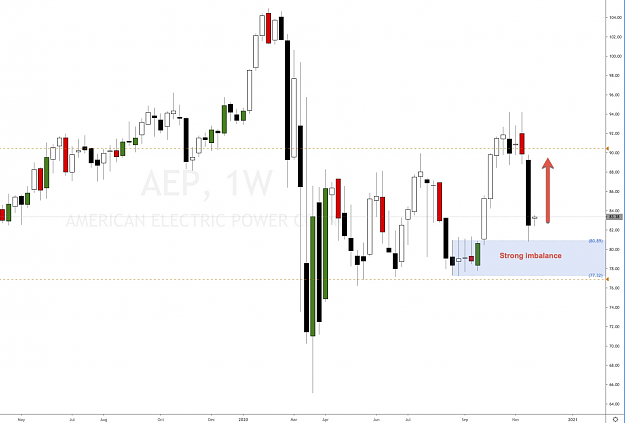

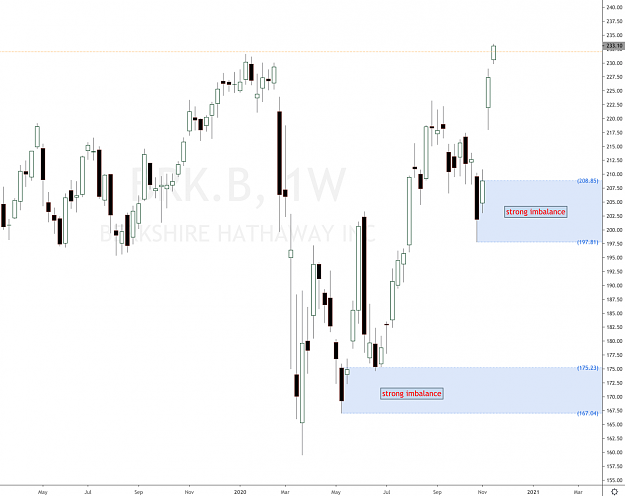

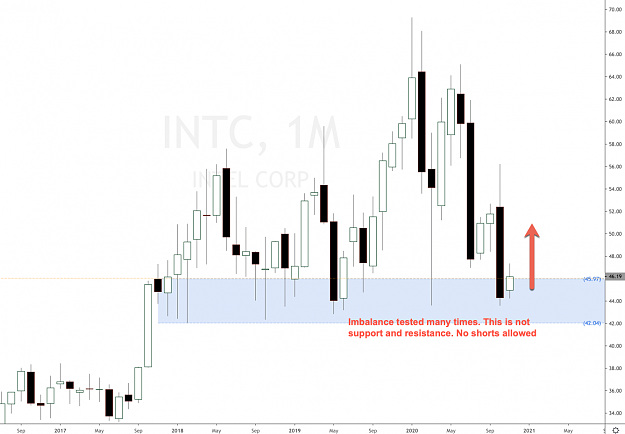

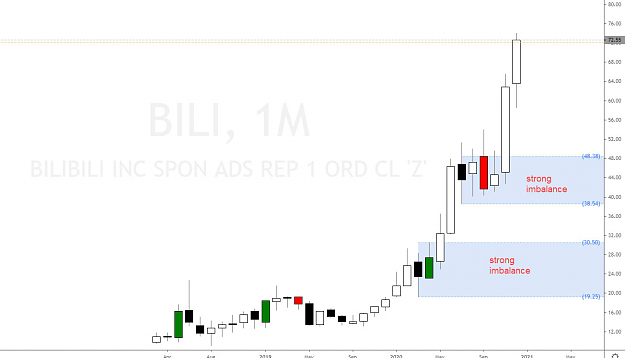

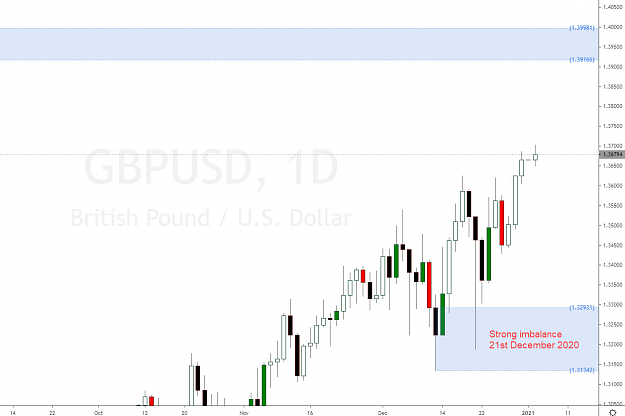

Maybe you havenít realized yet but being proficient at reading price action and the numerous candlestick patterns can tell you a lot about the future moves of the market. You may have started to follow me and my analyses, or maybe youíve been reading them for quite a long time. One thing that is common in all my analysis is the strength of the impulse, and the patience one needs to have to wait for the price to pull back to those impulses.

Some many so-called magic indicators and oscillators will tell you when to buy or when to sell, but Iím pretty sure you know they will not work. Otherwise, youíd probably not be wasting your time reading my weekly newsletters.

Staying away from your computer as much as you want is actually a variable you should have in your trading plan because if you keep on watching the charts expecting to move the price with the power of your mind, you might be disappointed.

You can read the full article and forex and stock analysis in this link

Maybe you havenít realized yet but being proficient at reading price action and the numerous candlestick patterns can tell you a lot about the future moves of the market. You may have started to follow me and my analyses, or maybe youíve been reading them for quite a long time. One thing that is common in all my analysis is the strength of the impulse, and the patience one needs to have to wait for the price to pull back to those impulses.

Some many so-called magic indicators and oscillators will tell you when to buy or when to sell, but Iím pretty sure you know they will not work. Otherwise, youíd probably not be wasting your time reading my weekly newsletters.

Staying away from your computer as much as you want is actually a variable you should have in your trading plan because if you keep on watching the charts expecting to move the price with the power of your mind, you might be disappointed.

You can read the full article and forex and stock analysis in this link

Set and Forget supply and demand trading community