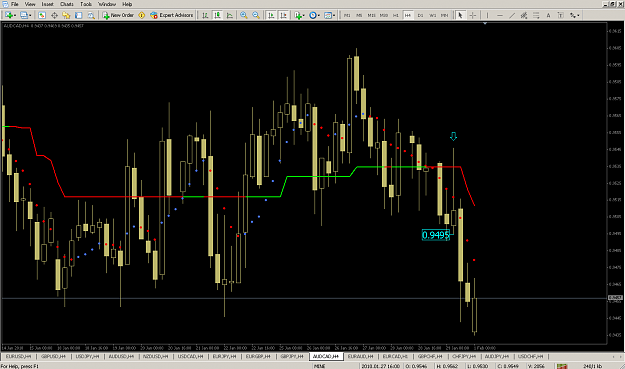

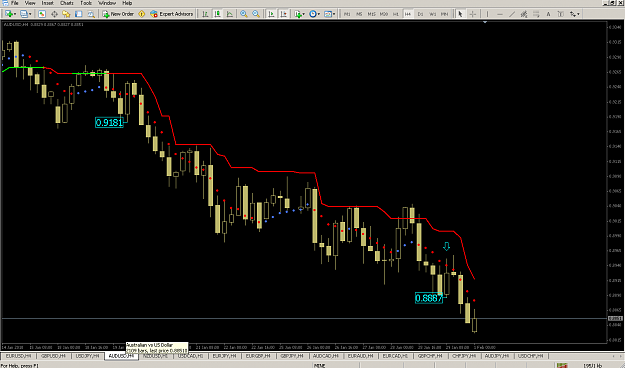

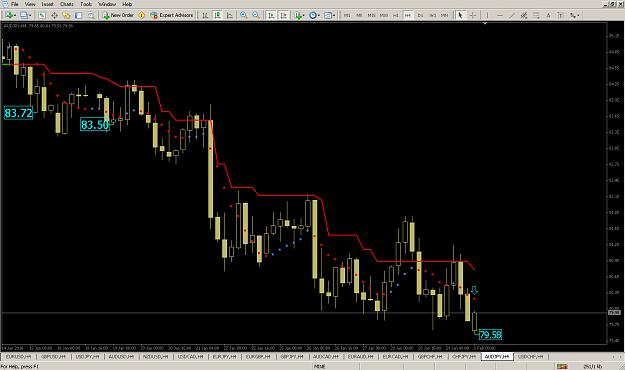

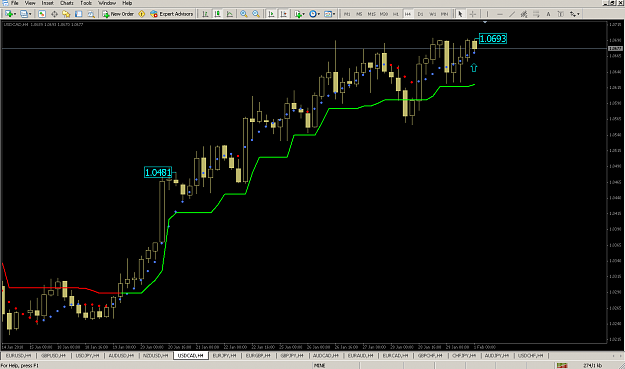

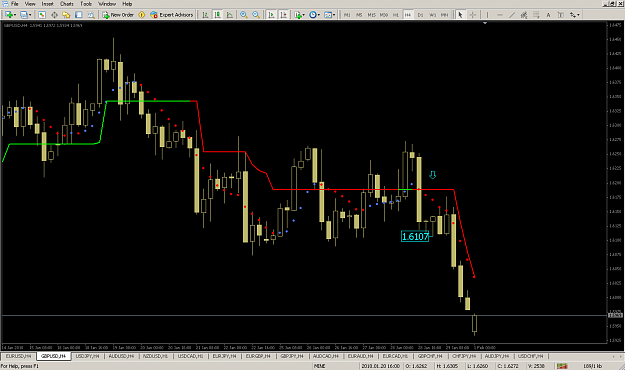

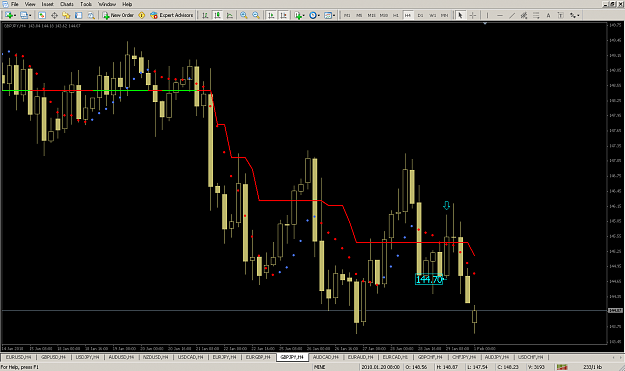

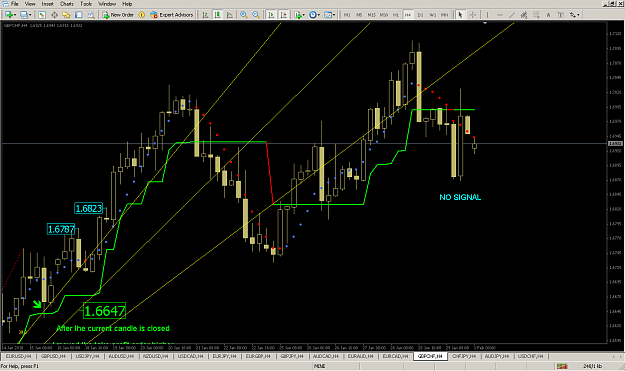

Andrew which time frame have you found to work best.on your videos i see you work on the 4hr i guess the higher the timeframe the better the signals,as i see some of the members working your system on the 15min timeframe.

How long have you been using your system to trade live Andrew?

Regards

How long have you been using your system to trade live Andrew?

Regards