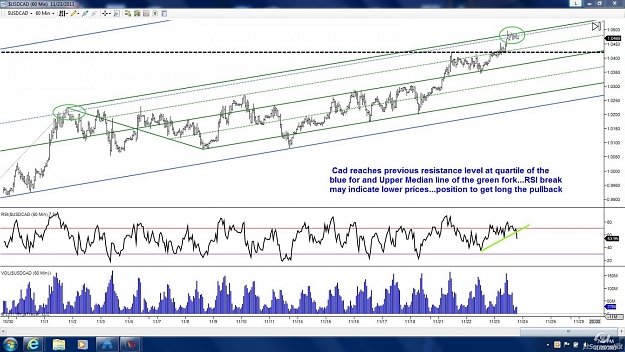

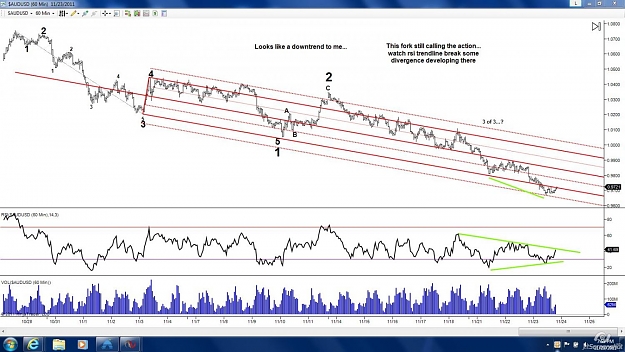

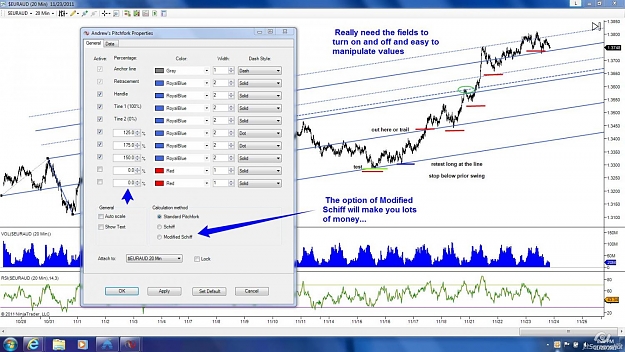

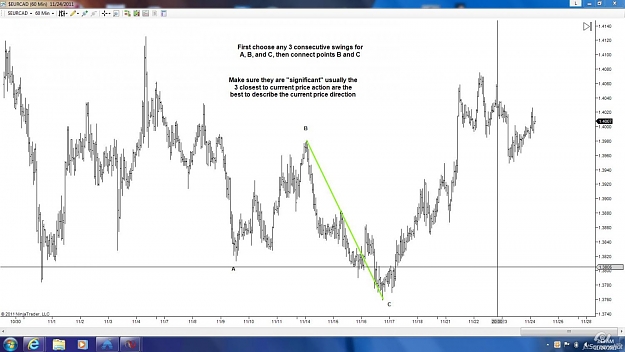

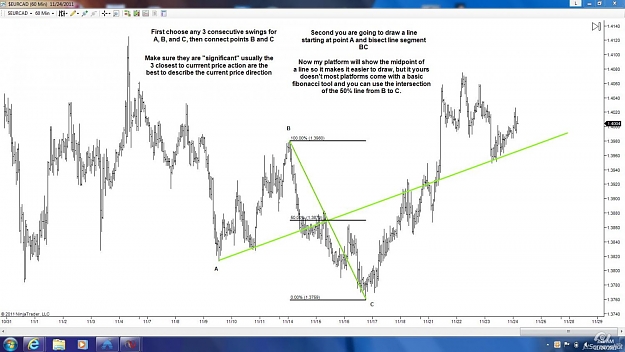

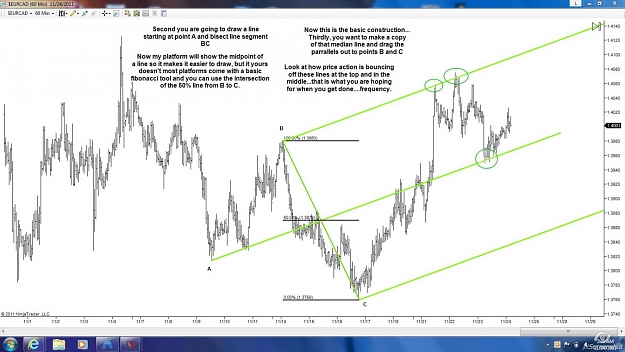

A friend advised me some of you may appreciate looking at some clearly explained charts and analysis...Hope you enjoy. Any comments good or bad are welcomed. I use pitchforks to get the general path of price and trade off them as support and resistance.

Each market has a frequency of it's own, it's just a matter of tuning into it and letting the lines show you the way.

Still looking at volume on a weekly and daily basis, but these harmonic patterns on the 15 and 60m time frames are too consistent to overlook...

-----------------------------------------------

It's been a few years now, things change people grow, new information comes to light, new tools, etc. and what I've come to learn about the markets is that all we can do is try to put the odds in our favor and use good money management. Probability -- we always hear about it but what gives us that probability/edge to successful trading? Basic market dynamics...have to give some props to Barry Burns put it pretty simply. Trend, cycle, momentum, supp/resis and fractal. These are all pieces of market dynamics that gives your trade probability...even if the stars align and you're doing 80+% trading putting the probabilities on your side, you are still going to fail/get stopped out 20% of the time. Now put that on a scale 100 trades...what are you going to do when those 20 losing trades line up together (drawdown) -- UHH, you just have to know it's part of the game and can you deal with it mentally so that you can get in there to enjoy the 80% winners. Psychology plays a huge role in successful trading. Tim Morge says it pretty well, Master yourself. Discipline, do you have it...even when it hurts during drawdown? Just some food for thought...good trading all.

Each market has a frequency of it's own, it's just a matter of tuning into it and letting the lines show you the way.

Still looking at volume on a weekly and daily basis, but these harmonic patterns on the 15 and 60m time frames are too consistent to overlook...

-----------------------------------------------

It's been a few years now, things change people grow, new information comes to light, new tools, etc. and what I've come to learn about the markets is that all we can do is try to put the odds in our favor and use good money management. Probability -- we always hear about it but what gives us that probability/edge to successful trading? Basic market dynamics...have to give some props to Barry Burns put it pretty simply. Trend, cycle, momentum, supp/resis and fractal. These are all pieces of market dynamics that gives your trade probability...even if the stars align and you're doing 80+% trading putting the probabilities on your side, you are still going to fail/get stopped out 20% of the time. Now put that on a scale 100 trades...what are you going to do when those 20 losing trades line up together (drawdown) -- UHH, you just have to know it's part of the game and can you deal with it mentally so that you can get in there to enjoy the 80% winners. Psychology plays a huge role in successful trading. Tim Morge says it pretty well, Master yourself. Discipline, do you have it...even when it hurts during drawdown? Just some food for thought...good trading all.