Where we are in the Euro:

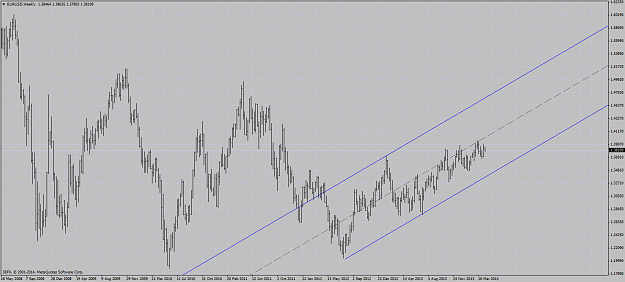

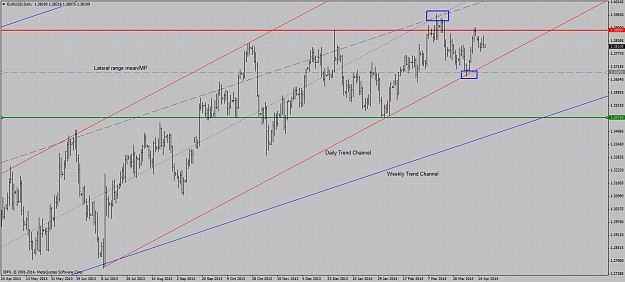

Both weekly and daily charts clearly define two upward trend channels. Earlier in the month traders were unable to find trades beyond the intersection of the mean of both these trend channels and sold off down to the lower extreme of the daily trend channel where traders again could not find any trades below. Having tested the lower end of this diagonal trading range, they rallied to resistance and spent this past week consolidating figuring out where to go.

Since October, traders have made sort of a pseudo-range between ~1.3450s to ~1.3850s. Just as with a diagonal trading range, a lateral trading range has a mean, a place where the most trades occur, and as such represent a point of potential support and/or resistance due to the sheer amount of volume that has to be worked out when/if traders try to take price through it. Notice again where the extreme low of the diagonal trading range coincided with the mean of the lateral trading range.

Having tested the lower end of a range, lateral or diagonal, the likely course of action is testing the other extreme of that range. Traders last week tested the upper end of the lateral trading range and, for this past week, appear to be uninterested in exploring higher prices. So the likely course of action from that information is that traders will test the lower end of the lateral trading range (~1.3450s). On the other hand, traders have recently tested the lower end of the diagonal trading range (the daily up channel) and were rejected. This would indicate the likely course of action of testing the other extreme of the diagonal trading range (1.4400-1.4500), with a pit-stop perhaps at the mean.

There is, however, the resistance at ~1.3895 to get through first. When looking at the general movement of the market, we have traders unable to make significantly higher highs, but we do have traders making higher and higher lows since October up to this resistance. (Actually we have traders making higher lows since August of 2012). This "tension" of traders stepping up and buying sooner and sooner each time, but being unable to move beyond 1.3895 could be building up a great deal of energy and serve as the springboard from which traders can take prices up to the upper reaches of the diagonal trading ranges. Or traders could give up trying to explore up having run into difficulty trying to do so and this pent-up energy could be the catalyst for driving prices down the to the lower extreme of the weekly trend channel.

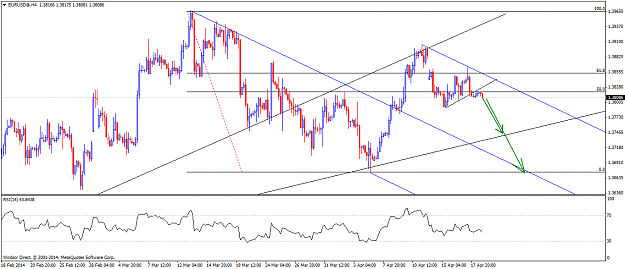

Sounds like a lot of info post-mortem, doesn't it? Of course - I should work for CNBC. As for what to do with all this is: wait. Trade from the extremes, should your lower bar interval charts indicate an a failure of traders to be able to continue on in one direction or another - this happens all over the place: the key is finding out where it is important to do so. A test and failure, or the break and pullback, of the upper resistance (lateral red line), the range mean (the lateral dashed gray line), the range low (lateral green line) would all be ideal locations to look for entries.

Both weekly and daily charts clearly define two upward trend channels. Earlier in the month traders were unable to find trades beyond the intersection of the mean of both these trend channels and sold off down to the lower extreme of the daily trend channel where traders again could not find any trades below. Having tested the lower end of this diagonal trading range, they rallied to resistance and spent this past week consolidating figuring out where to go.

Since October, traders have made sort of a pseudo-range between ~1.3450s to ~1.3850s. Just as with a diagonal trading range, a lateral trading range has a mean, a place where the most trades occur, and as such represent a point of potential support and/or resistance due to the sheer amount of volume that has to be worked out when/if traders try to take price through it. Notice again where the extreme low of the diagonal trading range coincided with the mean of the lateral trading range.

Having tested the lower end of a range, lateral or diagonal, the likely course of action is testing the other extreme of that range. Traders last week tested the upper end of the lateral trading range and, for this past week, appear to be uninterested in exploring higher prices. So the likely course of action from that information is that traders will test the lower end of the lateral trading range (~1.3450s). On the other hand, traders have recently tested the lower end of the diagonal trading range (the daily up channel) and were rejected. This would indicate the likely course of action of testing the other extreme of the diagonal trading range (1.4400-1.4500), with a pit-stop perhaps at the mean.

There is, however, the resistance at ~1.3895 to get through first. When looking at the general movement of the market, we have traders unable to make significantly higher highs, but we do have traders making higher and higher lows since October up to this resistance. (Actually we have traders making higher lows since August of 2012). This "tension" of traders stepping up and buying sooner and sooner each time, but being unable to move beyond 1.3895 could be building up a great deal of energy and serve as the springboard from which traders can take prices up to the upper reaches of the diagonal trading ranges. Or traders could give up trying to explore up having run into difficulty trying to do so and this pent-up energy could be the catalyst for driving prices down the to the lower extreme of the weekly trend channel.

Sounds like a lot of info post-mortem, doesn't it? Of course - I should work for CNBC. As for what to do with all this is: wait. Trade from the extremes, should your lower bar interval charts indicate an a failure of traders to be able to continue on in one direction or another - this happens all over the place: the key is finding out where it is important to do so. A test and failure, or the break and pullback, of the upper resistance (lateral red line), the range mean (the lateral dashed gray line), the range low (lateral green line) would all be ideal locations to look for entries.