Hi all,

This is my very first post in the thread. This is the very thread that will be used to document all my trades. Since I am still a beginner, this thread is called baby Squirtle. When I feel that I have hit the intermediate stage, I will rename this into Wartortle. And when I am in the advanced stage, this thread will be called Blastoise.

This is my very first post in the thread. This is the very thread that will be used to document all my trades. Since I am still a beginner, this thread is called baby Squirtle. When I feel that I have hit the intermediate stage, I will rename this into Wartortle. And when I am in the advanced stage, this thread will be called Blastoise.

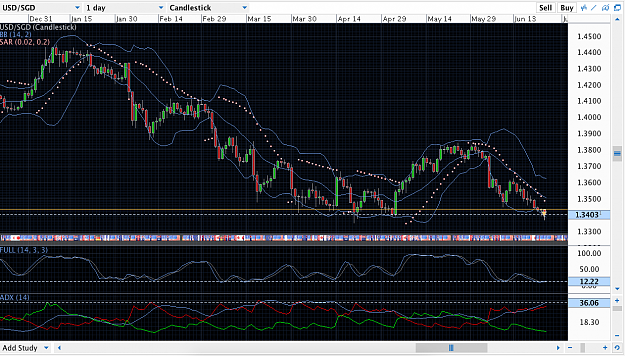

Attached Image

Bryan | Bryanpreneurship