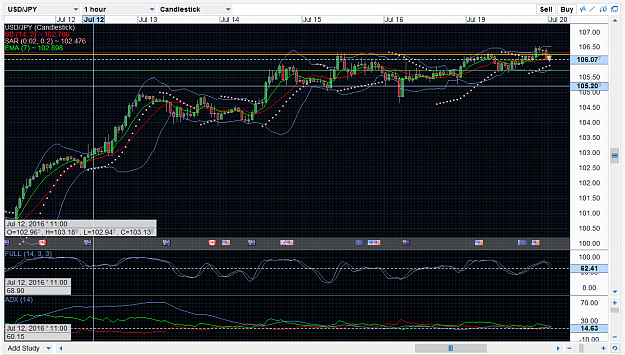

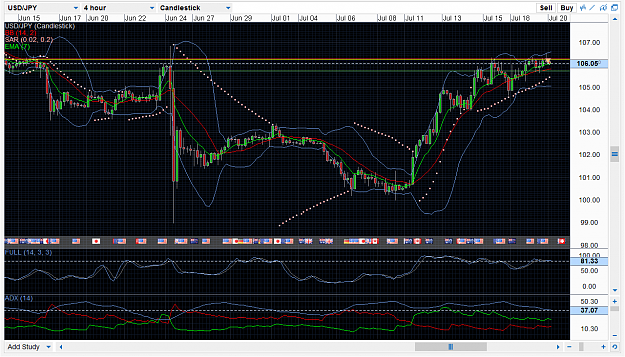

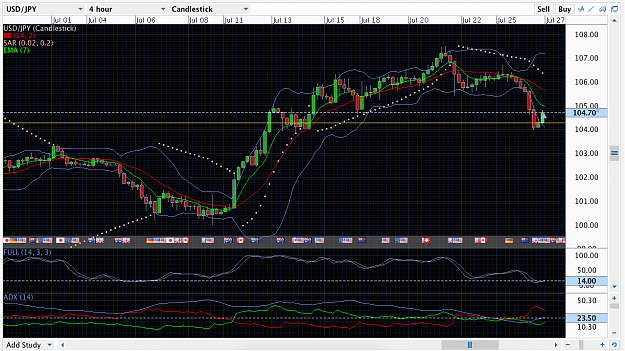

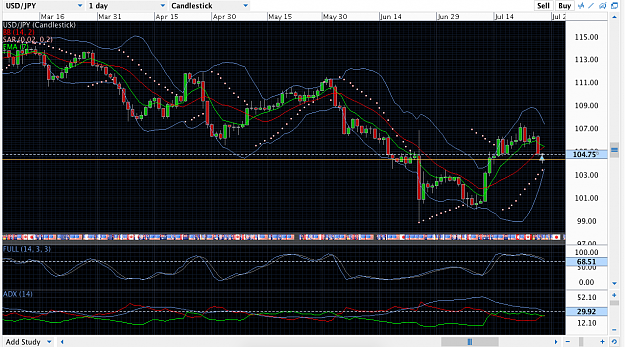

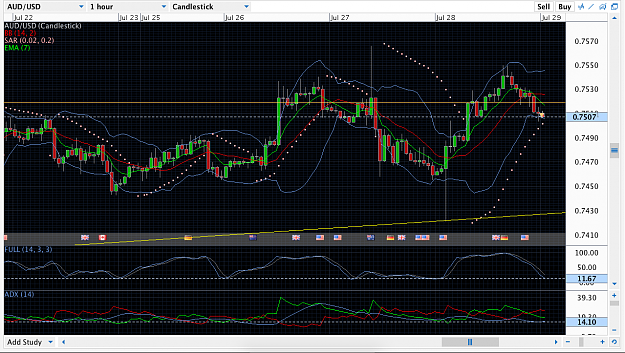

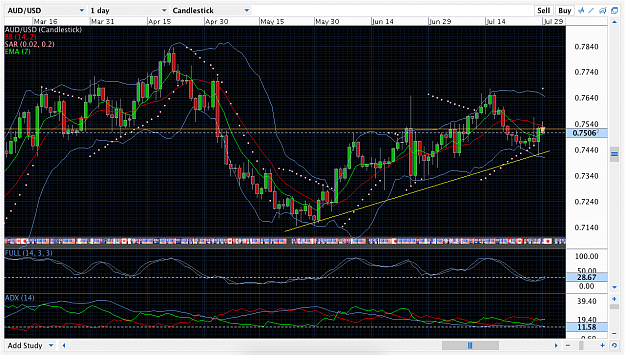

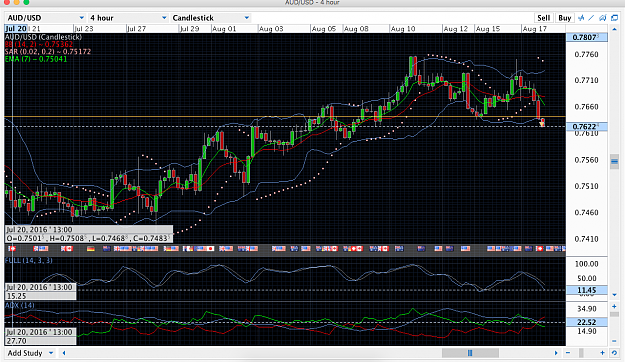

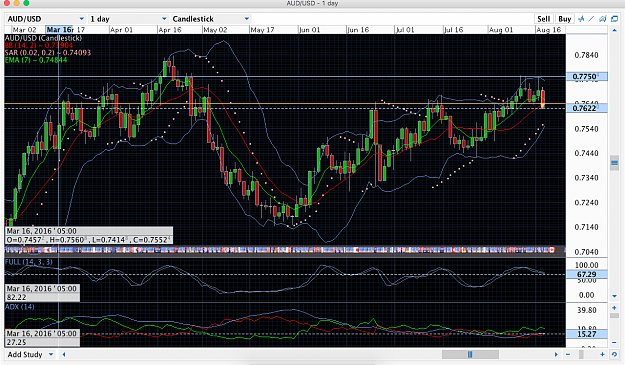

DislikedThis trade is almost completely in sync with my strategy. The only thing is that in the short term frame (1 hr), there wasn't really a strong trend and in the main frame, Stochastic levels were low, but not low enough to hit 20.. Other than that, I think that all the conditions were perfect for a short trade. The large time frame (1 day) is strongly trending in an extremely oversold condition while the main time frame is also strongly trending in a mildly oversold condition. The small time frame is mildly trending in an increasingly oversold condition....Ignored

Bryan | Bryanpreneurship