Looking for USD/CNY or USD/CNH M15 data 2013/14-2014/15 0 replies

AUD/USD - CNY trade balance figure confusion 3 replies

USD/CNY carry trade? 6 replies

DislikedChinese Government just issued a warninghttps://us.yahoo.com/finance/news/ch...185255705.html

Ignored

Disliked{quote} wow just did short but usdcnh. Good timing... lol {image}Ignored

Disliked{quote} this went all the way down to 6.45 after a failure {image}Ignored

DislikedForget the Fed, recommends Goldman, and watch how the dollar trades vs. the yuan http://www.marketwatch.com/story/for...uan-2016-06-06Ignored

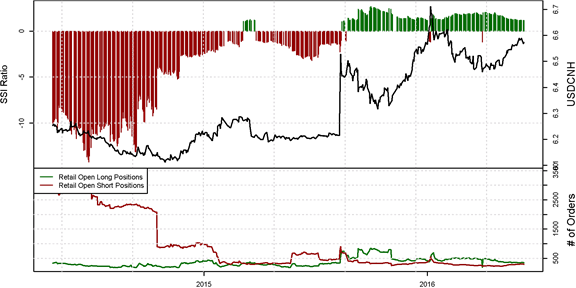

DislikedForget the Fed, recommends Goldman, and watch how the dollar trades vs. the yuan The Speculative Sentiment Index reading for USD/CNH shows ratio of long to short positions in the USD/CNH stands at 1.17 as 54% of traders are long. {image} We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are long gives signal that the USD/CNH may continue lower.Ignored

Disliked{quote} they are market makers and I have made more money trading in the opposite direction of what Goldman wrote about recentlyIgnored

Disliked{quote} The opposite usually happens when everyone is short and when everyone is bullish.Ignored