This will be a trading journal related to Spud's MTF Stochastics approaches.

I personally would profit and properly you too - if many of us,

who are seriously trying to get a hand on Spud's system could team up together in the beginning of the NEW YEAR.

Basic idea: why not let all of us trade the best we can

Each one of us is different - comes with personal abilities - past experiences and so on to the market.

Instead of setting up 'fixed rules - or new ideas for all' - why not let all of us trade the best we can based more or less on Spud's ideas.

Some might be more into Escalator to Pips, others more into Elastic back snaps, others like more the 5, 3,3 settings than the 14,3,3.

Some might prefer filters to avoid early entries which might turn bad - others might prefer early entries.

Compare where we are: this would be in my point the beneficial part of teaming up together.

Well, I believe each one of us tries to trade as best as we can - but if we could compare our process (NOT in a competition style but in a educational style) I would find this benefits:

e.g

* Miss XXXX might have a success rate of 95 % and her account might have grown 10 % because of sensitive chosen Unit sizes.

* My success rate could be in the same time 79 % and my account could be at 0.5 % profit in the same time.

If I could compare which trade I took and which Miss XXXX - wow I could see that somwhow not the MTF indicator idea is not ok - but that I do not have the right grasp on it yet.

If on the other hand all of us show negative signs maybe we did not get Spud's point at all - or we can conclude that something very important in his explanation is still missing. (of course it would be wonderful if Spud joins such an effort and we could also compare our trades to his).

How to do it:

What I would have in mind, that al of us who like the idea open up a

- same size account

- same home currency account

- start trading at the same day

- to keep it more simple: use only the same Pair to trade

and than each one provides a daily (or what we decide) feedback on:

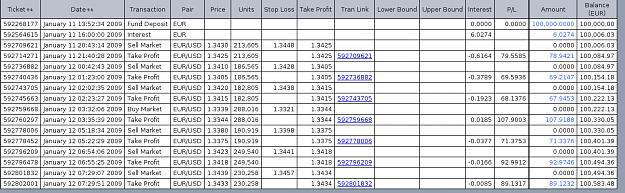

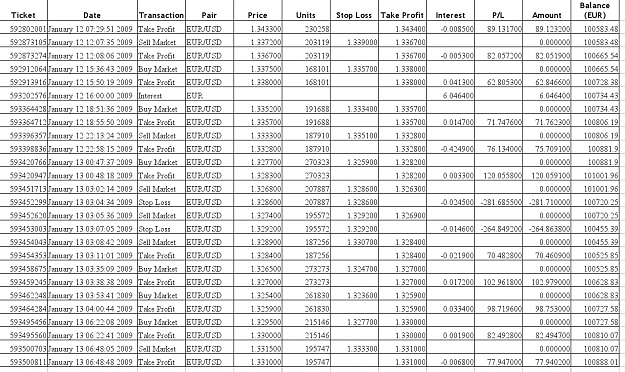

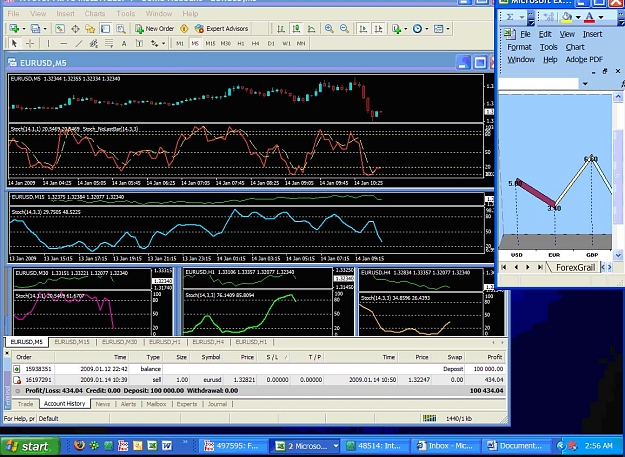

- Trades (like a transaction log)

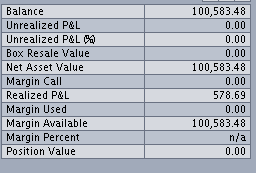

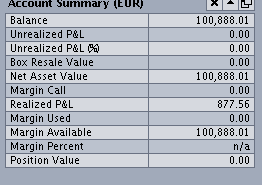

- Account Statement (like current Balance)

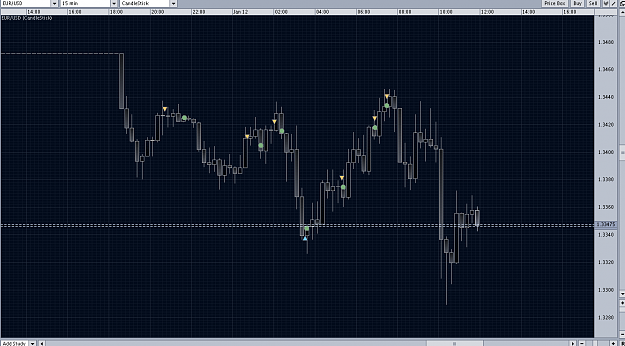

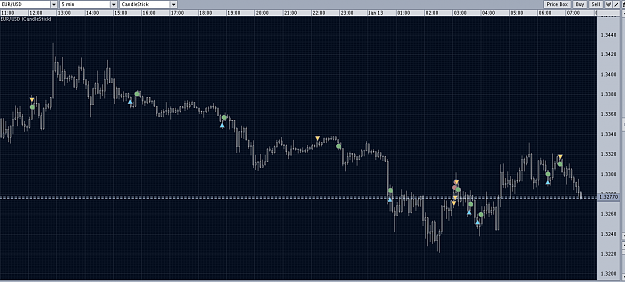

- maybe also 1 or 2 screenshots with the Trades for easier visualisation

- GMT Time offset - so that anyone can check for themself

So when I see that sarah2002, CindyXXXX, Spudfyre, LuboLabo, Harry123, jdcompute or who ever might join does well - I can check back how many Units they took at what time - how was the Stochastic situation ect .

I don't know who is using Spud's idea profitable and especially not to which extend (or have a transaction log I can see myself what was the situation that person took the trade ect...)

If anyone would be seriously interested - let me know.

regards MJ

PS: I got a feedback from Spud himself:

DislikedNot sure I could commit to such a project as I have several on the go. However, I wouldn't mind following along and taking a look at what you are developing..and thro wany comments in I do have.Ignored