DislikedI am not sure if I am qualifed to know either way (whether the market is precise or not), but I want to chip in the little that I have 'experienced'. Not sure if anyone else has ever had this experience.

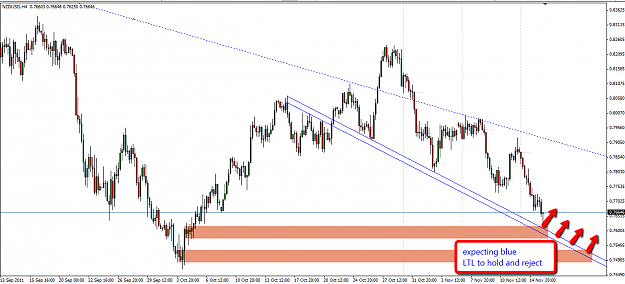

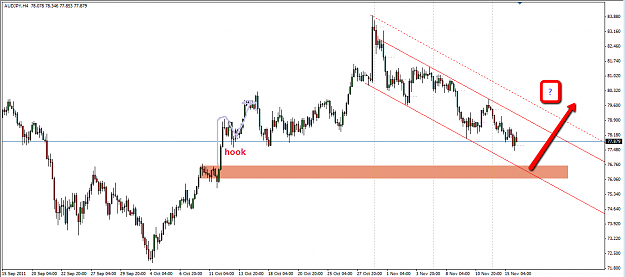

I used to look at a naked chart and sometimes things were clear, but often I just saw a jumbled mess. One day, Wmd was sharing a chart with me, and it was a god awesome mess. I woud have bet my letf nad there was no rhyme, rythem or structure in that chart.

Wmd them draw a few lines and a few coulpe of levels and all of the sudden the chart...Ignored

__________

michael

Be like water.