Disliked{quote} Hey Focus, Check out my response to Juisen above as it relates to your question. Also, my win ratio is about 85%, so even if my R/R is 2/1, worst case, I'm still coming out ahead. But again, it's a dynamic stop, so average R/R is about 1/1 which is great at an 85% win rate. Risk/Rewards is hugely misunderstood and miss used...or maybe I should say over emphasized. And I'm talking about R/R, not money management, money management can't be over emphasized. I could snap my fingers and change my R/R to 1/3, but my win rate goes down to 50%....Ignored

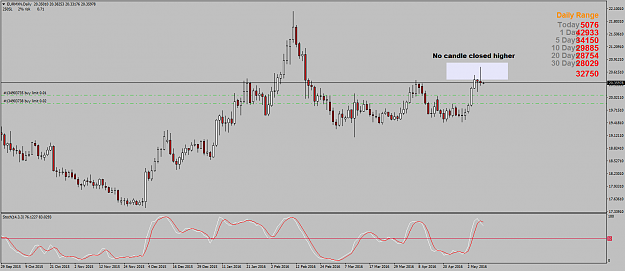

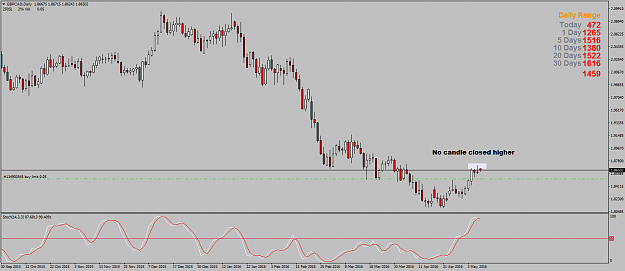

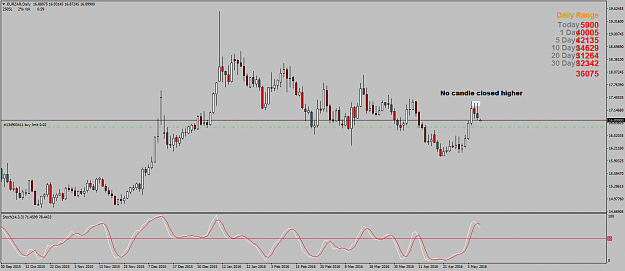

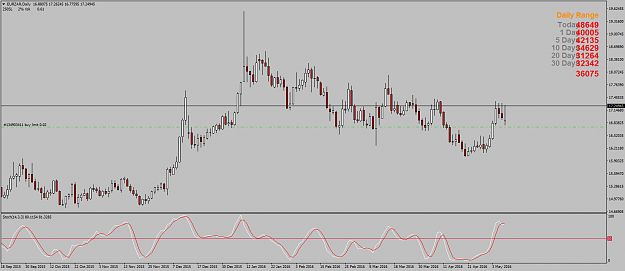

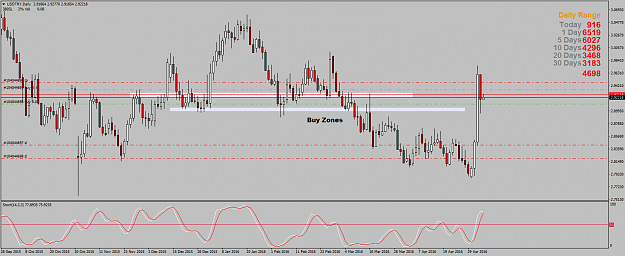

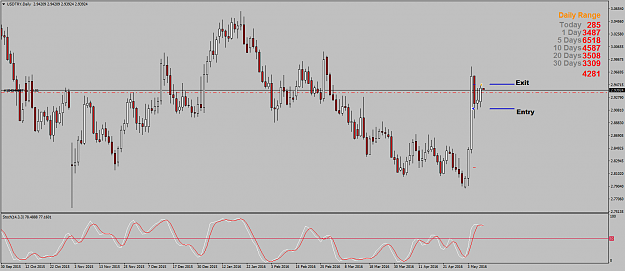

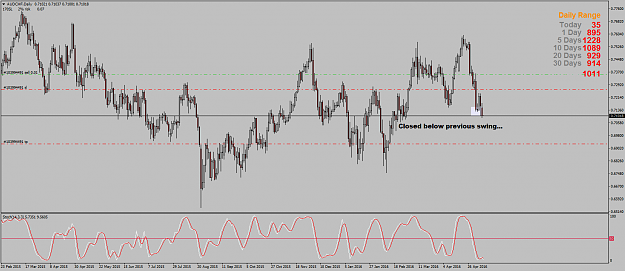

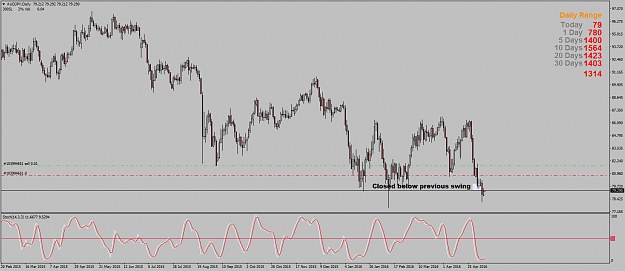

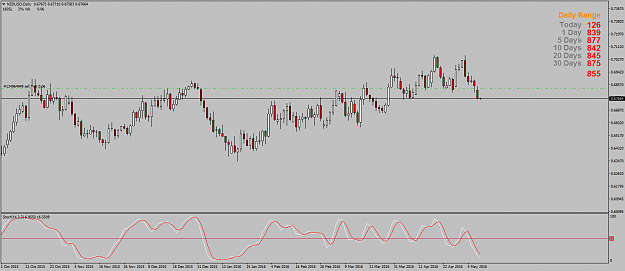

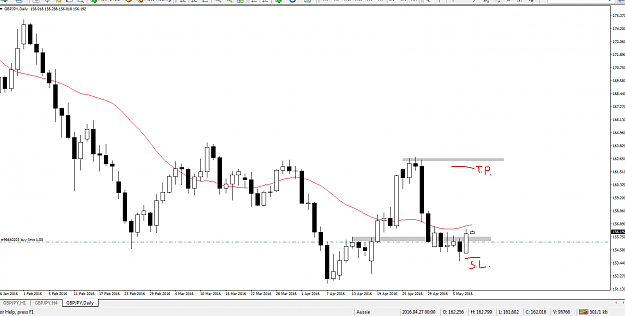

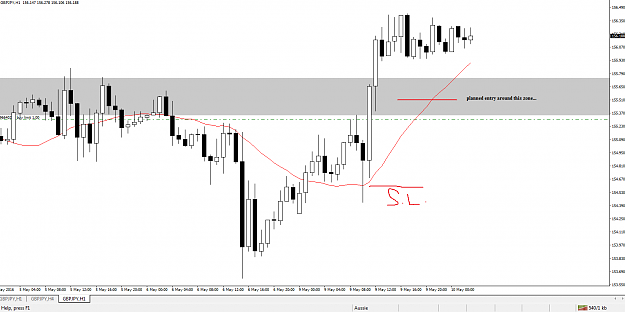

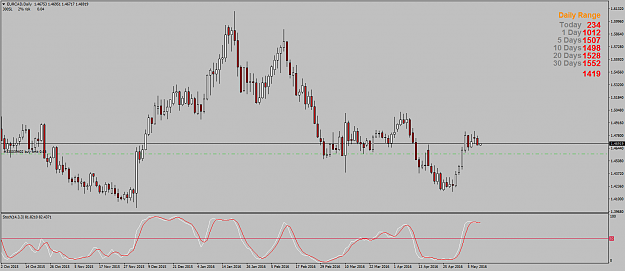

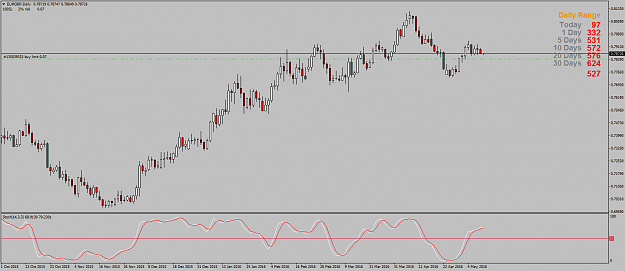

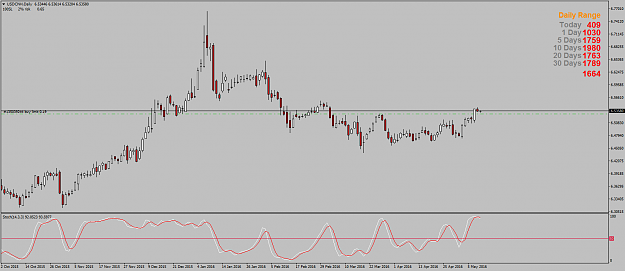

What support & resistance are you using? Meaning, how are you drawing your lines? Is it from the monthly? Weekly? Daily? If so, explain to me how or why do you consider that support & resistance..