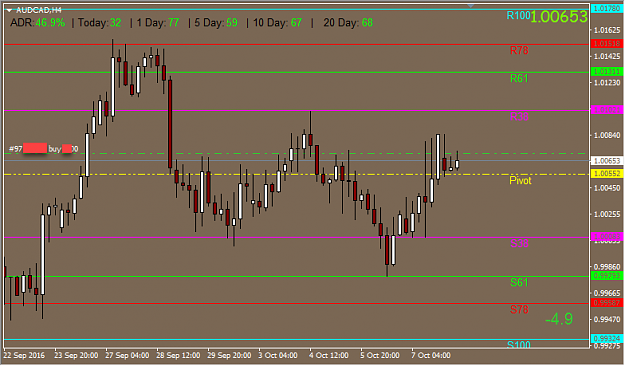

DislikedI still can't figure why the CAD is so weak.Good data,oil up and it got spanked hard...EC 4880!!! wow Need to wait on my UC trades and carry over next week.I just don't have the answers why.Poor USD data,Dec hike almost out the window...and yet lots of money is getting to on USD. Could be Brexit panic money going on USD ...which could explain irrational selling of the CAD. Anyway lousy last 2days.Ignored

October 7, 2016 17:46 GMT

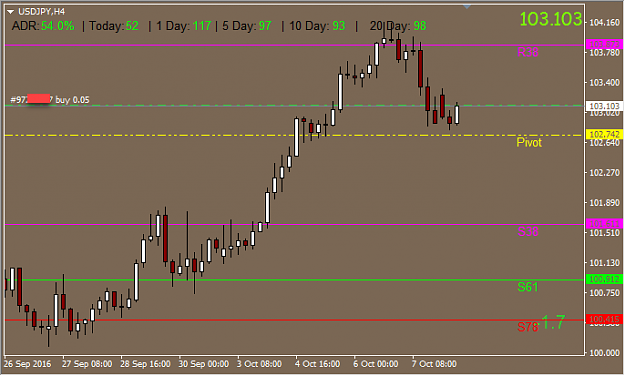

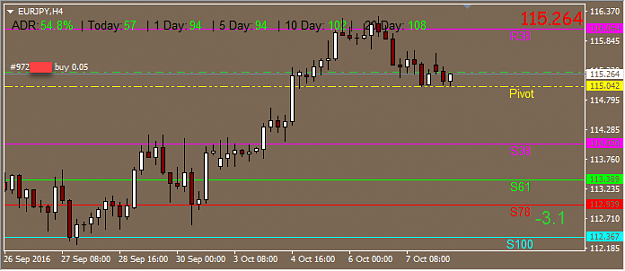

The US jobs report triggered some volatility in the markets today, with the Greenback pulling back on softer numbers. The data fell slightly short of analyst forecasts, but overall expectations for a rate hike in December increased slightly following the data. Comments from Fed Fischer triggered a shift in the markets, leading to a technical breakout in USD/CAD.

The initial reaction in the markets was a move lower in the US Dollar on the softer figures, while the futures market priced in a slightly higher probability of a December rate hike, and lower odds for a move in November. The US Dollar retreated after notable gains this week but turned higher after Fischer reaffirmed that the Fed is on track in reaching its goals.

The Fed vice chair confirmed that the United States is moving closer to full employment, calling the NFP figure close to a “Goldilocks” number, and stating that the data was consistent with the positive trend in labor markets.

The Greenback turned higher following his comments, with the US Dollar index (DXY) returning to positive territory for the day. DXY had reached a low of 96.40 following the data release and was last seen at 96.82 for a gain of 0.14%.

Oil prices saw some initial volatility, but have turned lower as WTI crude oil (USOIL) is seen dropping below the $50.00 handle. The current decline has taken prices below Thursday’s low and a daily bearish engulfing candle appears probable. The combined strength of the Dollar and turn in oil prices, after seven consecutive daily gains, has triggered a technical break in USD/CAD.

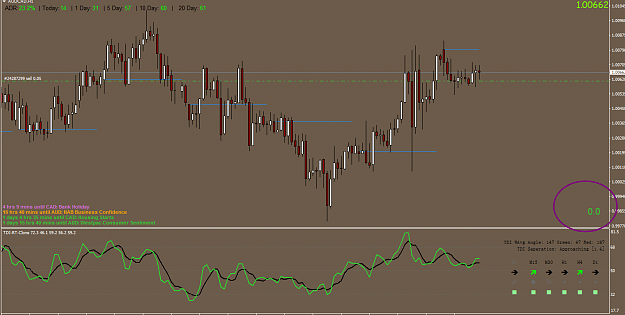

USD/CAD has been trading in a range over the past five months, with the exchange rate hovering near range highs over the past three weeks. Horizontal resistance from late July highs, as well as the 200-period daily moving average had capped rallies since mid-September, while the push higher today shows the exchange rate scaling the major resistance zone for a clear technical break.

Resiliency has been seen in the currency pair, as recent events surrounding the oil production freeze have not impacted the Loonie, causing a divergence between the currency pair and oil prices. With the pair able to hold ground while oil price had been moving higher, the turn in USOIL has added to gains in USD/CAD.

Following a five-month range, the bullish break today should keep the pair bid in the medium-term, potentially turning the currency pair back into the broader uptrend seen on the weekly and monthly charts.

Data out of Canada came in positive with a rise in employment of 67,000 against the expected 10,000 and the unemployment rate unchanged at 7%. The Ivey purchasing managers index printed at 58.4, reflecting the highest reading since January. The data triggered some initial strenght in the Loonie, but gains were not sustained following the turn in oil prices.

The prior resistance zone comprising of the July highs and the 200-period daily moving average is now seen as important support. The first level of notable resistance to the upside is seen at 1.3353 referencing prior resistance from September 2015.

USD/CAD Daily Chart

http://www.economiccalendar.com/wp-c...aily-Oct-7.png

D labour of a fool wearieth him cos he doesn't know how to enta d city

1