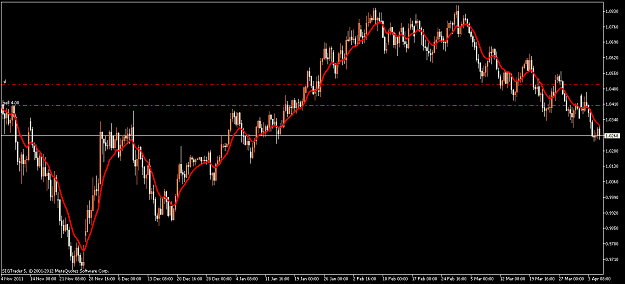

DislikedEURUSD will be giving a Sell Signal at the end of the day.

What I like:

- Break of short-term Trend Line (gray dotted TL)

- Sell in the direction of long-term Trend Line (aqua TL down)

- Bounce at previous week highs

What I don't like:

- There is not much room between price and mid-term Trend Line (aqua TL up). If the TL rejects the price, at least we will have the SL at BE.

What do you think guys??

Greg.Ignored

It looks good but there are a couple of things that are going to make me pass on the trade, your TL is one ,it doesn't give me enough room to justify the risk (SL size) and trading that close into a RN .3200 is the other. Once beyond that, if it doesn't runaway, there are 150 pips of room until the next support point. Im not saying don't take the trade , just sharing my view, and I am an ultra conservative trader. If it all doesn't line up I pass evertime. BTW good job on your EURCAD trade

Always Learning