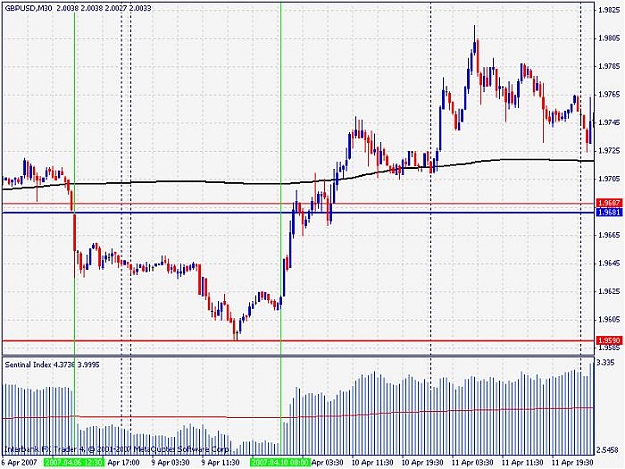

Hi all, I just made this template which contains vertical lines on NFP dates for Jan-Dec 07. Plus, it contains two bold horizontal lines for the NFP range (friday-midnight sunday) top and bottom. Also, it contains two (non-bold) horizontal lines that you can move at week's end to show weekly high and low for re-entry purposes if need be (by Kevin's rules). At the end of the year, just reset the dates for the vertical lines, and you're ready to go!

All objects are labelled so that you can easily identify the proper line when you're editing them (but you should only have to do this at the end of the year). So, at week's end adjust your two thin lines, at month's beginning observe highs and lows between the lime green lines and set you bold horizontal lines to match, and just follow the system! I did this template for the gbpusd pair, so you will have to manually edit the values of the 4 horizontal lines to get them at the right values for any other pair.

Hope you enjoy.

All objects are labelled so that you can easily identify the proper line when you're editing them (but you should only have to do this at the end of the year). So, at week's end adjust your two thin lines, at month's beginning observe highs and lows between the lime green lines and set you bold horizontal lines to match, and just follow the system! I did this template for the gbpusd pair, so you will have to manually edit the values of the 4 horizontal lines to get them at the right values for any other pair.

Hope you enjoy.

Attached File(s)