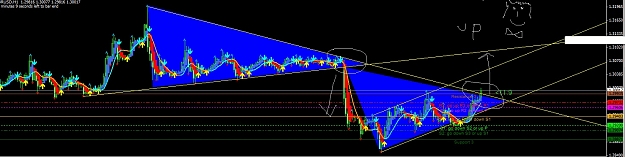

Dislikedi am not holding any trade at the moment, mixture of both fundamental and technical. i feel bottom reached and market over reacted last week

i will wait whole day for my 20 pip entry

Edit: bull can only confirmed by stops, so far stop not touchedIgnored

- Post #579,122

- Quote

- Jan 3, 2012 2:30am Jan 3, 2012 2:30am

- Joined Dec 2010 | Status: Foook Bollinger-dr.Kegel knows! | 9,740 Posts

- Post #579,126

- Quote

- Jan 3, 2012 2:39am Jan 3, 2012 2:39am

- Joined Jan 2011 | Status: Ordinary Members | 10,684 Posts

Mohan

- Post #579,127

- Quote

- Jan 3, 2012 2:41am Jan 3, 2012 2:41am

- Joined Dec 2010 | Status: Foook Bollinger-dr.Kegel knows! | 9,740 Posts

- Post #579,129

- Quote

- Jan 3, 2012 2:43am Jan 3, 2012 2:43am

- Joined Dec 2010 | Status: Foook Bollinger-dr.Kegel knows! | 9,740 Posts

- Post #579,130

- Quote

- Edited 2:59am Jan 3, 2012 2:44am | Edited 2:59am

- Joined Jan 2011 | Status: Ordinary Members | 10,684 Posts

Mohan

- Post #579,131

- Quote

- Jan 3, 2012 2:44am Jan 3, 2012 2:44am

- Joined Jun 2009 | Status: Carry Trader that not want interest | 2,016 Posts

Bismillah

- Post #579,133

- Quote

- Jan 3, 2012 2:46am Jan 3, 2012 2:46am

- Joined Jan 2011 | Status: Ordinary Members | 10,684 Posts

Mohan

- Post #579,134

- Quote

- Jan 3, 2012 2:47am Jan 3, 2012 2:47am

- | Joined May 2010 | Status: Member | 1,017 Posts

- Post #579,135

- Quote

- Jan 3, 2012 2:47am Jan 3, 2012 2:47am

- | Additional Username | Joined Dec 2011 | 210 Posts

Beauty awakens the soul to act. Dante Alighieri

- Post #579,136

- Quote

- Jan 3, 2012 2:48am Jan 3, 2012 2:48am

- Joined May 2011 | Status: grizzly long gone | 2,427 Posts

Don't get mad, get even!

- Post #579,137

- Quote

- Jan 3, 2012 2:49am Jan 3, 2012 2:49am

- Joined Dec 2010 | Status: Foook Bollinger-dr.Kegel knows! | 9,740 Posts

- Post #579,139

- Quote

- Jan 3, 2012 2:57am Jan 3, 2012 2:57am

- | Joined Nov 2009 | Status: Member | 268 Posts