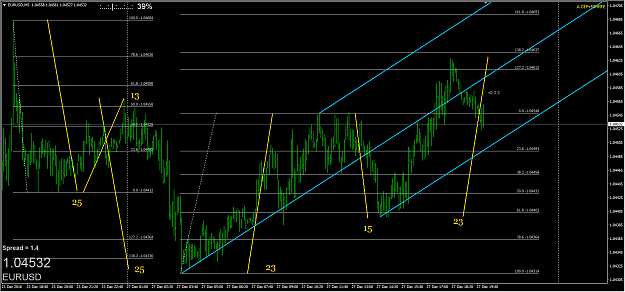

Just drew 5 W's in a 5 minute chart, some W's inside bigger W's .... its getting crazy ! weird thing is that they do follow the bearish harmonic behaviour, but their ratios are all wrong.

- Post #23,161

- Quote

- Dec 27, 2016 11:34am Dec 27, 2016 11:34am

- | Joined Dec 2016 | Status: Member | 332 Posts

- Post #23,162

- Quote

- Edited 1:02pm Dec 27, 2016 11:46am | Edited 1:02pm

- Joined Mar 2008 | Status: He who believes has eternal life. | 3,631 Posts

The things that we love tell us what we are Thanks Redsword11 and Tim Morge

- Post #23,163

- Quote

- Dec 27, 2016 11:54am Dec 27, 2016 11:54am

- | Membership Revoked | Joined Jul 2010 | 9,273 Posts

If you fail to plan, you plan to fail.

- Post #23,164

- Quote

- Dec 27, 2016 11:55am Dec 27, 2016 11:55am

- | Membership Revoked | Joined Jul 2010 | 9,273 Posts

If you fail to plan, you plan to fail.

- Post #23,165

- Quote

- Dec 27, 2016 12:02pm Dec 27, 2016 12:02pm

- Joined Mar 2008 | Status: He who believes has eternal life. | 3,631 Posts

The things that we love tell us what we are Thanks Redsword11 and Tim Morge

- Post #23,166

- Quote

- Dec 27, 2016 12:12pm Dec 27, 2016 12:12pm

- | Joined Dec 2016 | Status: Member | 332 Posts

- Post #23,167

- Quote

- Dec 27, 2016 7:05pm Dec 27, 2016 7:05pm

- | Joined Mar 2016 | Status: Member | 1,068 Posts

- Post #23,168

- Quote

- Dec 27, 2016 7:12pm Dec 27, 2016 7:12pm

- | Joined Mar 2016 | Status: Member | 1,068 Posts

- Post #23,169

- Quote

- Edited Dec 28, 2016 4:55pm Dec 27, 2016 10:51pm | Edited Dec 28, 2016 4:55pm

- | Joined Dec 2013 | Status: Member | 1,118 Posts

- Post #23,170

- Quote

- Dec 27, 2016 11:38pm Dec 27, 2016 11:38pm

- Joined Mar 2008 | Status: He who believes has eternal life. | 3,631 Posts

The things that we love tell us what we are Thanks Redsword11 and Tim Morge

- Post #23,171

- Quote

- Dec 28, 2016 12:25am Dec 28, 2016 12:25am

- | Joined Sep 2016 | Status: Member | 585 Posts

- Post #23,172

- Quote

- Dec 28, 2016 7:10am Dec 28, 2016 7:10am

It's a dirty job but someone's gotta do it!

- Post #23,174

- Quote

- Dec 28, 2016 9:58am Dec 28, 2016 9:58am

- | Joined Mar 2016 | Status: Member | 1,068 Posts

- Post #23,175

- Quote

- Dec 28, 2016 11:24am Dec 28, 2016 11:24am

- | Joined Dec 2016 | Status: Member | 332 Posts

- Post #23,177

- Quote

- Dec 28, 2016 12:32pm Dec 28, 2016 12:32pm

- | Membership Revoked | Joined Jul 2010 | 9,273 Posts

If you fail to plan, you plan to fail.

- Post #23,178

- Quote

- Dec 28, 2016 12:33pm Dec 28, 2016 12:33pm

- | Membership Revoked | Joined Jul 2010 | 9,273 Posts

If you fail to plan, you plan to fail.

- Post #23,179

- Quote

- Dec 28, 2016 12:40pm Dec 28, 2016 12:40pm

- | Joined Dec 2013 | Status: Member | 1,118 Posts

- Post #23,180

- Quote

- Dec 28, 2016 12:42pm Dec 28, 2016 12:42pm

- | Joined Dec 2016 | Status: Member | 332 Posts