From what I read on forum most traders scalp. TA scalpers both direction.

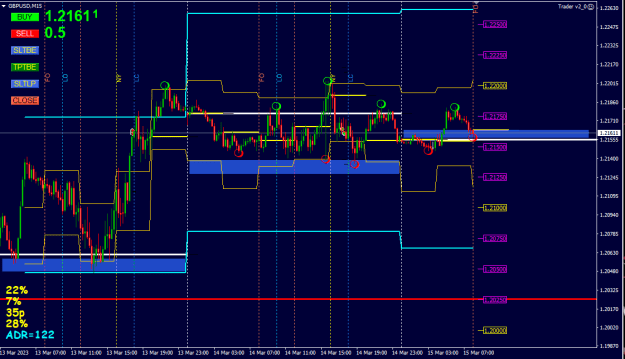

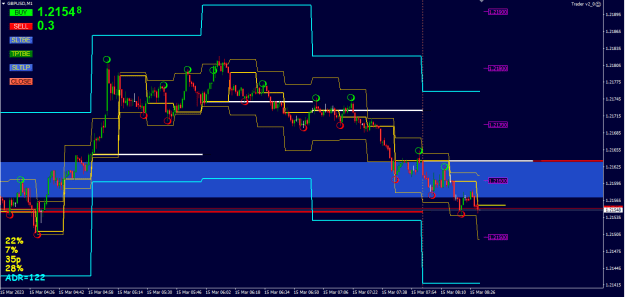

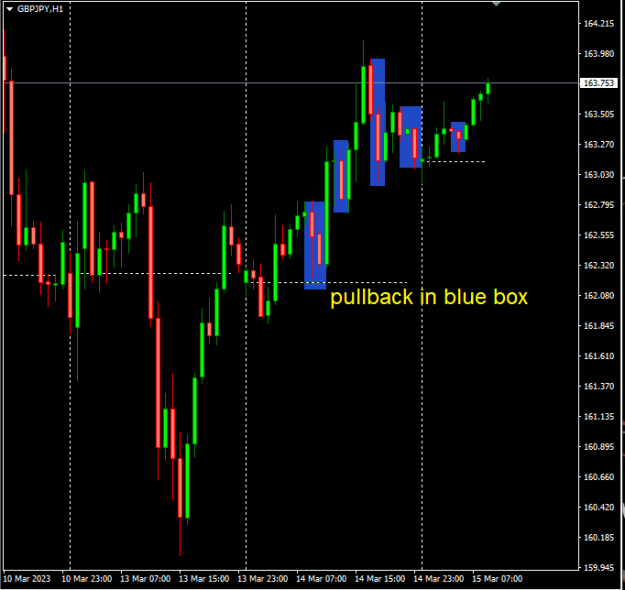

This topic is about this specific segment, intraday swing trading.

To me, a intraday swing trade has a minimum 50pips profit target. And the entry exit is on the same day.

Why most traders scalp instead of swing trade intraday?

Imo, there's zero trading strategy in this segment.

If you disagree, pls point us to such strategy.

Why I bring up this specific topic?

Imo, the current market structure or some call it market mechanism knowledge is faulty. And outdated.

I claim traders can only execute intraday swing trades only if there's proper reliable market structure knowledge.

You are welcome to post your opinion and discuss.

The purpose of this thread is to discuss the status of currently available market structure, or some call it market mechanism knowledge which imo is faulty and misleading.

Which directly contributed to most traders scalp instead of swing trade intraday. Therefore it limited the ability of the trader to swing trade intraday.

Imo, if the available market structure knowledge is faulty in this intraday segment, then by extension, there's a problem with swing trading as a whole.

This is a discussion. Everyone is entitled to his/her opinion. Disagreement is normal. But personal attacks will be dealt with swiftly. I allow off topic discussion as long as it make sense.

Cheers

"TA assumptions are faulty, misleading and dangerous.

TA market structure knowledge or mechanism is faulty, misleading and dangerous." ...... BWilliam

Why this perpetuation of faulty, misleading and dangerous TA assumptions?

https://www.forexfactory.com/thread/...8#post14382768

Adults gone downright desperate and dumb.

Lie to yourself is bad. Lie to FF members and readers must be called out.

This topic is about this specific segment, intraday swing trading.

To me, a intraday swing trade has a minimum 50pips profit target. And the entry exit is on the same day.

Why most traders scalp instead of swing trade intraday?

Imo, there's zero trading strategy in this segment.

If you disagree, pls point us to such strategy.

Why I bring up this specific topic?

Imo, the current market structure or some call it market mechanism knowledge is faulty. And outdated.

I claim traders can only execute intraday swing trades only if there's proper reliable market structure knowledge.

You are welcome to post your opinion and discuss.

The purpose of this thread is to discuss the status of currently available market structure, or some call it market mechanism knowledge which imo is faulty and misleading.

Which directly contributed to most traders scalp instead of swing trade intraday. Therefore it limited the ability of the trader to swing trade intraday.

Imo, if the available market structure knowledge is faulty in this intraday segment, then by extension, there's a problem with swing trading as a whole.

This is a discussion. Everyone is entitled to his/her opinion. Disagreement is normal. But personal attacks will be dealt with swiftly. I allow off topic discussion as long as it make sense.

Cheers

"TA assumptions are faulty, misleading and dangerous.

TA market structure knowledge or mechanism is faulty, misleading and dangerous." ...... BWilliam

DislikedThe TRUTH is, the Investing industry (NOT JUST TA) is littered with faulty, misleading and dangerous content every where you look, across every aspect of trading.Ignored

DislikedAL I can say here is - if a person does indeed possess common sense, they have no need for the council of others, especially if those others have little to do with your own thinking. And so it's no surprise why people take so long to learn ...... you're letting other people inside your head. Just a consideration. PeterIgnored

DislikedLook here brother. The pdf you sent, with this awesome HINDSIGHT teacher... he ONLY shows good trades that work out, AFTER the fact. But the same principles he shows, has loosing trades on the chart too, but he ignores them, this is why this trading industry is f*ed up.. full of fakes, and amateurs, does anyone make it here, or are the markets just random.. Literally on the Pic, HOD broken, rejects and goes down, but he totally ignores it xD, sad. {image}Ignored

Dislikedevery time I hear "probabilities" from someone, I know for a fact that they don't know "direction". cheers,Ignored

Adults gone downright desperate and dumb.

Lie to yourself is bad. Lie to FF members and readers must be called out.

Trade the value