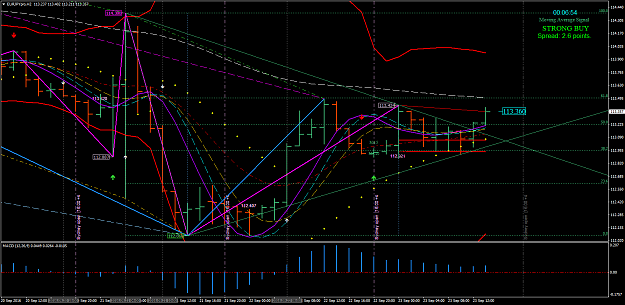

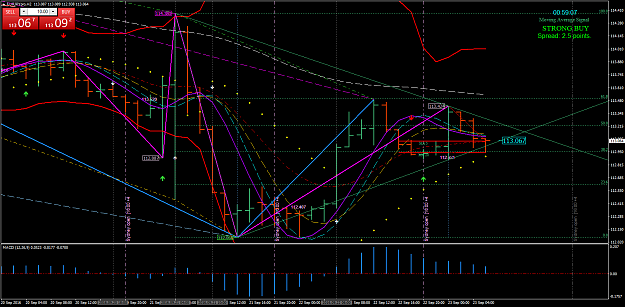

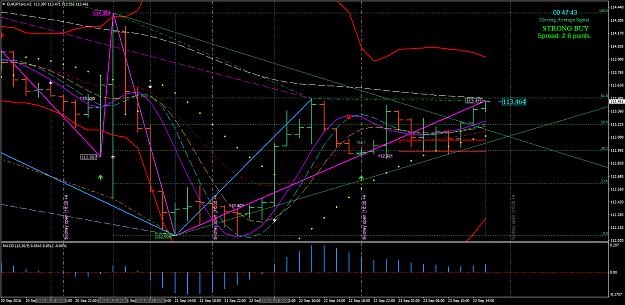

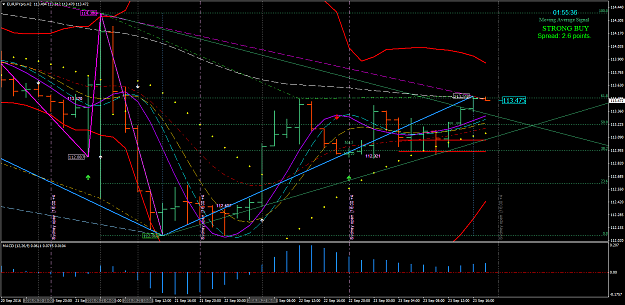

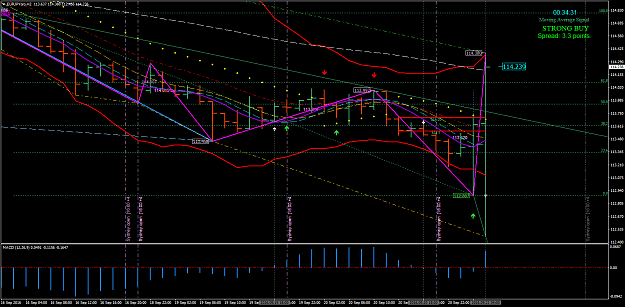

EURJPY

Date: 2016-09-23 2200 EDT

News for USD EUR JPY: HIGH at 1400 Local

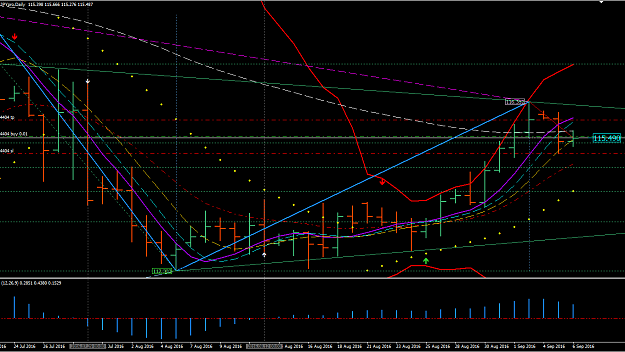

Daily:

ROMAR: R DN

EMA: R DN

PSAR: R DN

Last MACD 0 crossing: DN before EMA arrow

Last EMA Alert Arrow: DN

Last DB Attachment: 112.068B

Last SAR Attachment: 112.068B

Fibo up or down: UP

Notes: 4H downward, DB,SAR has LightSkyBlue outer box connection

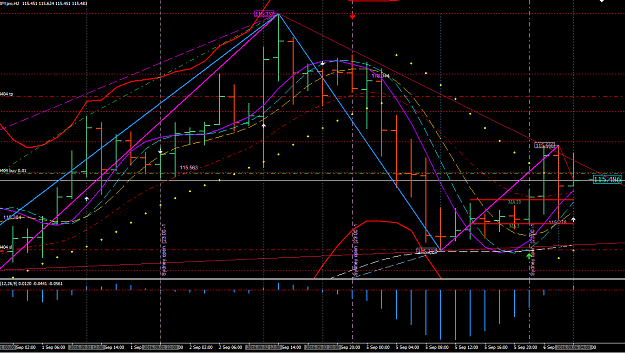

1HR: Open Price: 112.891

ROMAR: R DN

EMA: R DN

PSAR: S UP

Last MACD 0 crossing: UP

Last EMA Alert Arrow: UP

Fibo up or down: UP

Notes: 4H downward, W is at P at bottom of mini-swing, Market is above ROMAR resistance

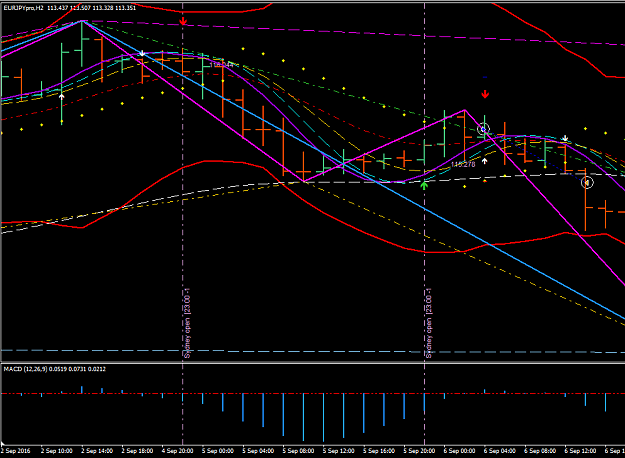

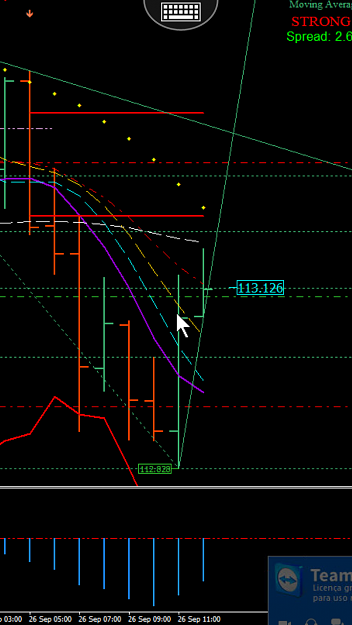

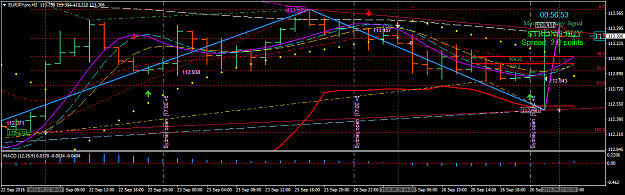

2HR:

ROMAR: R DN

EMA: S UP

PSAR: S UP

Last MACD 0 crossing: DN

Last EMA Alert Arrow: UP

Last DB Attachment: 113.490 T at Fibo 61.8

Last SAR Attachment: 113.424 T

Fibo up or down: UP

Notes: W,S crossed P, DB, SAR, Gold divergence and LightSkyBlue are all attached at 112.068, ROMAR is at 113.574

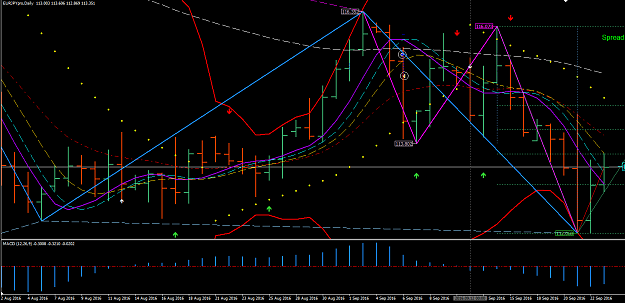

Notes for all 3 charts: 3TF ROMAR downward but Fibo's up. H2 EMA and PSAR are support

Entry: The market is above H1 ROMAR but I expect H2 ROMAR will provide significant resistance, therefore, I'll plan a short entry. First, H1 and H2 4H must be in sync. H2 SAR and DB, I expect, may join together below Fibo 0.0. When H2 PSAR is eliminated and intersects with EMA, I'll enter short at open below Smooth.

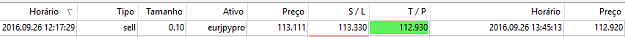

Result:

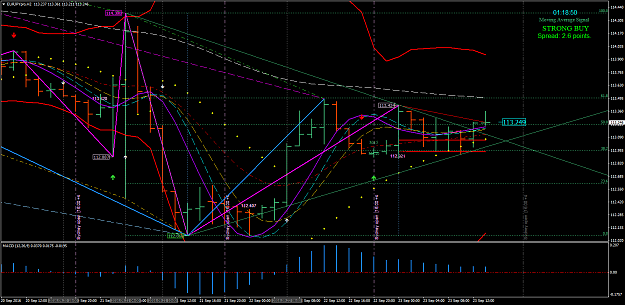

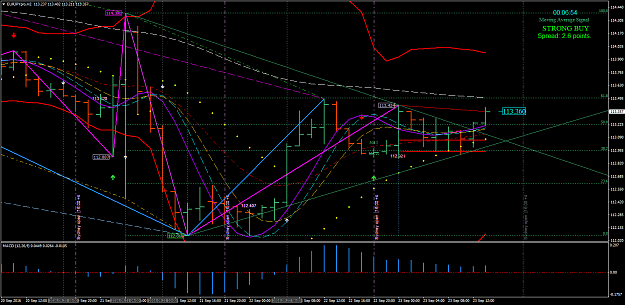

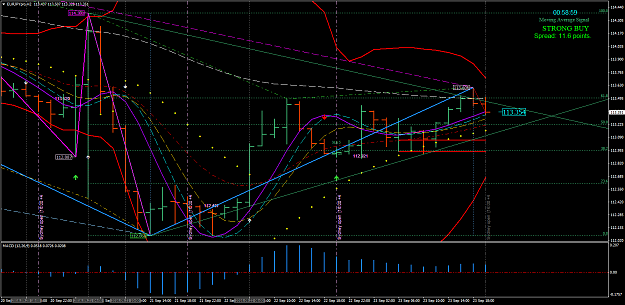

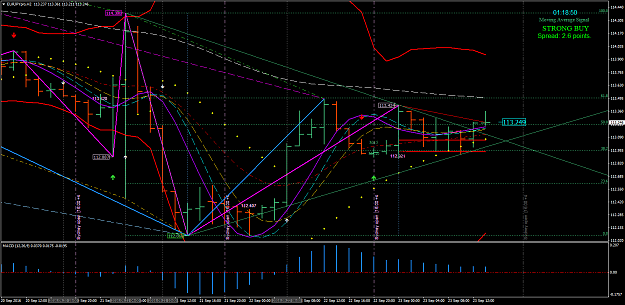

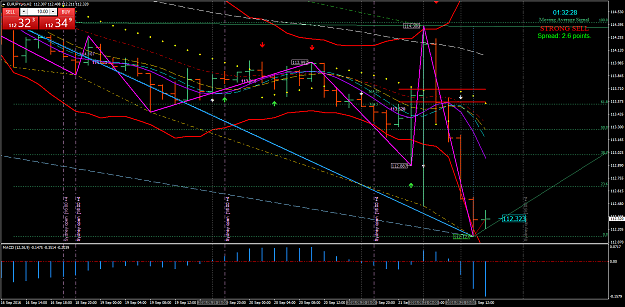

Date: 2016-09-23 2200 EDT

News for USD EUR JPY: HIGH at 1400 Local

Daily:

ROMAR: R DN

EMA: R DN

PSAR: R DN

Last MACD 0 crossing: DN before EMA arrow

Last EMA Alert Arrow: DN

Last DB Attachment: 112.068B

Last SAR Attachment: 112.068B

Fibo up or down: UP

Notes: 4H downward, DB,SAR has LightSkyBlue outer box connection

1HR: Open Price: 112.891

ROMAR: R DN

EMA: R DN

PSAR: S UP

Last MACD 0 crossing: UP

Last EMA Alert Arrow: UP

Fibo up or down: UP

Notes: 4H downward, W is at P at bottom of mini-swing, Market is above ROMAR resistance

2HR:

ROMAR: R DN

EMA: S UP

PSAR: S UP

Last MACD 0 crossing: DN

Last EMA Alert Arrow: UP

Last DB Attachment: 113.490 T at Fibo 61.8

Last SAR Attachment: 113.424 T

Fibo up or down: UP

Notes: W,S crossed P, DB, SAR, Gold divergence and LightSkyBlue are all attached at 112.068, ROMAR is at 113.574

Notes for all 3 charts: 3TF ROMAR downward but Fibo's up. H2 EMA and PSAR are support

Entry: The market is above H1 ROMAR but I expect H2 ROMAR will provide significant resistance, therefore, I'll plan a short entry. First, H1 and H2 4H must be in sync. H2 SAR and DB, I expect, may join together below Fibo 0.0. When H2 PSAR is eliminated and intersects with EMA, I'll enter short at open below Smooth.

Result: