This is my first post on FF after months of reading and trying some of the numerous systems provided by members of this forum. Months ago I came across the following indicators that were posted on one of the Vegas threads. I cannot remember who posted it but I am extremely grateful for their insight and hope they do not mind if I show my way of using this indicator.

After months of testing and swapping from system to system I've come back to this indicator and in hindsight I should have stuck with it from the start as it seems to work for my style of trading.

Anyway, on with the detail. I only trade daily charts and only EUR/USD, GBP/USD, USD/JPY and USD/CHF. Why these? Primarily because these are the only ones I have backtested and have been trading for the last 3 months. I also tend not to trade Monday mornings (Australian time) as prices sometimes gap over the weekend. However, this is discretionary.

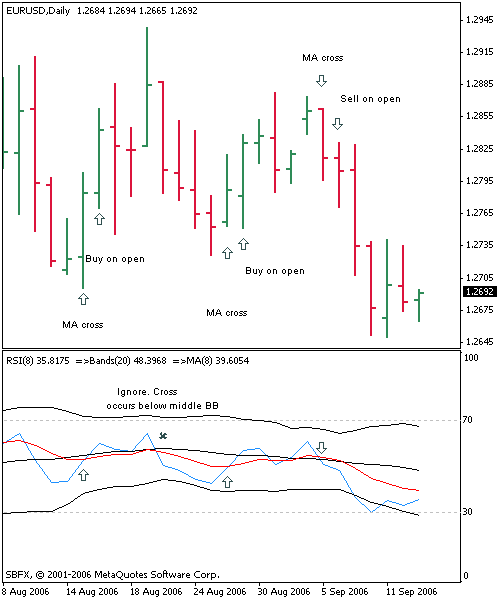

On each chart I have an 8 period RSI. I also have an 8 period MA of the RSI and Bollinger Bands with a 20 period setting, also on the RSI.

Long Entries: RSI must be below the middle Bollinger Band. Enter long on the open of the next bar after the MA has crossed above the RSI.

Short entries: RSI must be above the middle Bollinger Band. Enter when MA crosses below RSI.

Stop loss is the low/high of the previous bar. I move S/L to break even if the price moves greater than 40 pips in my direction. After the initial 40 pip move I use a trailing stop for exits (25 pips).

I only look at the charts once per day, just before 0.00 GMT. This way I know which pairs are approaching my set-up. I then place trades if my criteria has been met. That's it. A simple system that seems to work for me. Looking at charts all day does not suit me as I have a real job and I'm not in a convenient timezone. 10 minutes a day is all I need. This method provides a limited number of trades but the trades can last anywhere from 1 day to numerous days. There can also be days on end with no trades. I have found that the secret is have patience. I also have come to believe those who say longer timeframes are easier, especially for newbies.

I'm not going to say this system will always work but for me it has generated over 400 pips in September already. Please try this out on demos before putting your hard-earned into it. Just because it is working for me (at the moment) does not mean it will suit everyone.

Please feel free to comment.

After months of testing and swapping from system to system I've come back to this indicator and in hindsight I should have stuck with it from the start as it seems to work for my style of trading.

Anyway, on with the detail. I only trade daily charts and only EUR/USD, GBP/USD, USD/JPY and USD/CHF. Why these? Primarily because these are the only ones I have backtested and have been trading for the last 3 months. I also tend not to trade Monday mornings (Australian time) as prices sometimes gap over the weekend. However, this is discretionary.

On each chart I have an 8 period RSI. I also have an 8 period MA of the RSI and Bollinger Bands with a 20 period setting, also on the RSI.

Long Entries: RSI must be below the middle Bollinger Band. Enter long on the open of the next bar after the MA has crossed above the RSI.

Short entries: RSI must be above the middle Bollinger Band. Enter when MA crosses below RSI.

Stop loss is the low/high of the previous bar. I move S/L to break even if the price moves greater than 40 pips in my direction. After the initial 40 pip move I use a trailing stop for exits (25 pips).

I only look at the charts once per day, just before 0.00 GMT. This way I know which pairs are approaching my set-up. I then place trades if my criteria has been met. That's it. A simple system that seems to work for me. Looking at charts all day does not suit me as I have a real job and I'm not in a convenient timezone. 10 minutes a day is all I need. This method provides a limited number of trades but the trades can last anywhere from 1 day to numerous days. There can also be days on end with no trades. I have found that the secret is have patience. I also have come to believe those who say longer timeframes are easier, especially for newbies.

I'm not going to say this system will always work but for me it has generated over 400 pips in September already. Please try this out on demos before putting your hard-earned into it. Just because it is working for me (at the moment) does not mean it will suit everyone.

Please feel free to comment.

Attached Image