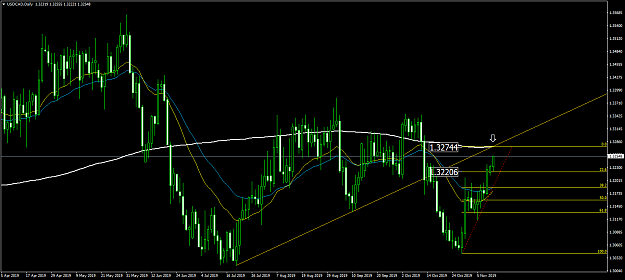

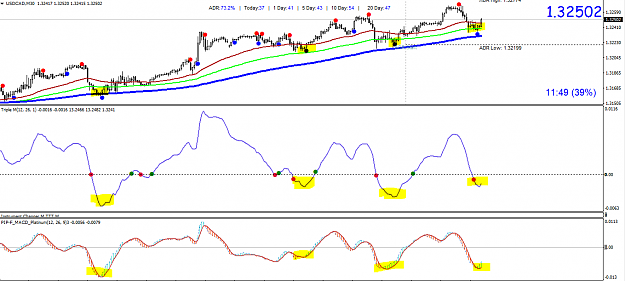

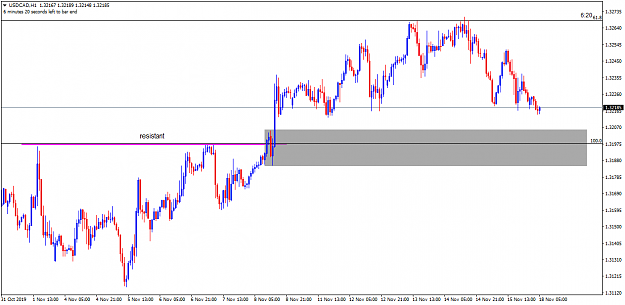

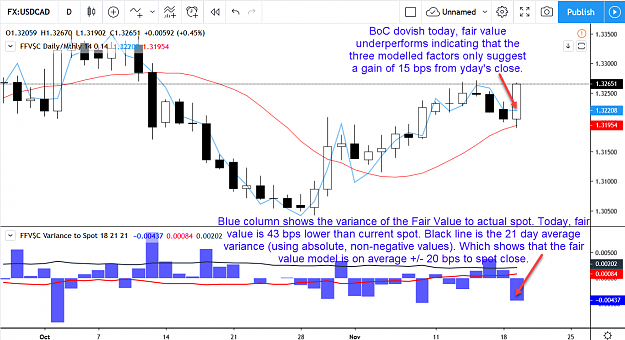

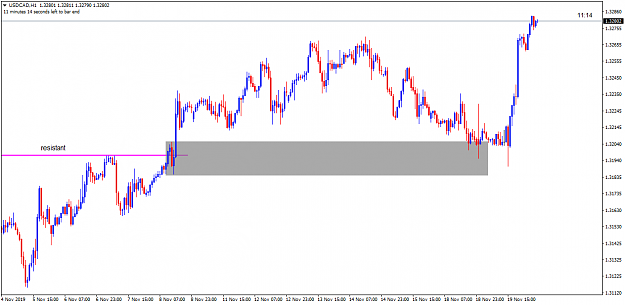

DislikedBread & Butter sell in USD/CAD Fundamentals: USDCAD retraced up by dint of dovish BOC statement today (BOC may cut Overnight Rate in Jan). Then Fed rate cut of 25bp was announced later today. But at present, the fact is rate cut by Fed and no rate cut by BOC and dovish BOC has already been priced in. Therefore, recent dovish FOMC press conference will push USD/CAD down again a little bit and it can reach 1.3105 (± 3.0) pips that is FIB61.8 of whole move up since yesterday. Technical analysis: A downward thrust that makes a ground of bread and butter,...Ignored

Now USD/CAD shows a new scenario which I am posting next.