Hello traders,

I would like to discuss trading with pure price action (tape-reading).

The last couple of days I have been playing around with pure PA (just the actual numbers) and have done it with surprisingly good success.

I have been playing around with mini lots with this model but if I can get more consistent I think this can be a funnier and maybe it will pay off better than my normal boring trading models.

Results

I have had 17 trades on 3 days where I have spent 6 hours all together and 12 wins and 5 lossess...

Anyway here's the model so far

I would like to discuss trading with pure price action (tape-reading).

The last couple of days I have been playing around with pure PA (just the actual numbers) and have done it with surprisingly good success.

I have been playing around with mini lots with this model but if I can get more consistent I think this can be a funnier and maybe it will pay off better than my normal boring trading models.

Results

I have had 17 trades on 3 days where I have spent 6 hours all together and 12 wins and 5 lossess...

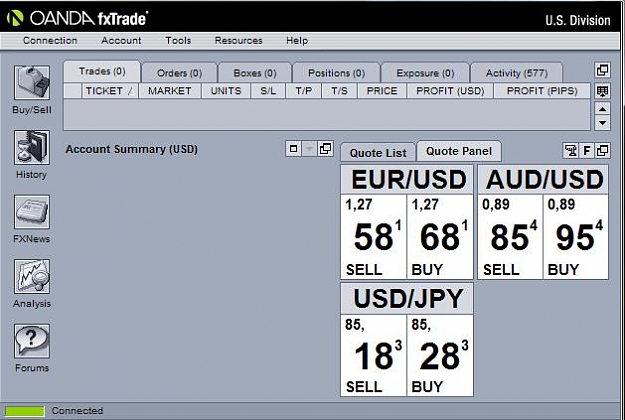

Anyway here's the model so far

- Wait for volume, would atleast see some good movement (10 pip change within 5-10 minutes....

- Looking at the price for a minimum of 5 minutes before action is taking place.

- After a win/loss --> your in penalty where you are not allowed too look at the price for atleast 15 minutes (this is because not knowing where the price have been keeps you from visualizing the chart as a whole, especially good if PA around big round numbers).

- Pip risk/reward 4/5 - 5/8 etc...

General Thoughts

Two ways to trade as I see it.

- I normally see the price to penetrate a new set of numbers like reaching 1.2723 before dropping back down to 1.271x (normally takes longer time)

- Forceful pentration of 1.2723 would normally lead to further incline or decline (tricky part & faster)

- Trying to catch price as it spreads over a round number gives a good probability and with a slightly better risk/reward we are hopefully good.

If this works out next week also I am going to write a book about it.![]()

And for those who have just read around about how to trade with proper rik/reward and scalping is stupid etc. DON'T WRITE IT DOWN HERE.

simple thread rule.

IF YOU HAVE SOMETHING POSITIVE/HELPFUL TO WRITE=WRITE

IF NOT, F*** OFF.