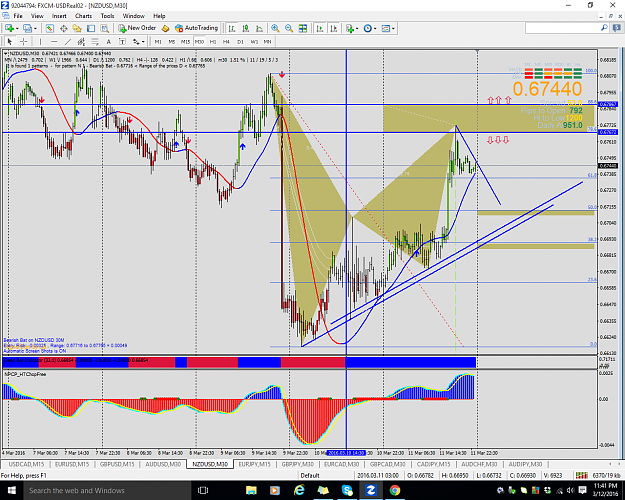

DislikedHello traders,hello Mr Pip I decided to start writing down a trading plan and then start following it mechanically.One of my first rules will be to take trades that are following the trend because going with the trend puts you in a better position. My question has to do with trend identification, Can we say that for each trader an uptrend or a downtrend has to do with the pips that is willing to risk?? ....and i will explain what i want to say with the following chart. in the chart we can see that long term we are in an uptrend (NSH,HL,NSH etc)...Ignored

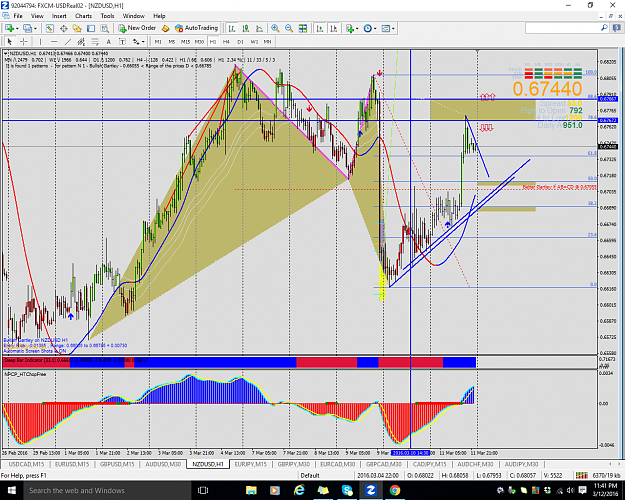

I think what is always important to ask the question "What is price doing now?" and "Who is in control - the bulls or the bears?"

In your chart above, price is making new structure lows, the order flow is bearish, and it looks like the bears are in control.