Hope you can help.

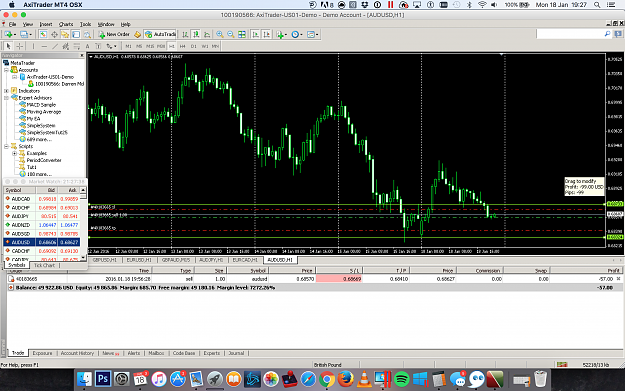

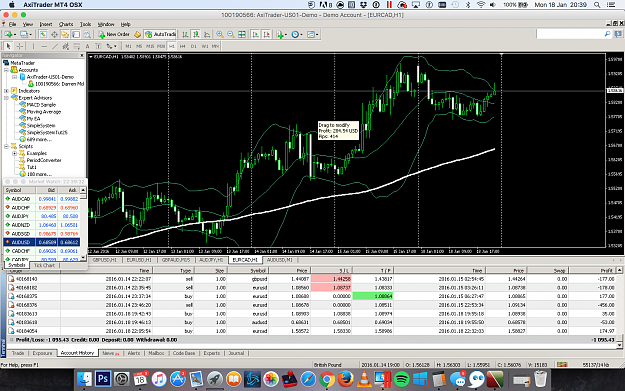

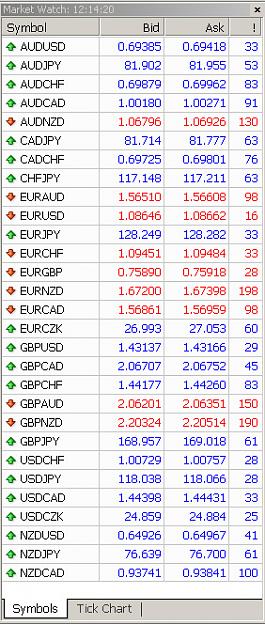

I am new to Forex, only a few months trading with real cash. The question i have is when people talk about closing half their open trade to "breakeven" and letting the other half to keep going with a trailing stop (I would post the page i read this from, but not sure if i am allowed). How do you know what the breakeven point is if you are in positive pip territory?? I still only trade with 0.01 lots with an account that has a 200:1 leverage and my lowest spread is 16 pips on the eur/usd pair. I know, before someone says it, i would place a trade that would have 0.02 lots to make this work.

It does also talk about placing a stop loss, for example, 20 pips below/above the 20-period EMA (which is one indicator i use for this trading method). But how do i know how many pips below my entry point this is??

I don't what else to put here, so please if you can help, let me know if you need more info, etc.

I am new to Forex, only a few months trading with real cash. The question i have is when people talk about closing half their open trade to "breakeven" and letting the other half to keep going with a trailing stop (I would post the page i read this from, but not sure if i am allowed). How do you know what the breakeven point is if you are in positive pip territory?? I still only trade with 0.01 lots with an account that has a 200:1 leverage and my lowest spread is 16 pips on the eur/usd pair. I know, before someone says it, i would place a trade that would have 0.02 lots to make this work.

It does also talk about placing a stop loss, for example, 20 pips below/above the 20-period EMA (which is one indicator i use for this trading method). But how do i know how many pips below my entry point this is??

I don't what else to put here, so please if you can help, let me know if you need more info, etc.