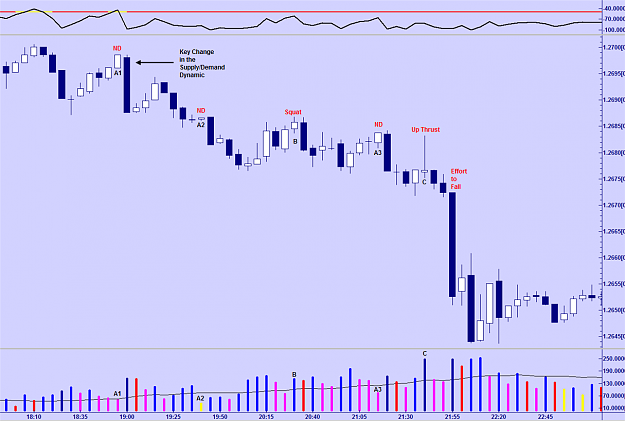

I would like to attach the pdf which is the same as the web page. So you can learn from this. Read it until you understand the basic concept of the volume. Especially the colors of the volume bars, which is really the absolute basic!

Attached File(s)