Isaac Newton's Law of Motion: (law of inertia)

"Corpus omne perseverare in statu suo quiescendi vel movendi uniformiter in directum, nisi quatenus a viribus impressis cogitur statum illum mutare." (Every body persists in its state of being at rest or of moving uniformly straight forward, except insofar as it is compelled to change its state by force impressed.)

- First Law: An object at rest tends to stay at rest, or if it is in motion tends to stay in motion with the same speed and in the same direction unless acted upon by a sum of physical forces.

- Second Law: A body will accelerate with acceleration proportional to the force and inversely proportional to the mass.

- Third Law: Every action has a reaction equal in magnitude and opposite in direction.

========================

Explanation: :nerd:

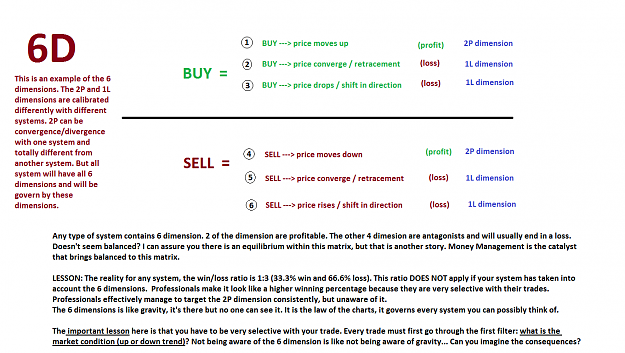

Newton's law of motion should be the first technical thing you must learn about charts. This law applies to charts. The law of inertia.

Prices move... Movement is motion... You need to understand how things move, how the prices move... It moves according to Newton's Law of Motion.

![]() This is how momentum works. When you have a lot of momentum behind a trade, your risks are greatly reduced. Why?... because it would take a lot of force to change the direction. It would take a lot of force for your trade to go against you.

This is how momentum works. When you have a lot of momentum behind a trade, your risks are greatly reduced. Why?... because it would take a lot of force to change the direction. It would take a lot of force for your trade to go against you.