Short term trading is completely random. I know that some folks here enjoy my posts, while others despise them. (I'm too cynical, lol)

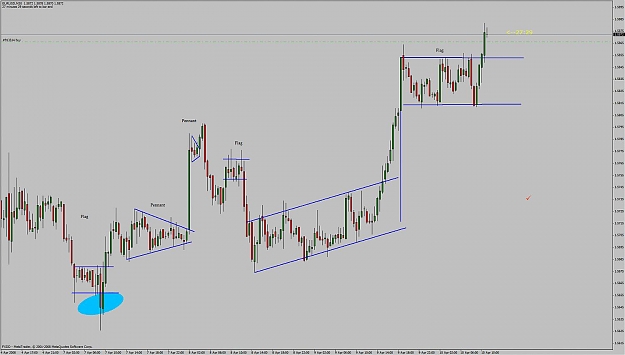

I just gazed into my EURUSD chart and scrolled back on the H1 for a few months. There is pure chaos at the H1 level. Zero rhyme and reason, just central bankers reacting to news and hunting stops. This is the Quantum (irrational world) and not the Macro Physical world that Newton observed with a bright red apple.

Okay fibonacci traders, start posting how H4 fib levels match perfectly. As for me, I am in the camp that price is a result of Superstring for the Superwealthy (bankers, that is.)

I just gazed into my EURUSD chart and scrolled back on the H1 for a few months. There is pure chaos at the H1 level. Zero rhyme and reason, just central bankers reacting to news and hunting stops. This is the Quantum (irrational world) and not the Macro Physical world that Newton observed with a bright red apple.

Okay fibonacci traders, start posting how H4 fib levels match perfectly. As for me, I am in the camp that price is a result of Superstring for the Superwealthy (bankers, that is.)