Genry,

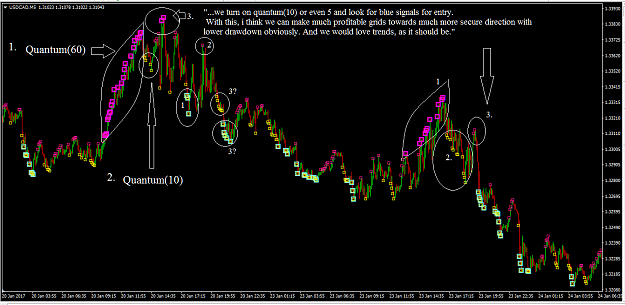

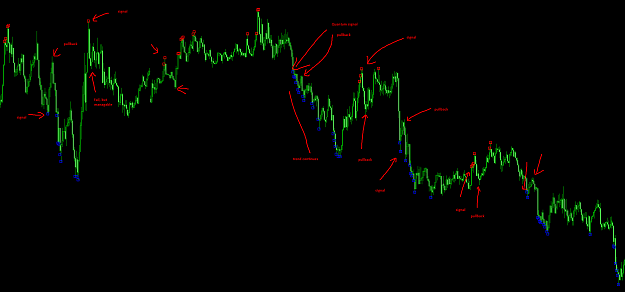

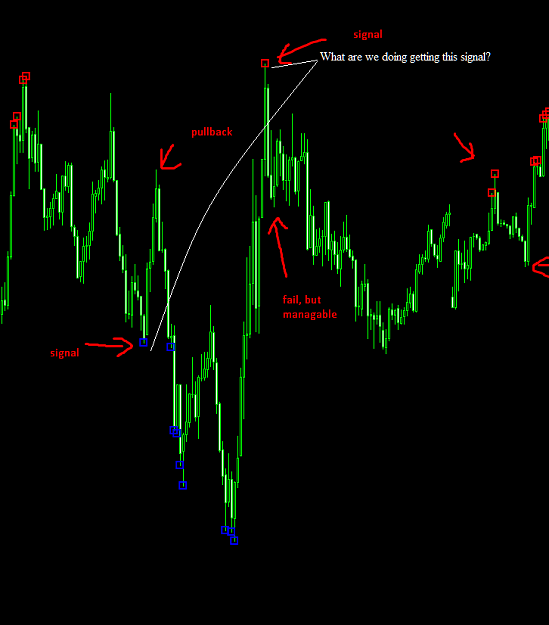

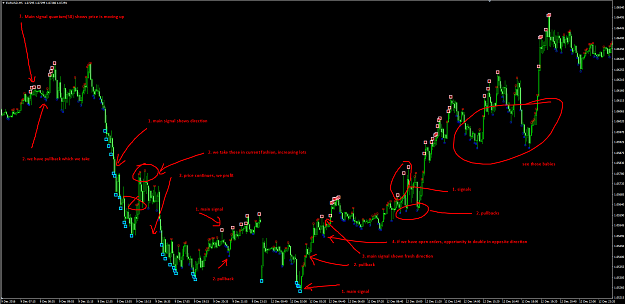

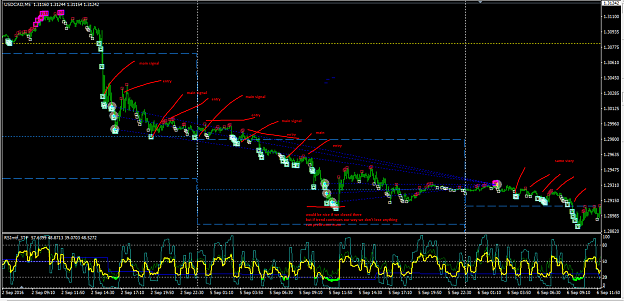

i think we should catch main signal from quantum with higher eintDepth and then catch those pullbacks with quantum with lower eintDepth.

Lets say we derive main trend from quantum(50) which is making his highs up represented with red square signal, we turn on quantum(10) or even 5 and look for blue signals for entry.

With this, i think we can make much profitable grids towards much more secure direction with lower drawdown obviously. And we would love trends, as it should be.

With current state of EAs, we can get accounts lose good chunk with any sudden bump up like on election day, imagine if we traded pullbacks there, we'd end up winning both ways.

Let me know what you think about this.

i think we should catch main signal from quantum with higher eintDepth and then catch those pullbacks with quantum with lower eintDepth.

Lets say we derive main trend from quantum(50) which is making his highs up represented with red square signal, we turn on quantum(10) or even 5 and look for blue signals for entry.

With this, i think we can make much profitable grids towards much more secure direction with lower drawdown obviously. And we would love trends, as it should be.

With current state of EAs, we can get accounts lose good chunk with any sudden bump up like on election day, imagine if we traded pullbacks there, we'd end up winning both ways.

Let me know what you think about this.

1