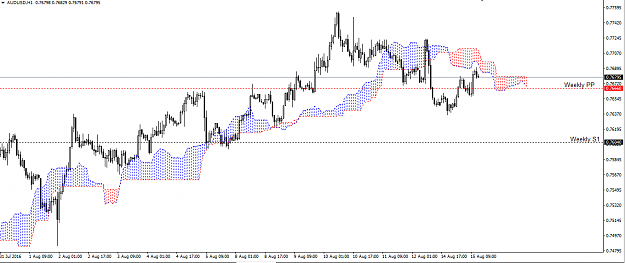

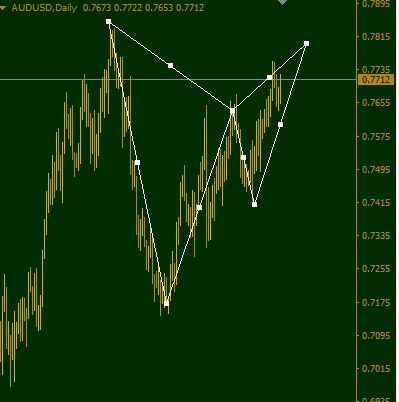

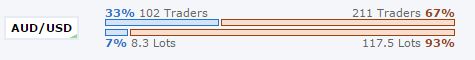

DislikedJust exited my barrage of long entries at 7680 with decent profit.feeling verrrry lucky n stupid for being indisciplined. I was long audusd after bad US data on friday, how ever i missed the opportunity to exit around 7720, so i got angry and kept adding long positions as price kept dropping all the way down to 7645. So of course i could not enjoy my weekend seeing that i was a sitting duck in a pool of alligators, market could have opened with a gap down or price could have dropped below7635( asia low). really could not sleep as 100 pips...

Ignored

Just do not do it again. Find a way which does not keep you awake.

trading is simple but is simple is not easy.