I will be using this thread to document all my trades on the Dax (German30) Index. I may also take trades on Dow, EU, GU and UJ but my main focus is on the Dax.

My strategy is a TREND FOLLOWING Strategy and has 3 main entry types:

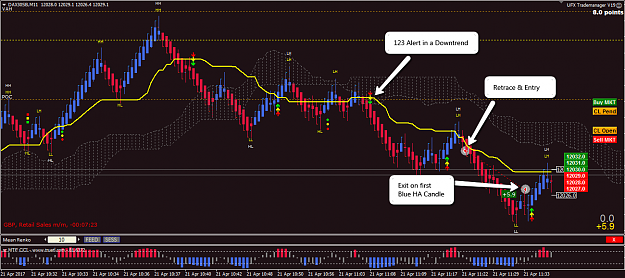

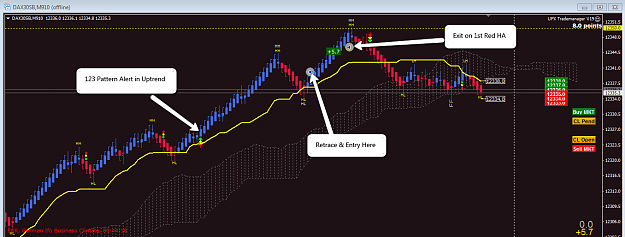

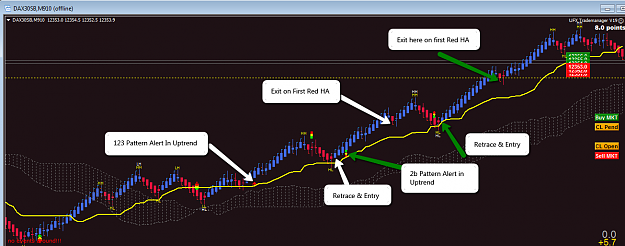

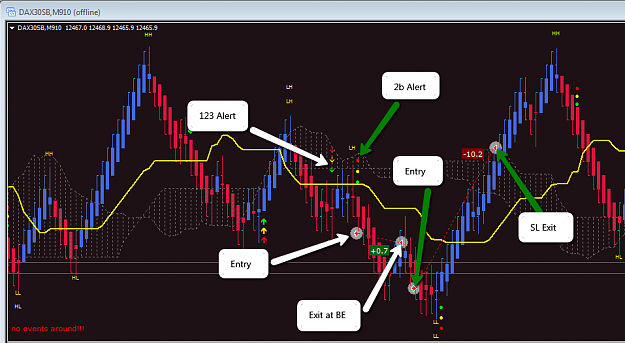

1. 123 Pattern in direction of trend (Pattern confirms then I look for pullback to enter)

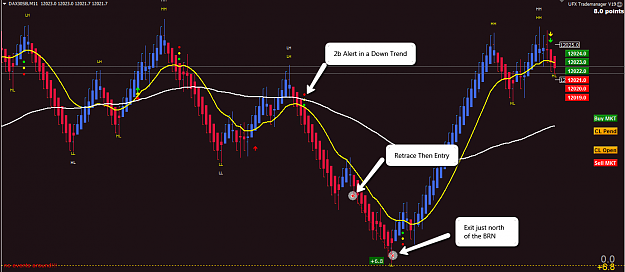

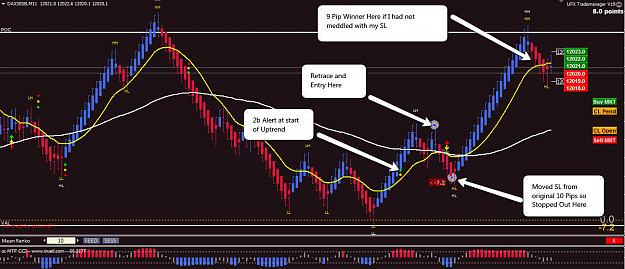

2. 2b Pattern in direction of trend (Pattern confirms then I look for pullback to enter)

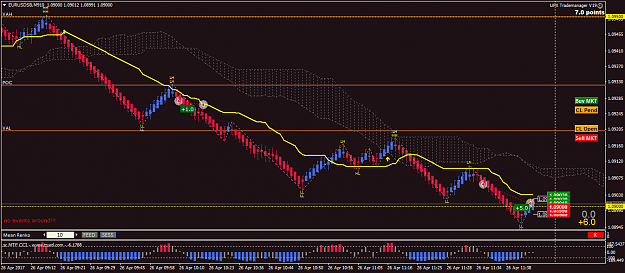

3. Momentum Pullback (Market structure HH's LL's etc then I look for a pullback to enter)

The patterns are all based on my interpretation of them, if they do not conform to some kind of standard, frankly i don't care - my journal, my trades, my rules.

Trend is determined by price making Lower Lows or Higher Highs with the addition of the Ichimoku Cloud and Kijun Sen to assist in Trend determination (I used to use a 20LWMA and 240LWMA but changed to using Ichimoku).

I use Mean Renko bars overlayed with Heiken Ashi and analyse the 1 pip , 2 pip and 3 pip variants for trade entries.

Trades are normally taken from London Open for the next 2 hours (that's the plan anyway)

I must give recognition to Harold aka 'Divergence' on this forum for his unselfish sharing of his knowledge of 123 and 2b patterns and how to trade them. Harold is no longer active on FF which is a real shame, i feel blessed that i was able to learn from him before the haters drove him away.

On Chart Arrows/Circles/Boxes:

You will see on any chart i post little arrows/circles and boxes - these are alerts for my 123 and 2b chart patterns:

Arrows = 123 Pattern Alerts

Circles/Boxes = 2b Pattern Alerts

My strategy is a TREND FOLLOWING Strategy and has 3 main entry types:

1. 123 Pattern in direction of trend (Pattern confirms then I look for pullback to enter)

2. 2b Pattern in direction of trend (Pattern confirms then I look for pullback to enter)

3. Momentum Pullback (Market structure HH's LL's etc then I look for a pullback to enter)

The patterns are all based on my interpretation of them, if they do not conform to some kind of standard, frankly i don't care - my journal, my trades, my rules.

Trend is determined by price making Lower Lows or Higher Highs with the addition of the Ichimoku Cloud and Kijun Sen to assist in Trend determination (I used to use a 20LWMA and 240LWMA but changed to using Ichimoku).

I use Mean Renko bars overlayed with Heiken Ashi and analyse the 1 pip , 2 pip and 3 pip variants for trade entries.

Trades are normally taken from London Open for the next 2 hours (that's the plan anyway)

I must give recognition to Harold aka 'Divergence' on this forum for his unselfish sharing of his knowledge of 123 and 2b patterns and how to trade them. Harold is no longer active on FF which is a real shame, i feel blessed that i was able to learn from him before the haters drove him away.

On Chart Arrows/Circles/Boxes:

You will see on any chart i post little arrows/circles and boxes - these are alerts for my 123 and 2b chart patterns:

Arrows = 123 Pattern Alerts

Circles/Boxes = 2b Pattern Alerts