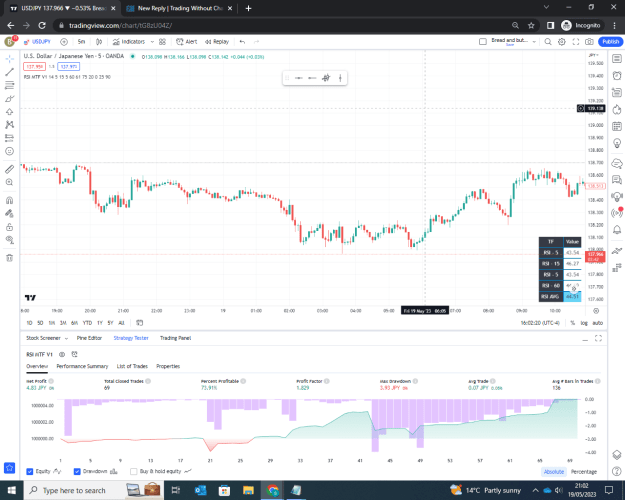

Disliked{quote} you know what they say....don't wrestle with pigs, because everyone gets dirty, but they enjoy it. {image} This is the results from sept last year. Go long when RSI is above 61 and go short when RSI goes below 40. Its a stop and reverse trade. its not looking good with these entry/exit rules, there is plenty of profits to be had before the exits. I think there is something here. This is a 5 min chart, with RSI on 5/15/30/1hrIgnored

Thanks for the test. A couple of suggestions:

Stop and reverse should be one of the weakest approaches. I haven't tried it personally due to that belief. What I tend to do is look for exits at defined levels. This will somewhat limit trade time and profit (and you will of course still experience reversals) but I've found it better to grab smaller and more regular profits. You should find the win rate greatly increases. A good starting point is 75 or 80 for long exits and 25 or 20 for short exits. You can then tweak from there depending upon what you witness.

I'd also suggest removing either the 30m or 1H from your calculations. Probably the 30m. I find 3 timeframes with a tiny bit of separation to be best.