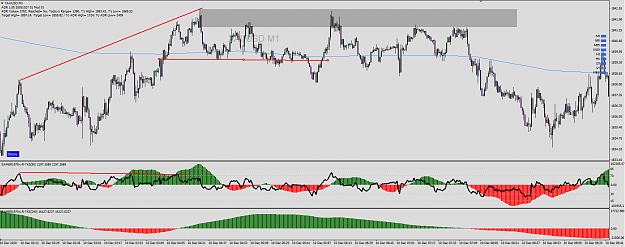

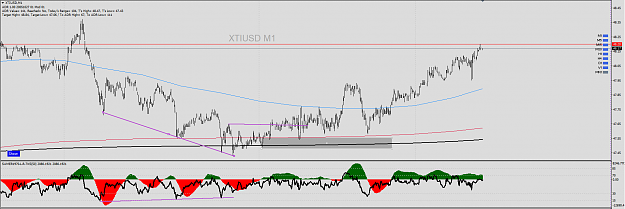

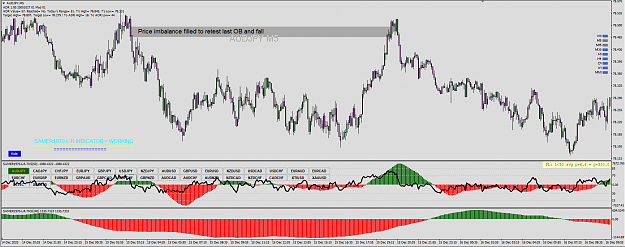

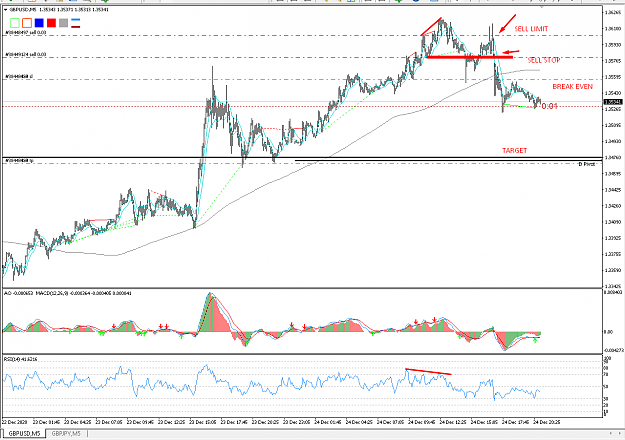

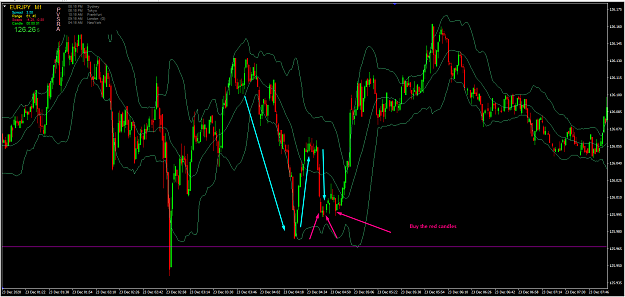

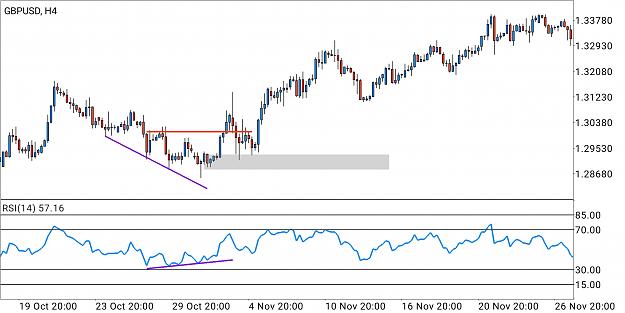

Guys divergence only an indication, nothing can beat your eyes! we dont just jump in looking at divergence, dont let it excite to enter in any trade immediately.

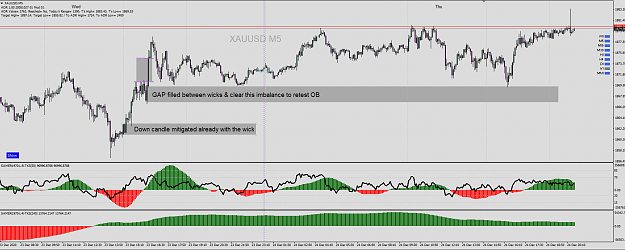

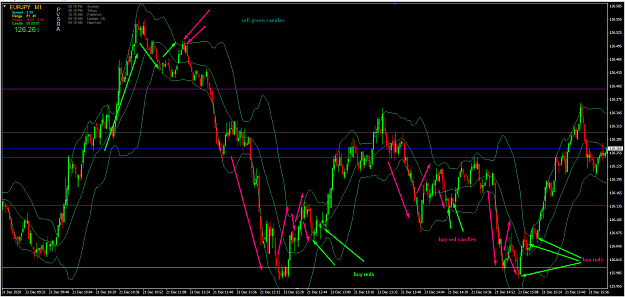

we only trade price action with a confluence of divergence/convergence and break/continuation in market structure and enter only upon retest of OB.

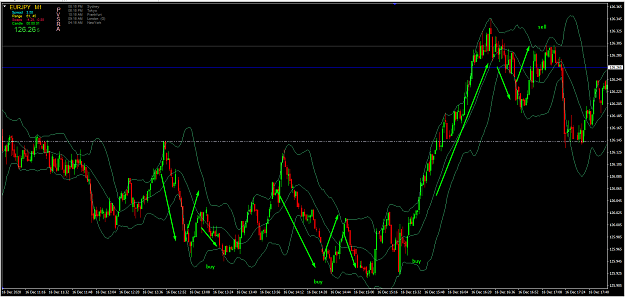

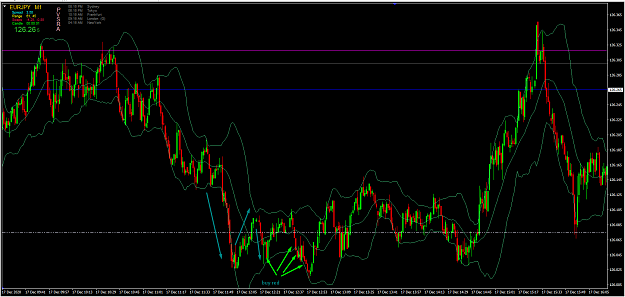

"Exchange of hands"

6