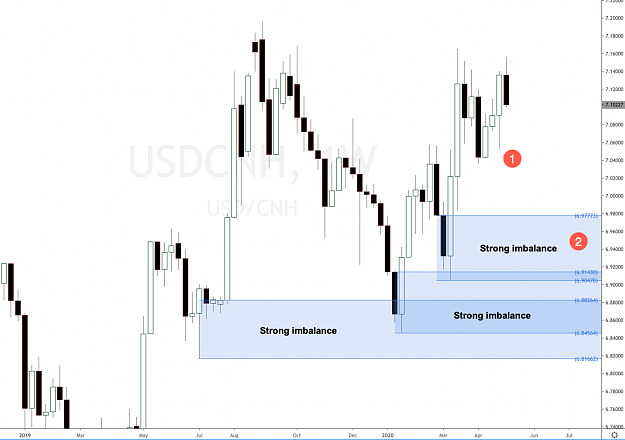

USD CNH Chinese Yuan offshore forecast

This is a quick supply and demand Forex analysis update for the Chinese currency pair, USDCNH Chinese Yuan offshore. In our last update, we were expecting this Forex cross pair to retrace to a strong weekly imbalance, it tried to a couple of weeks ago but it couldn’t make it then. Still waiting for the same scenario or a strong rally creating new imbalances.

The US dollar is very strong against Chinese Yuan offshore currency pair, reason why last two weekly demand imbalances around 6.91 and 6.87 have been respected. There is a brand-new imbalance slightly higher around 6.95 price level. Will this new imbalance be respected like the previous ones? We do not know but what we do know is that it’s a strong imbalance in a clear trend. Waiting for the same Forex trading scenario or a strong rally creating new imbalances.

Supply and demand Forex trading strategy

This is a quick supply and demand Forex analysis update for the Chinese currency pair, USDCNH Chinese Yuan offshore. In our last update, we were expecting this Forex cross pair to retrace to a strong weekly imbalance, it tried to a couple of weeks ago but it couldn’t make it then. Still waiting for the same scenario or a strong rally creating new imbalances.

The US dollar is very strong against Chinese Yuan offshore currency pair, reason why last two weekly demand imbalances around 6.91 and 6.87 have been respected. There is a brand-new imbalance slightly higher around 6.95 price level. Will this new imbalance be respected like the previous ones? We do not know but what we do know is that it’s a strong imbalance in a clear trend. Waiting for the same Forex trading scenario or a strong rally creating new imbalances.

Supply and demand Forex trading strategy

Set and Forget supply and demand trading community