Dear FF-Community-Member!

The Forex, or Foreign Exchange market is now the absolutely hottest thing on the trading and speculating scene. Just in sheer volume, the international trading market is about 5,000 times bigger than the total stocks, options, futures and bonds markets in the USA. It functions 24 hours a day, is very volatile, and is as thrilling as options trading. I know how difficult trading can be sometimes. Currency trading, forex trading and stock trading can sometimes be frustrating and difficult, especially if you are just starting out. It is far too easy to become overloaded with information and feel lost or confused. Wouldn’t it be great if you could discover put yourself on the path to trading successfully? Some psychological parameters have to be activate when trading the Forex market, e.g. the Tolerance to Risk. Most people have a different tolerance to risk and managing risk is a vital part of trading well consistently. So if we all have a different tolerance to risk, clearly we won’t all have the same level of comfort and confidence in the same trading plan. Therefore, we all have to discover that approach that suits us as an individual person. There is really only one caveat: Forex trading is mostly done on margin, so be careful and don't overextend yourself!

Trading Concept

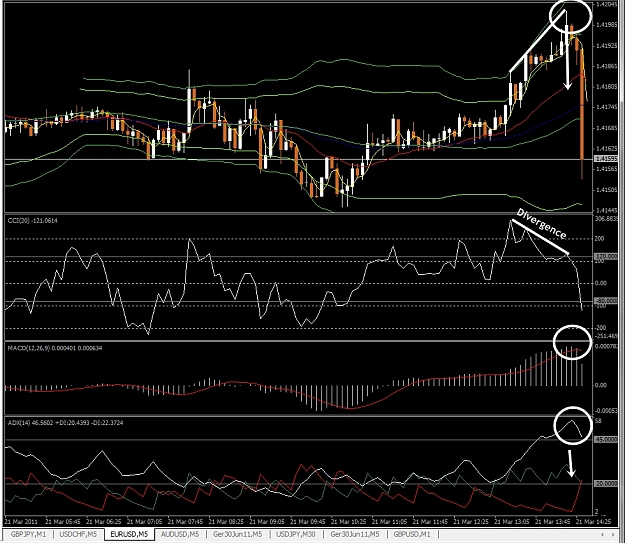

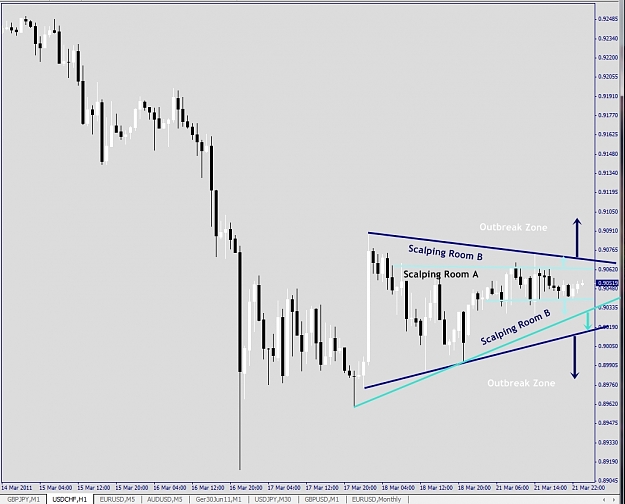

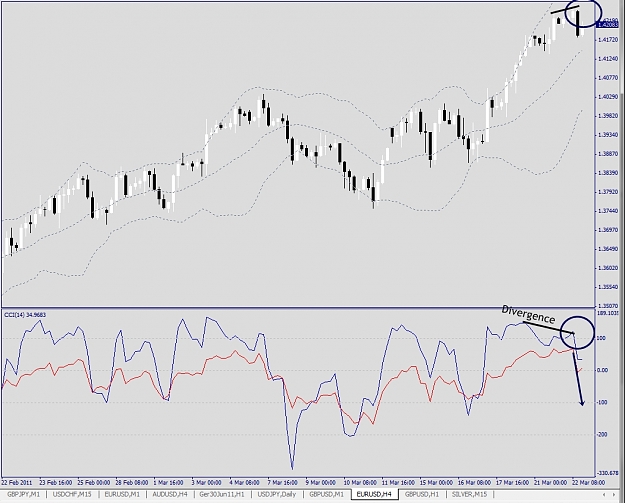

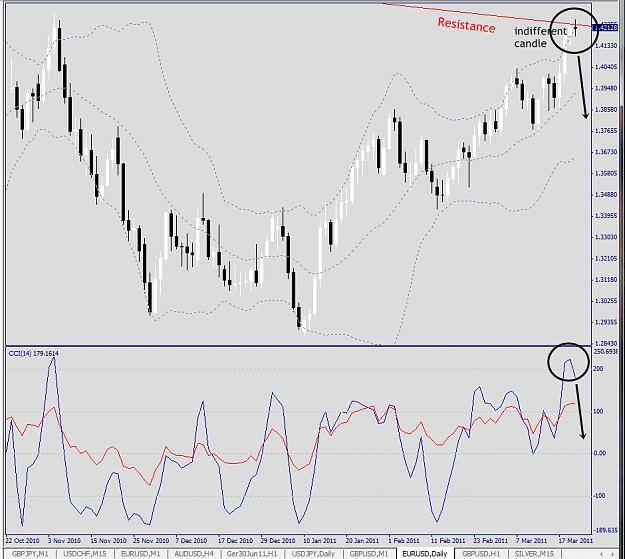

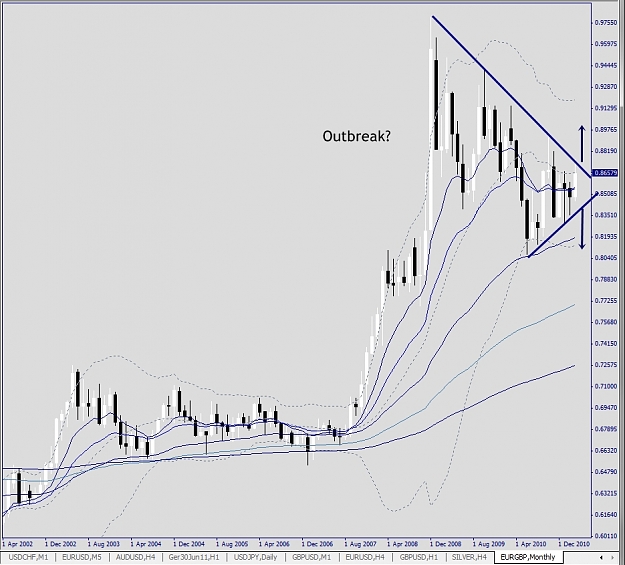

Swing Trades should be done at CCI(14) Tops and Bottoms Trading Strategy with due regards to a Multiple Time Frame Analyse (MTFA). "CCI(14) Tops & Bottom Trading" is simple, fast & efficient. See "Time Cell Trading", please: http://www.forexfactory.com/showthread.php?t=249257

Time Cell Trading (TCT) is a manual trading strategy. Trades could be triggered within different time frames and can used in ranging and in trending markets. TCT has used since 2004. You can use Time Cell Trading strategy only by using the CCI(14) tops and bottoms in combination with the price action (e.g. engulfing patterns, hammers, shooting stars, in bars). It's simple and efficient! If you will get other arguments more, so look at the extreme points at murrey math or/and at the pivotal points and/or the fibonnacis. The EMA lines will show you apart from price action momentum and if there is either a trending environment or a ranging market.

The guideline that I have laid out for "CCI-Top-&-Bottom-Strategy" should be just a guideline - guidelines, not define rules carved in stone, learning how to identify high probability entries can improve your odds of success when trading this strategy.

Time Frames: any

Currency pairs: any

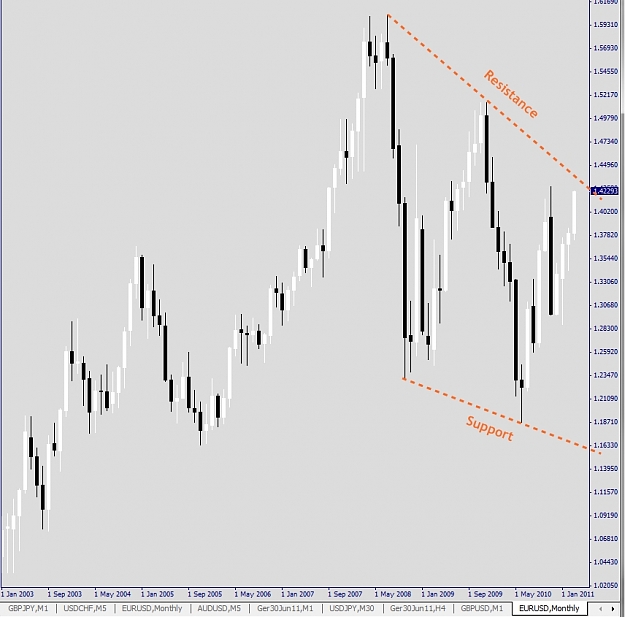

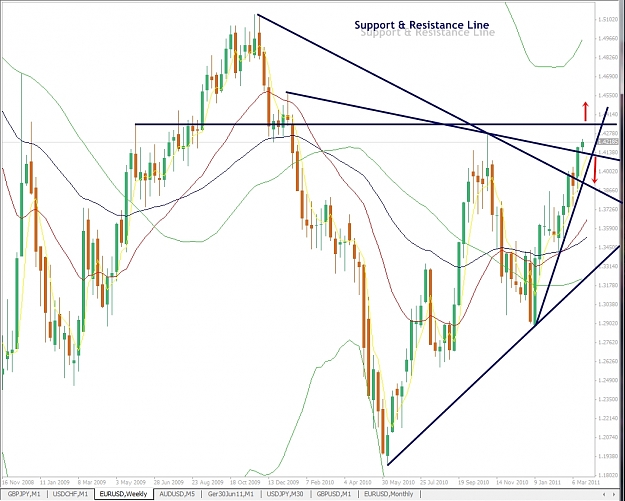

Indicators: BB, CCI(14), Pivotals, EMAs, Fibonacci Levels, Support & Resistance, ADX, MACD

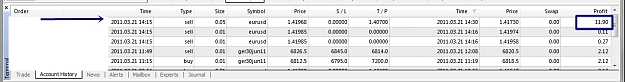

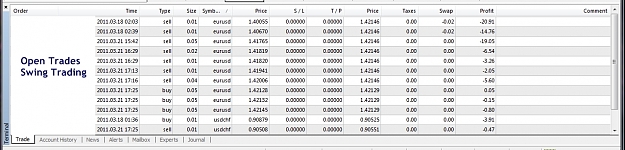

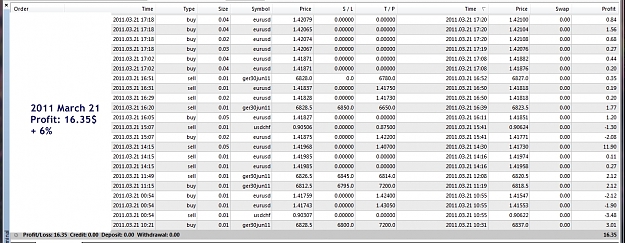

Trade ExampleS

EURUSD, H1, 2011 March 28, p.4, #58; EURUSD, M1, 2011 March 29, p.5, #61; GBPNZD, H1, 2011 April 09, p.11, #156; EURUSD, EURUSD, M5, 2011 April 14, p.15, #212; M1, 2011 April 14, p.15, #215;

Indicators - Back Copy:

ADX in process

CCI >>> CCI Indikator (ger.), p.16, #228; Trading Forex with Woodies CCI, p.16, #229; Complex Trading System (CCI Divergence Breakout) > Link, p.16, #230; Channel Breakouts With The CCI (by Kathy Lien and Boris Schlossberg), p.16, #231; Commodity Channel Index (CCI) with a CCI Download Box > Link, p.16, #233; Forex CCI Indicator Explained, p.16, #234, #235; CCI Forex Floor Trader System, p.16, #236;

Bollinger Bands under way

EMA in process

Fibonacci Levels in process

MACD in process

Pivotal Points >>> p.19, #271;

Price Patterns >>> Candlesticks Charts Explained, p.19, #273 et seq.;

Trend Lines >>> How to Draw Trendlines, p.15, #218; Forex Technical Analysis, p.15, #219; Trendlines > Links, p.15, #220; Die Trend Lines (ger.) #222; Forex Trading Tool - The Three Trendline Strategy, p.15, #223.

WellxAMA in process

etc.

Articles & Links

Why High Probability Forex Trading Strategies Are For Suckers!, p.3, #44; Forex Day Trading, Scalping and Swing Trading, p.4, #46; US Dollar Index, p.4, #50; Trading the Dollar with USDX, p.4, #51; Forex Lots, pips, risk, leverage. margin, spread, order types, swap, etc all explaine, p.7, #91; Trading Multiple Time Frames in FX, p.7, #92; Multiple Time Frame Analysen (ger.), p.7, #93; Multiple Time Frameanalysis Of The Spot Forex, p.7, #94; What Time Frame Should I Trade?, p.7, #95; Top 4 Fibonacci Retracement Mistakes To Avoid, p.10, #150 & p.11, #151; Forex Strategy "Flag + ABC", p.13, #185; A Beginner's Guide To Scalping In The Forex Markets, p.13, #186; How to choose the best combination of Forex indicators, p. 13, #195; Forex Money Management & Exit Strategies, p.18, #258;

Music & Songs

Michel Petrucciani - Take the "A" Train, p.9, #132; Michel Petrucciani Trio - Cantabile, p.9, #133;

More trades are published at:

http://www.fxbookies.com/showthread....-Cell-Trading&

Real Account

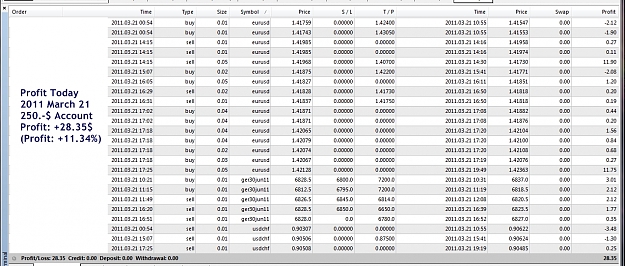

Trades should be done at an 250.-$ Real Account.

Note:

Normally I don't trade with a 250.-$ Account. The first trial was an absolutely crash down (see there, http://www.forexfactory.com/showthread.php?t=281021, please). I don't think that it's possible to trade with a 250.-$ Account seriously with 0.01 lot, nevertheless it should be a trier. Serious trades have to be done at minimum 1'000.-$ with maximum 0.01 Lot sizes or a 10'000.-$ Depot around 0.1 Lot with say 1% Profit per Day. Do you prefere a "Higher Risk Trading Plan"? Let's see the "Kooky K's", p.4, #66 (Target: 25-50% Profit per Month).

Last Result: See p.23, #339 at 2011 Mai 04.

Real Account, Deposit: 250.-$; Beginning Date: 2011 April 26

Target A-Level: 2.50.-$ a Day (1%) / Target H-Level: Kooky K's (25-50% Profit per Month, p.4, #66), see also p.20, #287;

http://www.forexfactory.com/forexcube

Trading the Forex Market?

I'm just explaining how I do it and why, nothing more.

I wish all of you success & happiness!

Kindest regards

FXcube

2011 Mai 4

It's time to say Good-Bye!

Enough has been said!

I wish you Success & Happiness!

FXcube

The Forex, or Foreign Exchange market is now the absolutely hottest thing on the trading and speculating scene. Just in sheer volume, the international trading market is about 5,000 times bigger than the total stocks, options, futures and bonds markets in the USA. It functions 24 hours a day, is very volatile, and is as thrilling as options trading. I know how difficult trading can be sometimes. Currency trading, forex trading and stock trading can sometimes be frustrating and difficult, especially if you are just starting out. It is far too easy to become overloaded with information and feel lost or confused. Wouldn’t it be great if you could discover put yourself on the path to trading successfully? Some psychological parameters have to be activate when trading the Forex market, e.g. the Tolerance to Risk. Most people have a different tolerance to risk and managing risk is a vital part of trading well consistently. So if we all have a different tolerance to risk, clearly we won’t all have the same level of comfort and confidence in the same trading plan. Therefore, we all have to discover that approach that suits us as an individual person. There is really only one caveat: Forex trading is mostly done on margin, so be careful and don't overextend yourself!

Trading Concept

Swing Trades should be done at CCI(14) Tops and Bottoms Trading Strategy with due regards to a Multiple Time Frame Analyse (MTFA). "CCI(14) Tops & Bottom Trading" is simple, fast & efficient. See "Time Cell Trading", please: http://www.forexfactory.com/showthread.php?t=249257

Time Cell Trading (TCT) is a manual trading strategy. Trades could be triggered within different time frames and can used in ranging and in trending markets. TCT has used since 2004. You can use Time Cell Trading strategy only by using the CCI(14) tops and bottoms in combination with the price action (e.g. engulfing patterns, hammers, shooting stars, in bars). It's simple and efficient! If you will get other arguments more, so look at the extreme points at murrey math or/and at the pivotal points and/or the fibonnacis. The EMA lines will show you apart from price action momentum and if there is either a trending environment or a ranging market.

The guideline that I have laid out for "CCI-Top-&-Bottom-Strategy" should be just a guideline - guidelines, not define rules carved in stone, learning how to identify high probability entries can improve your odds of success when trading this strategy.

Time Frames: any

Currency pairs: any

Indicators: BB, CCI(14), Pivotals, EMAs, Fibonacci Levels, Support & Resistance, ADX, MACD

Trade ExampleS

EURUSD, H1, 2011 March 28, p.4, #58; EURUSD, M1, 2011 March 29, p.5, #61; GBPNZD, H1, 2011 April 09, p.11, #156; EURUSD, EURUSD, M5, 2011 April 14, p.15, #212; M1, 2011 April 14, p.15, #215;

Indicators - Back Copy:

ADX in process

CCI >>> CCI Indikator (ger.), p.16, #228; Trading Forex with Woodies CCI, p.16, #229; Complex Trading System (CCI Divergence Breakout) > Link, p.16, #230; Channel Breakouts With The CCI (by Kathy Lien and Boris Schlossberg), p.16, #231; Commodity Channel Index (CCI) with a CCI Download Box > Link, p.16, #233; Forex CCI Indicator Explained, p.16, #234, #235; CCI Forex Floor Trader System, p.16, #236;

Bollinger Bands under way

EMA in process

Fibonacci Levels in process

MACD in process

Pivotal Points >>> p.19, #271;

Price Patterns >>> Candlesticks Charts Explained, p.19, #273 et seq.;

Trend Lines >>> How to Draw Trendlines, p.15, #218; Forex Technical Analysis, p.15, #219; Trendlines > Links, p.15, #220; Die Trend Lines (ger.) #222; Forex Trading Tool - The Three Trendline Strategy, p.15, #223.

WellxAMA in process

etc.

Articles & Links

Why High Probability Forex Trading Strategies Are For Suckers!, p.3, #44; Forex Day Trading, Scalping and Swing Trading, p.4, #46; US Dollar Index, p.4, #50; Trading the Dollar with USDX, p.4, #51; Forex Lots, pips, risk, leverage. margin, spread, order types, swap, etc all explaine, p.7, #91; Trading Multiple Time Frames in FX, p.7, #92; Multiple Time Frame Analysen (ger.), p.7, #93; Multiple Time Frameanalysis Of The Spot Forex, p.7, #94; What Time Frame Should I Trade?, p.7, #95; Top 4 Fibonacci Retracement Mistakes To Avoid, p.10, #150 & p.11, #151; Forex Strategy "Flag + ABC", p.13, #185; A Beginner's Guide To Scalping In The Forex Markets, p.13, #186; How to choose the best combination of Forex indicators, p. 13, #195; Forex Money Management & Exit Strategies, p.18, #258;

Music & Songs

Michel Petrucciani - Take the "A" Train, p.9, #132; Michel Petrucciani Trio - Cantabile, p.9, #133;

More trades are published at:

http://www.fxbookies.com/showthread....-Cell-Trading&

Real Account

Trades should be done at an 250.-$ Real Account.

Note:

Normally I don't trade with a 250.-$ Account. The first trial was an absolutely crash down (see there, http://www.forexfactory.com/showthread.php?t=281021, please). I don't think that it's possible to trade with a 250.-$ Account seriously with 0.01 lot, nevertheless it should be a trier. Serious trades have to be done at minimum 1'000.-$ with maximum 0.01 Lot sizes or a 10'000.-$ Depot around 0.1 Lot with say 1% Profit per Day. Do you prefere a "Higher Risk Trading Plan"? Let's see the "Kooky K's", p.4, #66 (Target: 25-50% Profit per Month).

Last Result: See p.23, #339 at 2011 Mai 04.

Real Account, Deposit: 250.-$; Beginning Date: 2011 April 26

Target A-Level: 2.50.-$ a Day (1%) / Target H-Level: Kooky K's (25-50% Profit per Month, p.4, #66), see also p.20, #287;

http://www.forexfactory.com/forexcube

Trading the Forex Market?

I'm just explaining how I do it and why, nothing more.

I wish all of you success & happiness!

Kindest regards

FXcube

2011 Mai 4

It's time to say Good-Bye!

Enough has been said!

I wish you Success & Happiness!

FXcube