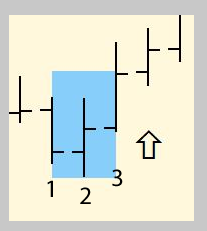

DislikedI forgot to mention to ignore the settings (MAs) lol. I used that from another indicator I did previously. I did pop arrows all over the place which is why I'm trying to understand how you are filtering the entries.. I put this image below and numbered the trades. Can you please tell me which ones are good or bad entries and why accordingly to method 3 if that is the most profitable one. In addition, I've been working on some filters based in your strategy (which I apparently got it wrong lol). Take a look and let me know what you think. {image}...Ignored

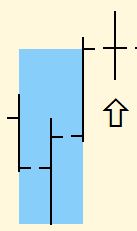

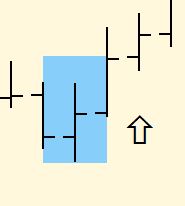

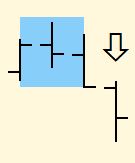

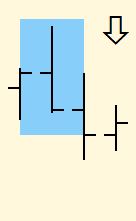

Picture 3 is the only one that matches Method 3. It has a bullish candle then 2 bearish candles. The 2nd candle makes the highest high. The 3rd candle closes below the lows of the first two. The basis of this thread is having a 3rd candle close below the highs or lows of the 2 previous bars. Method 2 and 3 combine this using a 3bar swing high or low. Method 3 is a specific pattern in which the bars will be either bullish bearish bearish for shorts or bearish bullish bullish for longs. It is ok if the 2nd bar is an outside bar as well

I've attached my original example pics of Method 3

Attached Images