The whole trading world is talking about the same thing, the US stock market crash 2020, which is also a worldwide stock market that affects every single world exchange.

Has the market crash in 2020 began because of the corona virus effect? Have the Oil war and OPEC and Russia decisions affected the crash? Well, they have obviously affected the sell off in most stocks, indexes and ETFs, but they are not the only reason why price is dropping so strongly.

US Stock market correction 2020

There are obvious reasons why corona virus could affect Norwegian Cruise Line (NCLH) stock, citizens cannot travel like before, many countries have banned other countries and flights are scarce or non-existent. The US has banned flight coming from the European Union and now even the UK, similar bans have been established in Spain, Italy, China and other countries. All this bans will undoubtedly cause a strong disruption in our travelling habits.

NYSE crash

Airlines and hotels are very much affected. Iíve many friends who have lost their jobs in Spain because of the effects of the corona virus. Many hotels have closed, restaurants have to be closed by order of our President. Employment rate will hit maximums in no time in Spain and probably in other countries whose Gross Domestic Product (GDP) is mostly focused on the services sector (hotels, restaurants, travelling).

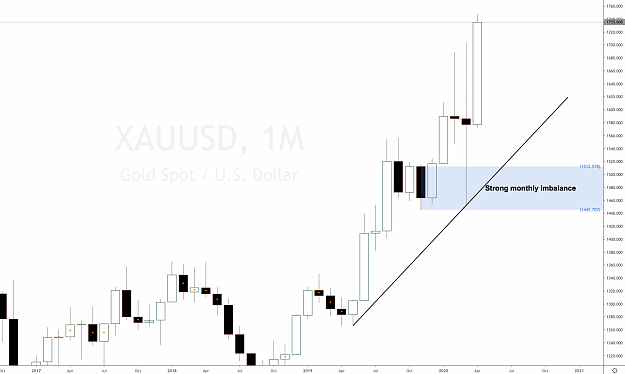

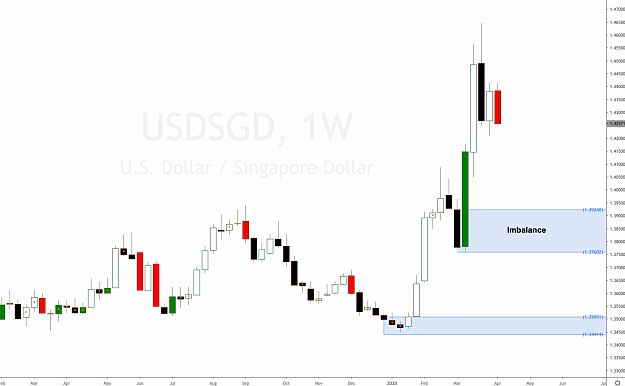

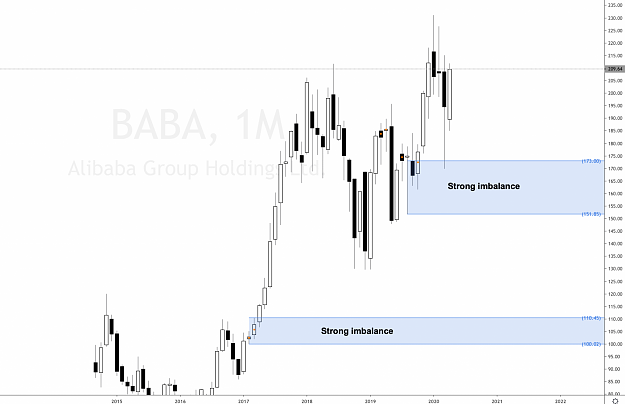

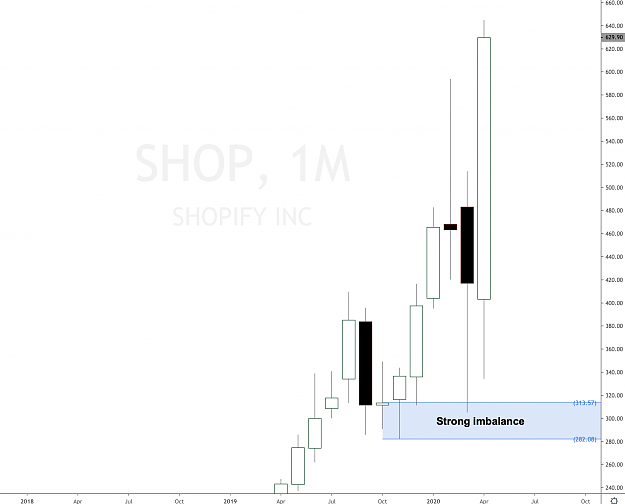

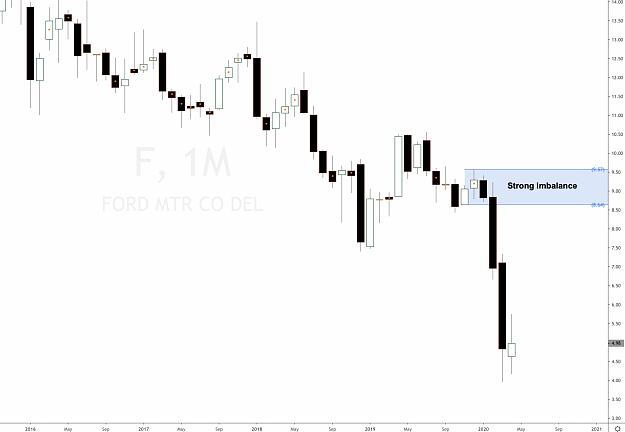

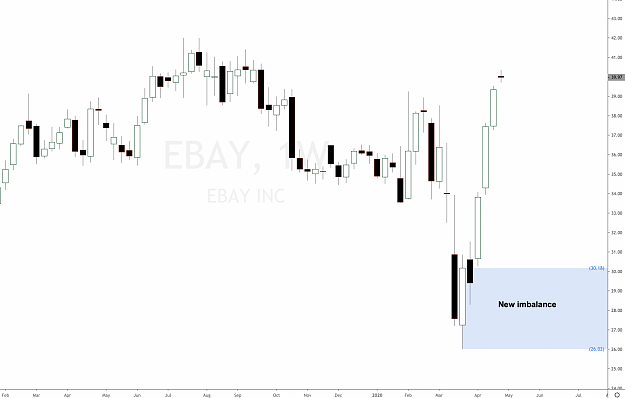

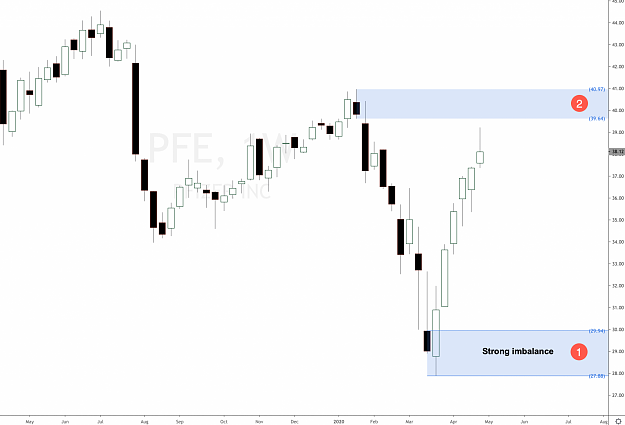

However we are forgetting something very important, price action itself and supply and demand. Price action is the only non-lagging indicator, if a candlestick closes at $45 on the daily, weekly or monthly timeframes, then the candle cannot unclose next day or week at a different close, itís just impossible. The same cannot be said about indicators and oscillators, they change with sharp moves of the underlying asset and very high volatility like the one happening now in the US stock market crash 2020.

US Stock market crash 2020

Has the market crash in 2020 began because of the corona virus effect? Have the Oil war and OPEC and Russia decisions affected the crash? Well, they have obviously affected the sell off in most stocks, indexes and ETFs, but they are not the only reason why price is dropping so strongly.

US Stock market correction 2020

There are obvious reasons why corona virus could affect Norwegian Cruise Line (NCLH) stock, citizens cannot travel like before, many countries have banned other countries and flights are scarce or non-existent. The US has banned flight coming from the European Union and now even the UK, similar bans have been established in Spain, Italy, China and other countries. All this bans will undoubtedly cause a strong disruption in our travelling habits.

NYSE crash

Airlines and hotels are very much affected. Iíve many friends who have lost their jobs in Spain because of the effects of the corona virus. Many hotels have closed, restaurants have to be closed by order of our President. Employment rate will hit maximums in no time in Spain and probably in other countries whose Gross Domestic Product (GDP) is mostly focused on the services sector (hotels, restaurants, travelling).

However we are forgetting something very important, price action itself and supply and demand. Price action is the only non-lagging indicator, if a candlestick closes at $45 on the daily, weekly or monthly timeframes, then the candle cannot unclose next day or week at a different close, itís just impossible. The same cannot be said about indicators and oscillators, they change with sharp moves of the underlying asset and very high volatility like the one happening now in the US stock market crash 2020.

Inserted Video

US Stock market crash 2020

Set and Forget supply and demand trading community