i recently started an account with IB (interactivebrokers.com).

now i like that they are dealing with the interbank market and they are NO market makers.

also the spreads are quite low, for GU 1-1.5pips and for EU 0.5-1 pips.

what i dont like:

-commissions (about 0.3 pips/halfturn)

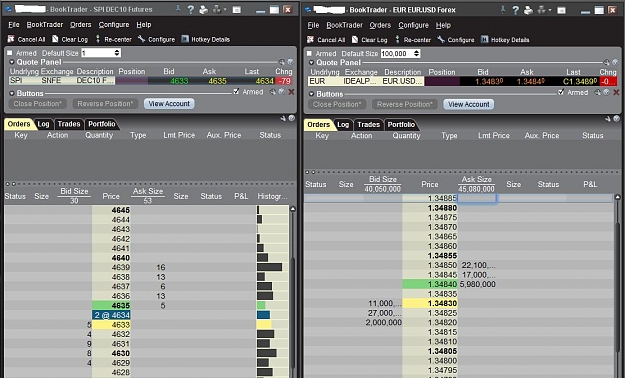

-and they have no MT4 platform. so you can use their own chart software,

which is getting better, but still not good as MT4.

-complicated account management functions: you have a section "market value real FX position" AND a section called "FX portfolio-virtual FX position".

so sometimes you see at the and of the day a realised profit for example of $100, but you cant see it on your account.

i am asking them why this is happening, they told me something about i have to "convert" all existing currency positions to "base currency".

so far i have no idea what this menas, its science for me.

so thats as far my experience with IB, good and bad.

has anybody else IB as a broker or knows something about this broker?

now i like that they are dealing with the interbank market and they are NO market makers.

also the spreads are quite low, for GU 1-1.5pips and for EU 0.5-1 pips.

what i dont like:

-commissions (about 0.3 pips/halfturn)

-and they have no MT4 platform. so you can use their own chart software,

which is getting better, but still not good as MT4.

-complicated account management functions: you have a section "market value real FX position" AND a section called "FX portfolio-virtual FX position".

so sometimes you see at the and of the day a realised profit for example of $100, but you cant see it on your account.

i am asking them why this is happening, they told me something about i have to "convert" all existing currency positions to "base currency".

so far i have no idea what this menas, its science for me.

so thats as far my experience with IB, good and bad.

has anybody else IB as a broker or knows something about this broker?

successful trading requires patience&discipline and DRINKING between.