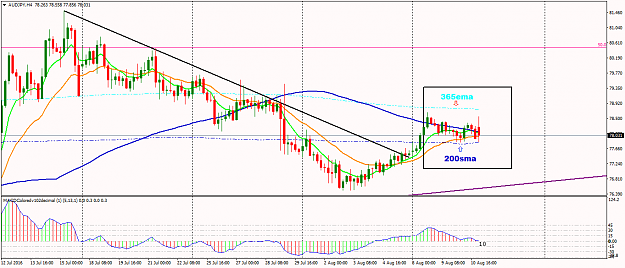

In many ways it is completely unnecessary and in my opinion a good example of how people try and over analyse the market.

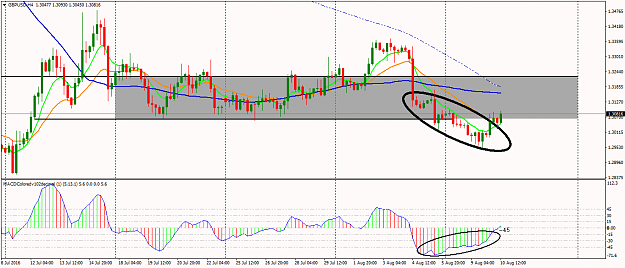

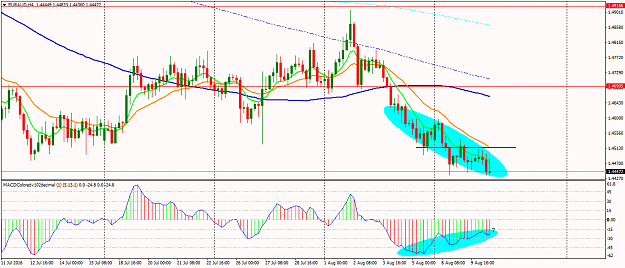

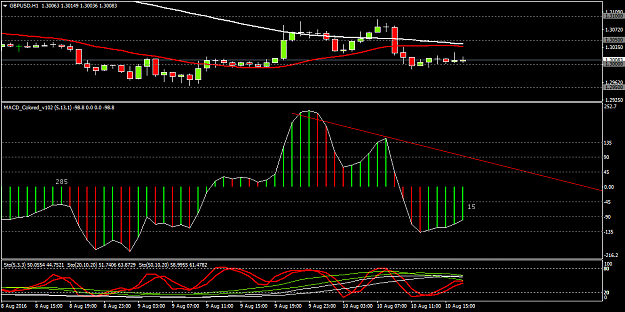

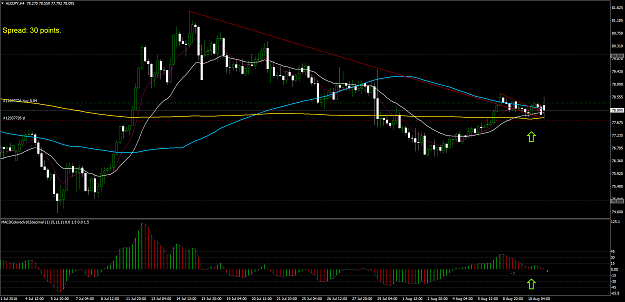

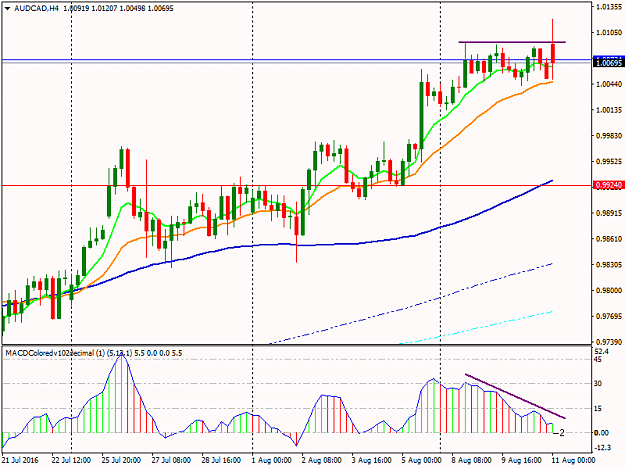

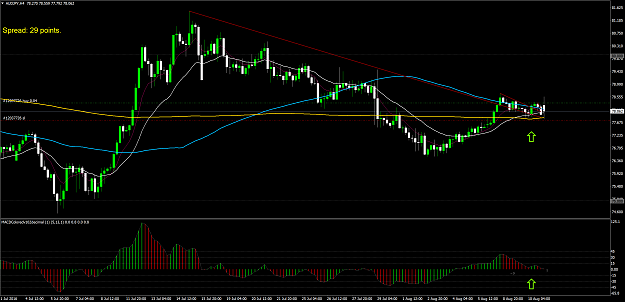

If the pattern is correct (and I'm not saying it is) and the price is going to move down, then it will break the 21ema, pullback and move lower.

If the pattern is wrong (and I'm not saying it is), the price will continue to pullback to the 21ema and move higher.

So you can see, in my opinion these type of patterns and analysis aren't helpful as they can amount to trying to guess the future. It is far better instead to wait for the market to show you what it is doing and simply react to it.

i.e

Break 21ema, pullback, move lower (if it does this, you are trading the pattern anyway without even needing to have it on the chart or knowing it's there)

Pullback to 21ema, fail to break below, bounce and continue.

Hope this makes sense