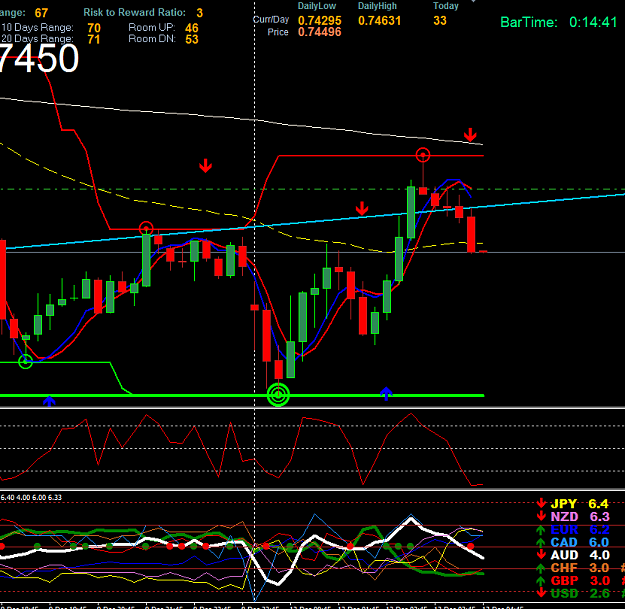

Dislikedwhat I say a long time - watch the smStrenghtRange about the move of the currencies from one pair - good is 8.0 and above against 2.0 and below = 8.0 sell 2.0 buy - example EUR is 8.2 and USD is 1.8 possible EUR go weaker USD go more strength = EURUSD sellIgnored

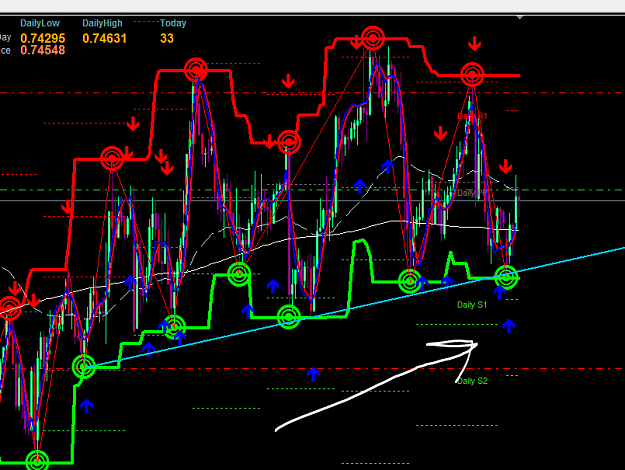

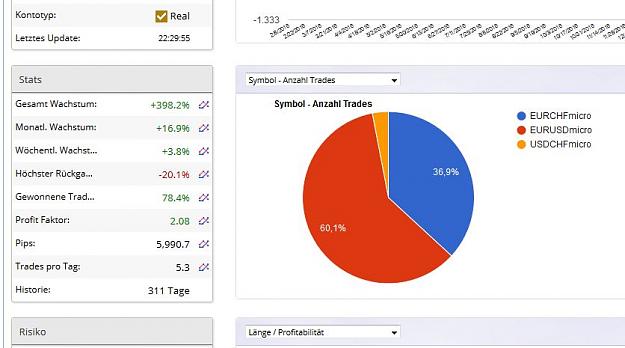

Looking for profitable short term trades ...|