I want to say a big thank you to Nikos Mermigas for having shared a lot of his system for free.

Too bad my daily schedule does not allow me to apply for his live sessions.

But as soon as I can find enough free time I will definitely register to his next weekly workshop, I regret I missed Santorini last October.

Too bad my daily schedule does not allow me to apply for his live sessions.

But as soon as I can find enough free time I will definitely register to his next weekly workshop, I regret I missed Santorini last October.

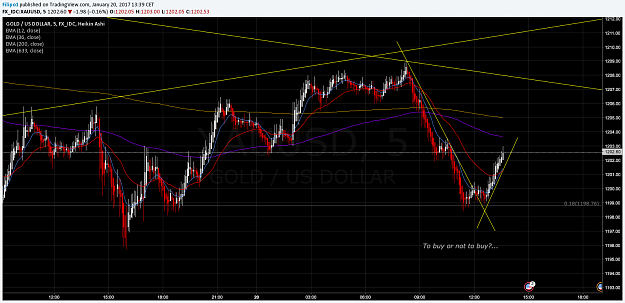

I used to be indecisive but now I'm not so sure...

1