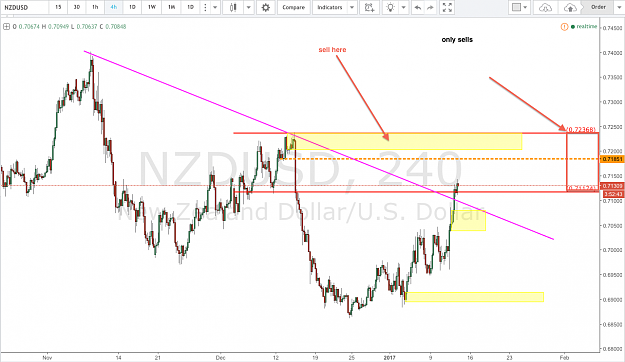

Dislikedhello everyone, i am still going through the hole threadi've already watched b.t.b videos - and again - thank You Akt, great job, respect. the question to these traders who are familiar with trendlines asspect, could you please answer which one from the screen below is the correct trendline? thank you in advance. regards,s. {image}

Ignored

thinking outside the box