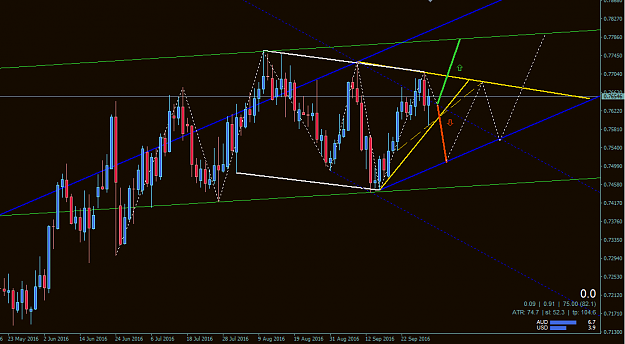

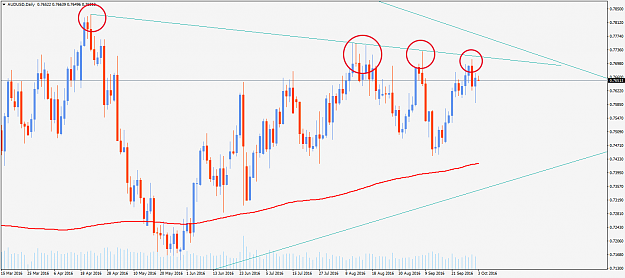

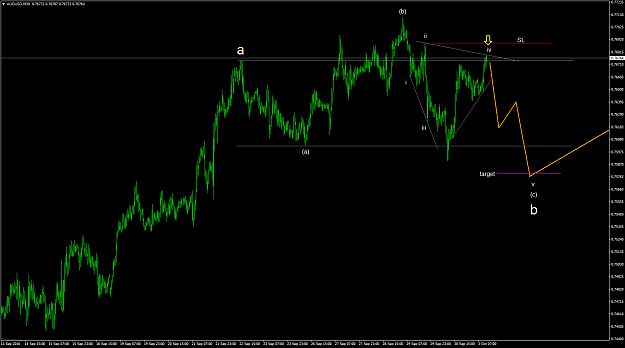

Disliked{quote} Nice charts. The last 2 months has been ranging. .78 is a strong resistant. If it breaks loose .78, the .82 is the next target. But I prefer selling till the end of the year. The prediction is .74 at the end of the year.Ignored

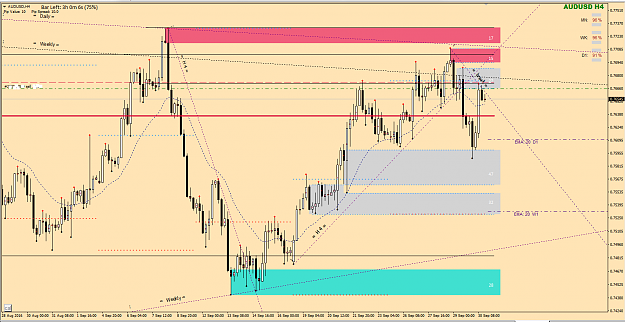

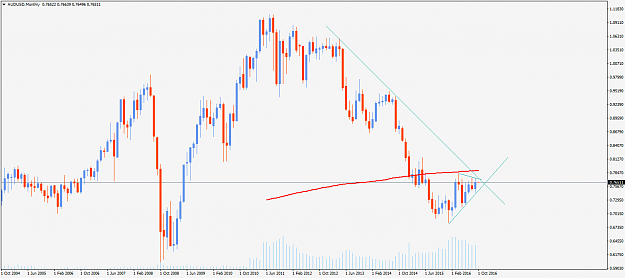

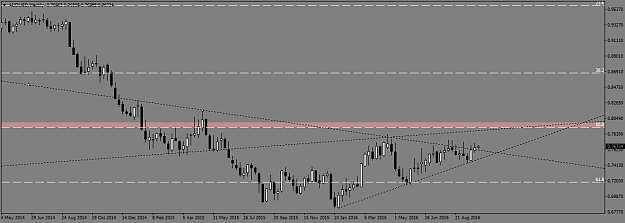

Was watching the weekly channel retest for a long time but has broken back inside that now, so switching to monthly for reference.

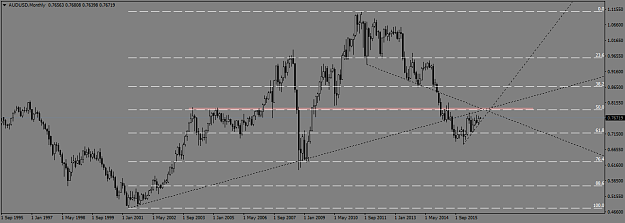

Come with me if you want to live....