PLEASE NOTE: This is a work in progress. I welcome your comments, criticisms, and improvements!

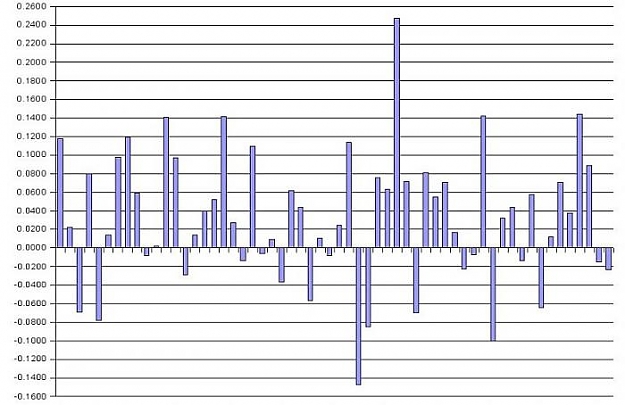

This approach is ultra simple. It is based only on price action and probabilities. It uses no predictions, no charts, and no discretion. It can be completely automated.

I have run historical studies using this approach from 2003-2007 on ten major pairs and the returns are positive across the board. It is probably applicable to other pairs as well, though I have not done any studies on exotics.

From these historical studies, I selected two pairs with a low correlation and a low risk/reward ratio for this system: EURUSD & USDCAD.

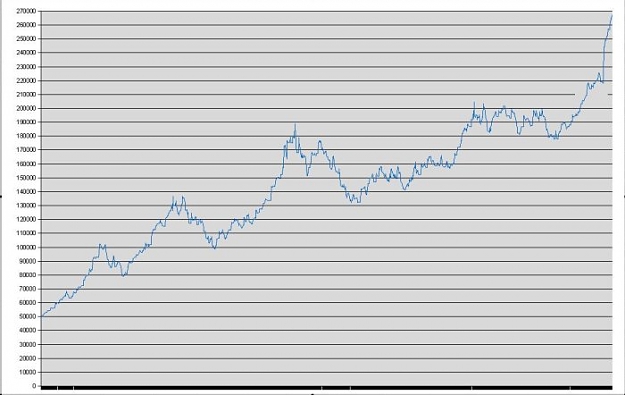

Trading these pairs in tandem with this approach would have returned more than 300 pips per month over the past 5 years.

I will describe the approach, trading rules, and risk management in separate posts.

All the best!

This approach is ultra simple. It is based only on price action and probabilities. It uses no predictions, no charts, and no discretion. It can be completely automated.

I have run historical studies using this approach from 2003-2007 on ten major pairs and the returns are positive across the board. It is probably applicable to other pairs as well, though I have not done any studies on exotics.

From these historical studies, I selected two pairs with a low correlation and a low risk/reward ratio for this system: EURUSD & USDCAD.

Trading these pairs in tandem with this approach would have returned more than 300 pips per month over the past 5 years.

I will describe the approach, trading rules, and risk management in separate posts.

All the best!