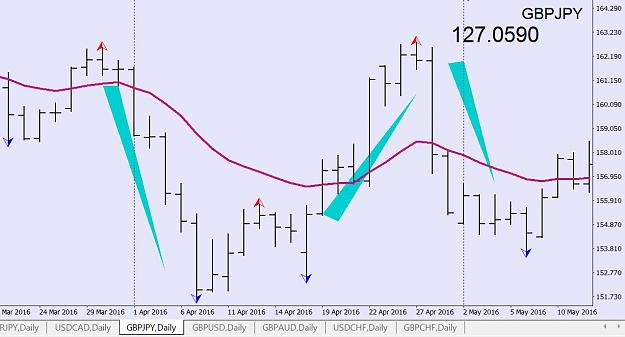

I thought I'd throw in a 200SMA filter, only taking longs above and shorts below, aiming for 10 pips profit.

GU 4hr, Method 3, from now to Jan 1st 2016: 26 wins, 6 losses

GJ: 28 wins, 4 losses

GU 4hr, Method 3, from now to Jan 1st 2016: 26 wins, 6 losses

GJ: 28 wins, 4 losses